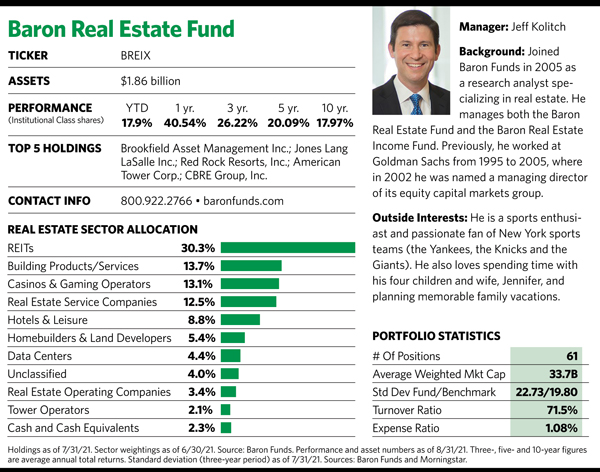

A developer of time-share resorts. A maker of outdoor, non-wood building products for homes. A casino operator that caters to locals on the outskirts of Las Vegas, rather than tourists on the city’s famed Strip. According to Jeffrey Kolitch, portfolio manager of the Baron Real Estate Fund, these aren’t the kind of holdings found in traditional real estate funds that typically focus on real estate investment trusts. But they are part of his fund, and he says such companies help differentiate his product from competitors and have helped fuel the fund’s best-in-category returns over the three-, five- and 10-year periods.

“We advocate a broader and more balanced and comprehensive approach to real estate investing than many of our peers,” says Kolitch, who has managed the Baron fund for nearly 12 years. “The product I manage is not a REIT fund. It is a real estate-related fund. We research, analyze and invest in REITs, and we’re quite optimistic about the prospects of REITs this year. But we don’t limit our real estate investments just to REITs.”

The companies in his portfolio must get the bulk of their revenue from either commercial or residential real estate. They should also have quality balance sheets and management teams that are “excellent allocators” of capital. In sum, he chooses companies he thinks are best in class and will grow faster than rivals.

One example is Red Rock Resorts Inc. “They own six casinos in arguably the best casino gaming market in the U.S., which isn’t the Las Vegas Strip but the Las Vegas locals market,” Kolitch says.

The Las Vegas locals market includes casinos operating along the Boulder Highway on the outskirts of town, as well as Henderson, North Las Vegas and unincorporated areas of Clark County. According to the Nevada Independent website, the locals market as a whole enjoyed a 16.6% rise in gaming revenue in this year’s first half while gaming revenue from Strip casinos saw an 11.3% decline.

“We think [Red Rock Resorts] will grow faster than most REITs, owns higher-quality real estate than many of the REITs we’re considering, and has a faster organic and external development growth rate,” Kolitch says. “And we see a path where over the next five years we believe we can double our investment.”

Another company he highlights is Marriott Vacations Worldwide Corp., a developer of real estate time-share resorts. That’s not to be confused with hotel operator Marriott International Inc., a company the Baron Real Estate Fund doesn’t own because it faces uncertain prospects for a rebound in business travel.

“Time will tell about hotels,” Kolitch says. “Two-thirds of the revenue from most hotels are generated from business travelers.”

Instead, he is more bullish on the recovery in vacation travel. “We’re more focused on the real estate time-share business, where 100% of its business comes from the leisure traveler,” he says.

And then there’s Azek Company Inc., a maker of outdoor, non-wood building products such as decking, railing, trim and other goods. Kolitch says 95% of Azek’s cash flow comes from the U.S. residential housing market, and he believes the company has a compelling multiyear strategic growth plan that should result in strong share price appreciation during the next few years.

Three Themes

In the second half of 2020, Kolitch structured his fund to take advantage of what he believed were three compelling investment themes. And he’s sticking with that game plan in this year’s second half.

The first theme focuses on Covid-19 recovery beneficiaries. He expects the release of pent-up consumer and commercial demand—coupled with a rebound in cash flows—to boost several of the hardest hit segments of real estate as more people get vaccines and the economy resumes normal activities.

