The season before we started this annual “NFL Alphas” post, the Tampa Bay Buccaneers defeated the Oakland Raiders (formerly of Los Angeles and now of Las Vegas) in Super Bowl XXXVII. Where the Raiders call home isn’t the only thing that’s changed since then—San Diego (the 2003 host city) now has zero teams while the 2022 host has a fancy new stadium and two teams (one of which will be playing on Sunday).

The past 18 years have been good for equity investors: The S&P 500 Index has delivered an annualized return of 11.88% over that period. Things have also been pretty rosy for the Analytic Investors team’s NFL Alphas annual posts. Our predictive model has correctly identified the undervalued contender in 13 of 18 Super Bowls since we started running it in 2004, including the past 3.

For What It’s Worth

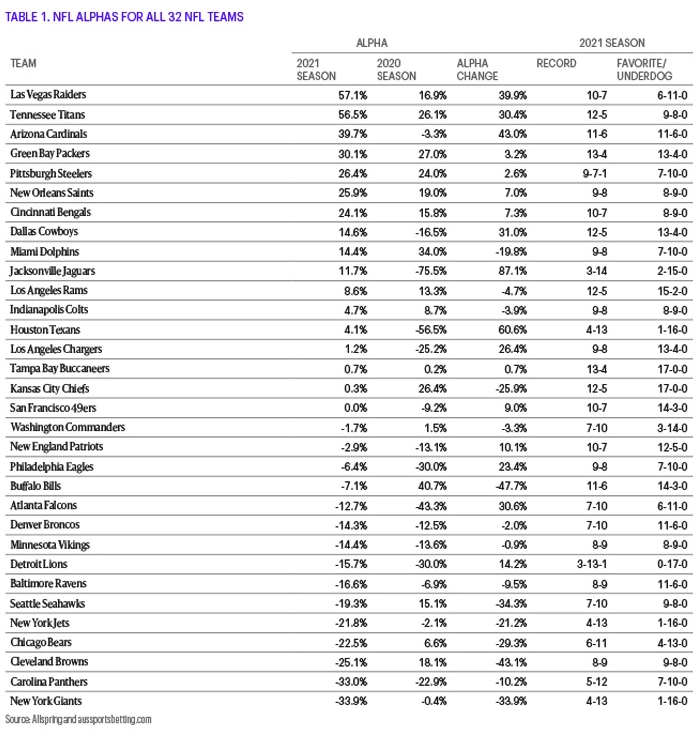

After the Super Bowl left town in 2003, we decided to start applying our quantitative investment management approach to the NFL. We devised a formula—we call it NFL Alphas—that calculates the cumulative return on investment relative to market (wagering) expectations for every team’s 16 (now 17) regular-season games.

To illustrate this concept, let’s use the Bills (the team with the highest Alpha in 2020). We’ll assume a hypothetical bettor places a $100 wager on the “money line” for Buffalo to win in each of their 17 regular-season games. If the Bills lose a game, the bettor has lost $100. If they win, the bettor would collect back the $100, plus an additional sum that’s computed based on the team’s win probability per market expectations. At the end of the season, the bettor adds up all winnings and compares that dollar amount with the $1,700 total wagered throughout the season. Anything less than $1,700 implies a negative Alpha, and anything greater is a positive Alpha. In 2021, the Bills’ wagers delivered $1,579, or a loss to the bettor of $121, which computes as a -7.1% NFL Alpha (Table 1).

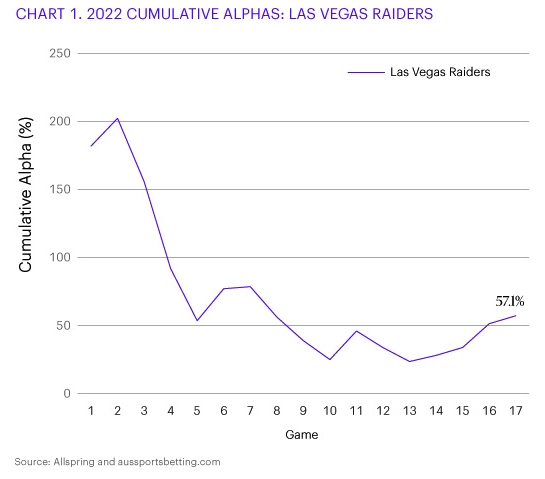

Viva Las Vegas

Each year, we like to take a closer look at the Alphas of top- and bottom-ranked teams. The 32nd-ranked team is generally one of the league’s worst performers while the top-ranked team isn’t necessarily in the upper echelon. This was the case in 2021, as the Las Vegas Raiders topped the Alpha rankings. The Raiders’ season played out like a night on the Strip: early success followed by a rough patch in the middle, only to finish with a hot streak. Like Sin City, the Raiders offered plenty of excitement. They notched a 6-2 record in one-score games, including an overtime win on the last day of the season to punch their ticket to the postseason (Chart 1).

