Calamity has struck in the form of a global pandemic that has spread into all facets of life. Financial markets have not been immune to infection. In the 24 trading days from February 19 to March 23, the widely watched S&P 500 benchmark required its own ventilator during a sickening 34% plunge. In dollars that means your $100K in stocks dropped to $67K in a matter of weeks. Since the bottom, that benchmark has recovered somewhat, but remains in the ICU.

The question we pose is this: how can investors get out of the way before losing a third of their wealth and also participate in price recovery? A tactical manager may be in possession of the vaccine. Here are three reasons we believe using tactical management may be an antidote for this volatile environment. Tactical strategies seek to manage losses, participate in gains, and create better returns with less risk than passive approaches.

What Is Tactical Management?

But first, what exactly is tactical investment management? In our view, it means responding to the information that the market is saying and doing so in a disciplined and rules-based way. The tactical approach embraces a dual mandate of limiting losses and participating in gains. In contrast, passive investing imparts a “set it and forget it” strategy taking a very long view and riding the market roller coaster ups and downs.

If recent market volatility is making you sick, here are three reasons to use a tactical style of investing.

Why Tactical? Reason #1: Seeks To Manage Losses

First, tactical management applies a rules-based approach that seeks to avoid losses and preserve wealth. A strict, unemotional sell discipline draws a line in the sand to determine when to sell, and therefore, preserve wealth.

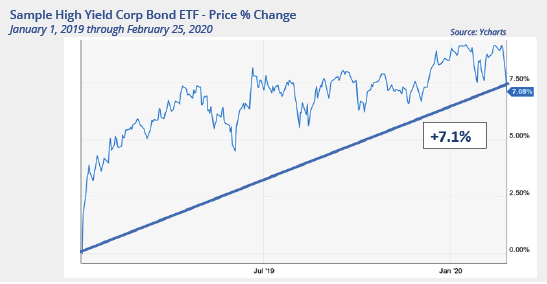

Here is an example. The chart on page two shows the chart of a high yield corporate bond ETF from the approximately 14 months from the start of 2019 until the realization of a sell on February 25, based on our proprietary rules. The investment generated about a 7% gain for the period.

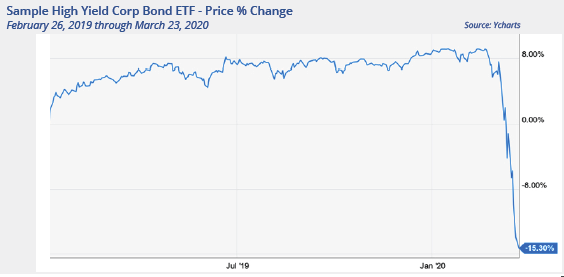

A passive or “buy and hold” manager would have the same results through this period of time. However, the tactical manager sells. What happens next? The next chart updates the following few weeks. In a classic example of investments taking the stairs up and the elevator down, all 14 months of gains are wiped out and quite a bit more. At this point, the buy and hold manager has lost 15% of value while the tactical manager that avoided losses is up 7%, a total difference of 22%.

The number one reason for tactical management is the focus on managing losses and wealth preservation.

Why Tactical? Reason #2: Seeks To Participate In Gains

The second reason to incorporate tactical investment management strategy is that a strict, unemotional, and disciplined strategy means also participating in gains. A rules-based approach identifies when an ill investment has become healthy enough to buy. Typically, a time of maximum pessimism is also a time of maximum opportunity, but absent a quantitative discipline, the emotional fortitude to take action can be in short supply. In other words, when it comes time to buy, will you do it?

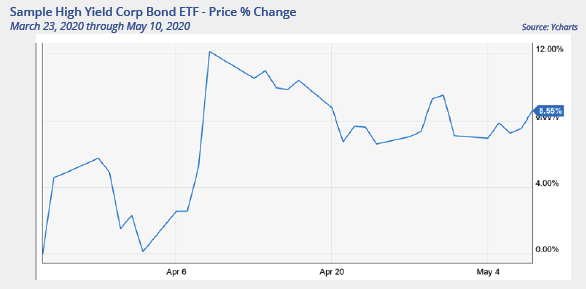

Taking our prior example through to the time of writing, the chart below shows the tactical manager’s re- purchase date through May 10. The gain during this new holding period is a vigorous 8.6%.

While the tactical manager seeks to avoid sickening losses, it is also important to that after periods of weakness, recovery and uptrends begin. Thus, the second reason to use tactical investment management to participate in those gains.

Why Tactical? Reason #3: Seeks Better Return, Less Risk

Just as a healthy patient can emerge from illness better than a feeble one can, a tactical investment approach may create stronger returns with less risk than a passive “buy and hold” approach can.

Just take a look at the health records. The tactical manager earned 7%, stepped out of the way during the drawdown that began in late February, and then earned an additional 8.6% when returning in late March. That total return of more than 16% over the holding periods stands in stark contrast to the buy and hold passive manager who lost -1.7% over more than 16 months. A line in the sand sell combined with a disciplined buy rule results in better returns and less drawdown.

Why Tactical?

We began this piece with a question: how can investors avoid that sickening period that can mean losing a third of their wealth and also participate in price recovery? We believe the answer comes from applying tactical investment management. Tactical strategies seek to manage losses, participate in gains and therefore create better returns with less risk than passive approaches can.

When you can make more money with less risk, just do it.

Terri Spath, CFA, CFP, is chief investment officer and portfolio manager at Sierra Investment Management.