That includes real estate casino and gaming companies, vacation time-share companies and amusement park operators. But Kolitch is selective. He trimmed fund positions in real estate casino and gaming companies such as Wynn Resorts Ltd. and Las Vegas Sands Corp. in the second quarter, mainly because of the ongoing pandemic-related travel restrictions in China, Macau and Singapore. He notes that he might buy additional shares of these companies in the future as travel restrictions lift and business activity resumes.

The pandemic recovery theme also focuses on commercial real estate services companies (such as CBRE Group Inc. and Jones Lang LaSalle Inc.) and land development companies (including the Howard Hughes Corp.). The theme further encompasses certain REITs in the office, apartment, mall and shopping center sectors, among others.

One of the Baron Real Estate Fund’s top net purchases in the second quarter was Vornado Realty Trust, a REIT that owns what Kolitch calls a high-quality portfolio of office and retail assets concentrated in New York City. He thinks leasing and occupancy trends will improve in the city as the economy rebounds, and he offered that Vornado’s stock price is attractively priced vis-à-vis his estimate of the company’s net asset value.

The second major theme pertains to residential real estate. Kolitch says there has been a structural underinvestment in residential construction, which he thinks will likely reverse in coming years.

“Most people think about multifamily rental when they think of residential REITs, but we look at the for-sale market that includes [home builders] Lennar, D.R. Horton and Toll Brothers. And we look at residential real estate-related building products companies such as Lowe’s, where there’s a very close correlation between what their business is doing and what’s happening in the housing market.”

The third investment theme relates to the intersection of technology and real estate. That includes real estate data analytics companies (for example, Zillow Group Inc.), as well as real estate tied to data centers and wireless tower operators.

“We own American Tower, a well-known tower REIT, but we also own a non-REIT tower company in Europe called Cellnex,” Kolitch explains. “This company trades at a similar multiple valuation to REITs, but will grow its cash flow over the next three to five years [at a pace that’s] at least twice the growth rate of many of the tower REITs.”

Elsewhere, the fund has broadened its scope by investing in SPAC-related real estate. SPACs, or special-purpose acquisition companies, are publicly traded shell companies that exist solely to raise money to buy or merge with private companies with actual businesses—and then take them public. SPACs have taken the investment world by storm but have produced a mixed track record in share price performance. Kolitch says his foray into these vehicles is limited, but carefully constructed.

“We’ve developed a prudent strategy for participating in real estate-related SPACs,” he says. “We’re partnering with highly regarded real estate sponsors such as Fifth Wall, which is the premier property technology venture capital firm in the country, led by Brendan Wallace. We’ve also invested with Scott Rechler, a well-known real estate investor at RXR Acquisition Corp., and with Tishman Speyer Innovation Corp.

“One SPAC-related company we’re very optimistic about is Smart Rent, which is sponsored by Fifth Wall,” he adds. “[Smart Rent] is the category-leading smart home automation platform. It’s a software company that enables connected homes.”

All-Weather Approach

Despite the Baron Real Estate Fund’s chart-topping returns over three-, five- and 10-year periods in Morningstar’s real estate category, this year is a different story, as its 17.9% return (through August 31) put it in the category’s bottom quartile.

“No question about it, we’re more like an equity approach to investing in real estate. There will be more volatility in our year-to-year performance than in more dividend-focused strategies,” Kolitch says, referring to the dividend-oriented approach of REITs and funds that focus on them. One such fund is the Baron Real Estate Income Fund, which he also manages.

The Baron Real Estate Fund, on the other hand, he characterizes as an all-weather product that can perform well in different real estate cycles and economic conditions.

“The fund’s flexibility means it can pivot away from REIT or non-REIT categories facing long-term cash flow or rent occupancy pressures,” Kolitch says. “And our differentiated approach enhances our potential to generate strong returns in various macroeconomic environments.

“If investors are willing to invest like we do, which is looking out over a three- to five-year period or longer, there might be a year of volatility or underperformance,” he adds. “But the merits of our strategy will shine bright over a multiyear period.”