Stock-market investors are over the moon about the prospects for Apple's next iPhone. But the company's top executive isn't sending the most bullish signal.

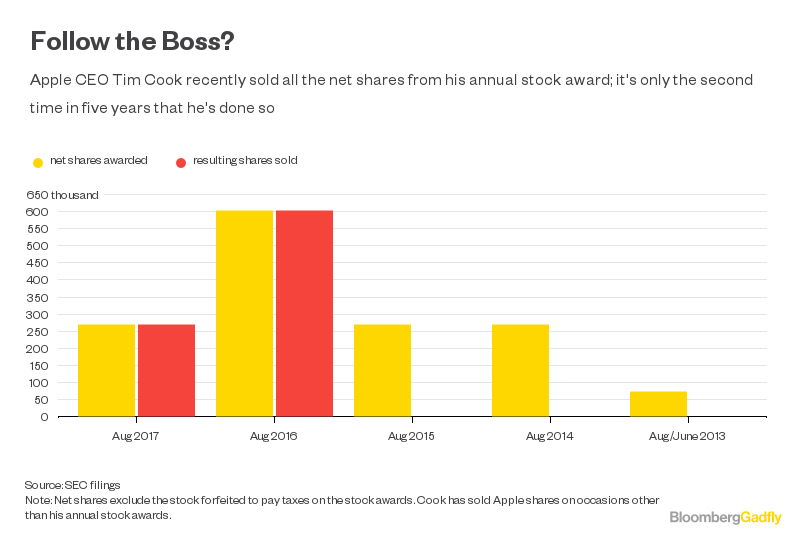

Apple Inc. CEO Tim Cook in recent days sold about $43 million worth of company stock, according to a regulatory filing, reflecting a sale of all the net shares he was awarded last week for his job performance.

It's a nice time for Cook to get handed a big batch of Apple stock. Shares hit an all-time high on Tuesday and have climbed 41 percent so far this year. But it might not be the greatest time to sell Apple shares, if you believe the company is on the cusp of (further) greatness.

Apple in a couple of weeks will introduce the latest iPhone models, including a hotly anticipated new version with a brighter screen that covers more real estate. There's huge anticipation this new model will unleash a frenzy of fresh iPhone sales. Ahead of this gadget debut, none of the stock analysts who follow Apple recommend investors sell the company's shares, according to Bloomberg data. Cook didn't listen to them.

I am reluctant to make too much of corporate executives' stock transactions. It's tough to know if someone needs cash to make college tuition payments or has his eye on a really big boat. Cook also sold shares valued at about $65 million at this point last year, when he got his prior annual stock payout. He didn't sell shares from the annual stock awards in 2015, 2014 or 2013, according to regulatory filings. Cook's recent stock sales, like most if not all of his prior transactions, were conducted under a preset stock-trading arrangement, which in theory gives him less wiggle room to time stock trades to his advantage. Cook is likely to collect millions more in Apple stock in coming years.

Still, it isn't meaningless when the CEO sells a chunk of his shares weeks before what could be a blockbuster new iPhone hits the market. Cook knows Apple's prospects better than anyone. (Or does he?)

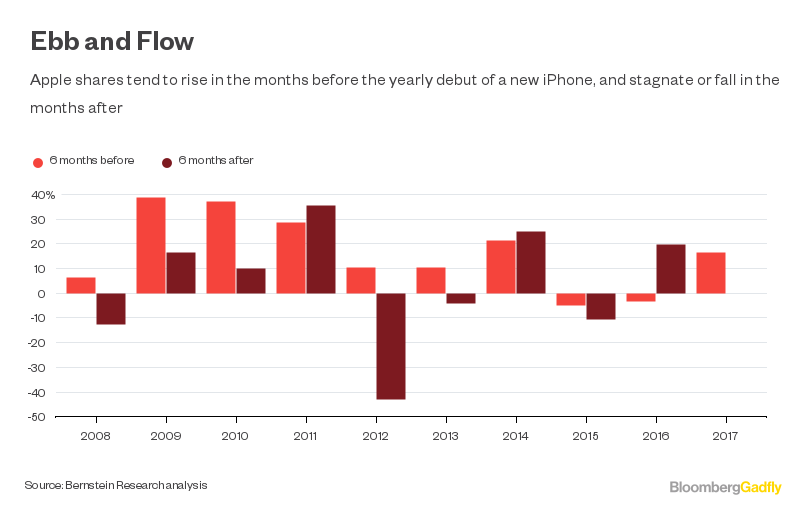

Cook's recent stock sales could be well-timed, if Apple shares stick to a pattern of rising before the introduction of a new iPhone and stagnating or falling in the months afterward.

Data compiled by Bernstein Research show Apple shares rose an average of 16.1 percent in the six months before the launch of new iPhones from 2008 to 2016. In the six months after those iPhone introductions, Apple shares rose 4.1 percent, on average, according to the Bernstein analysis.

Hewing to the first part of the pattern, Apple has been on a tear before next month's expected introduction of new iPhone models. The stock price has climbed 16.5 percent in the past six months -- close to the share gain in the same stretch before the 2014 debut of the iPhone 6, which turned out to be a hit. Shares continued to rise 25 percent in the six months after that iPhone 6 launch, as it became clear the popular device catapulted the company to a new level of growth and profits.

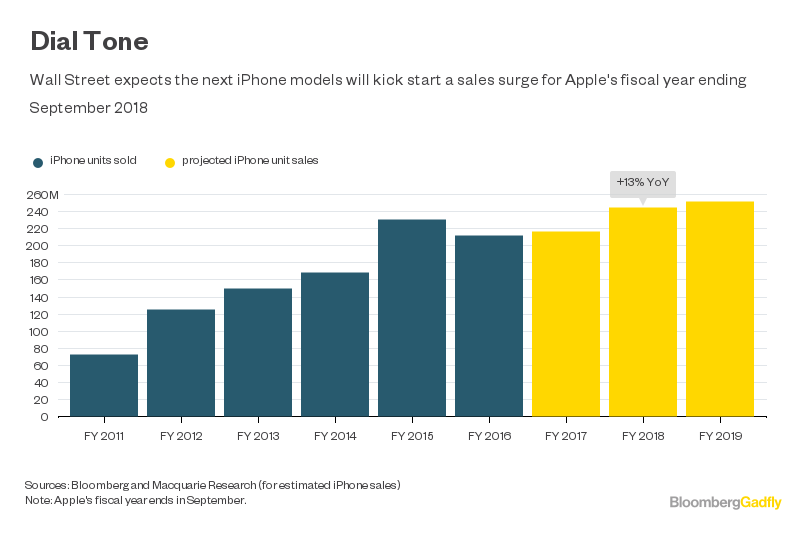

Not even Apple's biggest optimists expect the company's revenue to rise 28 percent, as it did in the fiscal year after the iPhone 6 launch. But sales are expected to jump in the next year, as Apple loyalists with older phones splurge on a new type of iPhone that is expected to cost $1,000 or so. Stock analysts on average expect Apple's total revenue to climb 15 percent in the fiscal year ending in September 2018, the fastest growth since the lift from the iPhone 6 sales surge.