American consumers rang in the New Year by paying off even higher credit card debt than they did in the old one, and recent moves by the Fed didn't help.

On December 20, 2018, the Fed hiked interest rates for the fourth time last year, costing credit card users nationwide an additional $1.56 billion in interest to service their existing debt, according to WalletHub.

The website has released a new report identifying U.S. cities whose residents have the most credit card debt.

WalletHub examined the median credit card balances of residents in 2,564 U.S. cities, based on TransUnion data. The analysis included credit cards that carried a balance, while excluding store cards.

Using WalletHub’s credit card payoff calculator, study analysts used consumers’ median income and median credit card balance in each city to determine the required number of months it would take consumers to pay off that balance and the attendant finance charges. Rankings are based on all three factors.

In ascending order, here are the top 10 cities with the most credit card debt entering 2019.

10. Sammamish, Wash.

The childhood home of actor Clint Eastwood, this city's median household and family incomes are each more than $100,000 per year. Residents of Sammamish have a median credit card debt of $4,386 with a $575 finance charge that will take an estimated 20 months and 24 days to pay off.

9. Needham, Mass.

This Boston bedroom community has about 30,000 residents and the median family income is over $140,000. Needham residents have a median credit card debt of $4,393 with a $577 finance charge that will take an estimated 20 months and 25 days to pay off.

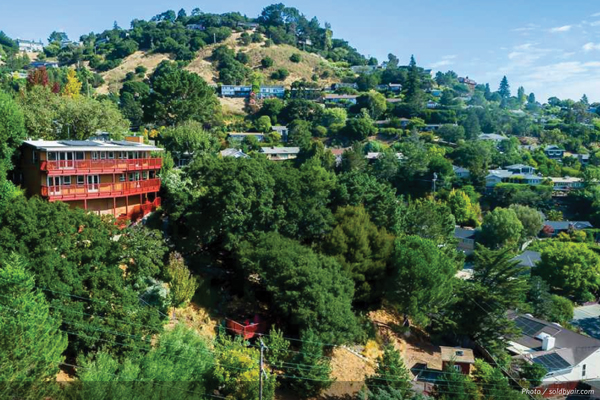

8. Mill Valley, Calif.

Mill Valley lies beneath Mount Tamalpais, just a short commute from San Francisco. Its idyllic location is popular with many high-income commuters in the Bay Area. Less than 14,000 residents can afford to live in this 4.85-square-mile municipality, where the median listing price of a single-family home is more than $1.5 million, according to Zillow. Mill Valley residents have a median credit card debt of $5,110 with a $672 finance charge that will take 20 months and 26 days to pay off.

7. The Woodlands, Texas

The brainchild of Texas oil industry investor George P. Mitchell, The Woodlands is a planned community developed 28 miles north of Houston, with a growing population of more than 100,000 residents that includes many notable athletes. The Woodlands residents have a median credit card debt of $5,088 with a $670 finance charge that will take them an estimated 20 months and 27 days to pay off.

6. Leawood, Kan.

Leawood was named in honor of Oscar G. Lee, an original owner of the town site, which was part of the Louisiana Purchase. Thanks to the Santa Fe Trail that runs through this small municipality, it has attracted a growing population of just over 30,000 residents. The median family income is over $145,000. Leawood residents carry a median credit card debt of $4,857 with a $642 finance charge that will take them an estimated 20 months and 29 days to pay off.

5. Summit, N.J.

Summit’s average annual household income is more than $220,000 and its population is just over 21,000. The median listing price is $999,500. It is ranked one of the wealthiest cities in America. Summit residents have a median credit card debt is $4,953 with a $655 finance charge that will take them an estimated 20 months and 29 days to pay off.

4. Fairbanks, Ala.

Fairbanks is Alaska’s second most populous city, yet the median annual household income is just over $55,000. Residents have a median credit card debt of $4,655 with a finance charge of $620 that will take an estimated 21 months and two days to pay off.

3. Park City, Utah

This vacation mecca draws more tourists annually than it does permanent residents living there. The rich and the famous frequent its popular ski resorts and hiking and biking trails. Park City residents have a median credit card debt is $5,376 with a $720 finance charge that will take an estimated 21 months and five days to pay off.

2. Darien, Conn.

Thirty-seven miles northeast of New York City, with a population of less than 21,000, Darien is one of the wealthiest municipalities in America. The average annual household income is over $300,000. Darien residents have a median credit card debt of $7,935 with a $1,167 finance charge that will take an estimated 23 months and eight days to pay off.

1. Colleyville, Texas

Consistently ranked as the safest city in Texas and one of the safest in the U.S., Colleyville offers residents a rural setting conveniently located less than four miles from the Dallas/Fort Worth Airport. The average household income is more than $200,000 and the median listing price for a home is $659,500. The median credit card debt is $5,593 with an $880 finance charge that will take an estimated 24 months and 28 days to pay off.

The full report can be viewed here.