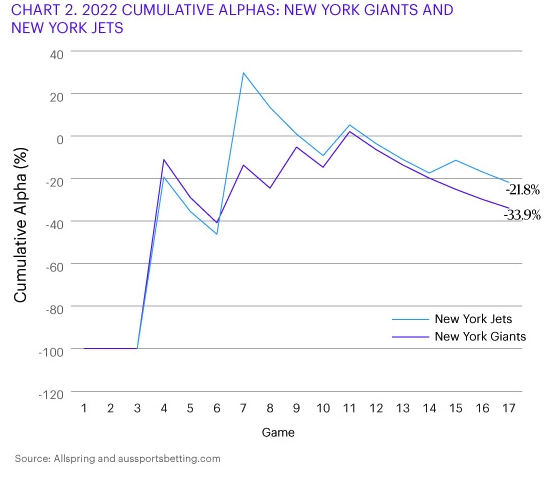

A New York State Of Mind

This year’s bottom team was the New York Giants with a paltry -33.9% Alpha, meaning a $1,700 “investment” returned only $1,124. In a show of community solidarity, New York’s other team—the Jets—had a -21.8% Alpha, or $1,329 in proceeds. The fact that these teams were underdogs 16 times in 2021 emulates the low level of expectations that’s normally reserved for the Jacksonville Jaguars. Fear not, Giants fans: The Jags won “Most Improved Alpha” in 2021. They were able to overachieve late in the season to deliver a +11.7% Alpha—a vast improvement over 2020’s -77.5%, which would have turned $1,600 (16 games in 2020) into $392 (Chart 2)!

Major Tom

The other big news last week was that Tom Brady is retiring. Twenty-two years, seven rings, and his ubiquitous GOAT (greatest of all time) status inspired us to reflect on Tom and our Alphas. People, institutions, and algorithms have been underrating Tom Brady for almost a quarter century, and he has pretty consistently proven them all wrong. Of the 18 Super Bowl games for which we’ve shared a prediction, Tom Brady played in nine, winning six. Our model hasn’t been quite as good when there is a “Brady Factor”—going a respectable 5-4 in those nine games compared with 8-1 when Tom was on the beach. Tom has confirmed that this season was his last dance, and we wish him and the rest of the Brady-Bündchen clan all the best in whatever comes next (as long as it’s away from the NFL).

High Hopes

We’ve been managing low-volatility equity strategies for about as long as we’ve been picking Super Bowl winners. Since 2004, the team has been running portfolios based on our award-winning research into the low-volatility anomaly: the idea that low-risk stocks generally outperform their high-risk counterparts over time. Over the past handful of years, we’ve been documenting a similar effect when it comes to the NFL: Less risky, lower-payout wagers on teams that are large favorites tend to outperform riskier ones placed on large-payout, heavy-underdog teams (commonly referred to as “lottery tickets”).

Recently, markets have been bucking this long-term trend as higher-risk stocks have been outperforming lower-risk stocks over the past few years. This is consistent with what we’ve seen in the betting markets: The trend we saw in 2019 and 2020 continued in 2021. Low-risk wagers returned -8.3% while the long shot, high-risk ones returned 42.8%: a 50.5% spread (Chart 3). If history gives us any insight, the payoff to these high-risk wagers, like the returns on the high-risk stocks we like to short, will see some reversion to the mean.

Don’t Stop Believin’

Our research has found that NFL teams tend to revert back to their average longer-term success ratios: Teams that outperform expectations in one season tend to underperform expectations in the next (and vice versa). We’ve also observed that this trend is apparent as soon as a season’s playoffs. More specifically, teams with higher NFL Alphas usually have underperformed in the postseason, thus making the team with the lower Alpha the better selection to cover the point spread.

We looked pretty good after the divisional week (having gone 5-1), but the “most exciting two weeks in NFL history” were a bit more challenging as the model went 3-3, ending the playoffs with a still-respectable 8-4 record (Table 2) to take the NFL Alphas’ all-time playoff record to 116-72, a 62% success rate.

I Love L.A.

This is the fourth time a local team has played in the Super Bowl. (While Palo Alto is not San Francisco and Pasadena is not Los Angeles, they are within Uber range, which is good enough for this narrative.) Home teams have won two out of three, including a win by Tom and friends last year. The one and only local team to lose the Super Bowl? Why, it was the 1980 Los Angeles Rams’ loss to the Pittsburgh Steelers at the Rose Bowl in Super Bowl XIV. Thirty-two years later, the Cincinnati Bengals (seventh-best Alpha of 24.1%) will face the Los Angeles Rams (Alpha of 8.6%). Since we expect higher-alpha teams to underperform, our pick for Super Bowl LVI is the Los Angeles Rams (Table 3). If Los Angeles covers the spread this weekend (current consensus is Rams by four points), the NFL Alphas will improve to 14-5, and while this may not qualify our model as the GOAT, it will likely be good enough for Rams fans everywhere. (Everywhere but St. Louis.)

Matt Robinson, CFA, is a portfolio analyst for Allspring Global Investments.