Are these stocks value plays with sustainable payouts or dividend traps?

Many clients are craving retirement income. In this long era of low interest rates, there aren’t that many places to get significant income streams. Stocks with juicy dividends can seem like good investments for them, but it’s up to advisors to do more digging to see if these equities are likely a good deal for patient investors or are likely to go south soon.

The following 20 equities have the highest dividend yields, as of October 8, 2019, according to FactSet.

20. Simon Property Group Inc. (SPG): 5.5%; YTD price return: -13.2%

Simon Property Group is the largest real estate investment trust and shopping mall owner in the United States. It also owns properties in Europe and Asia.

19. Kohl’s Corporation: (KSS); 5.5%; YTD price return: -27.0%

Kohl’s is one of the largest department store chains in the U.S. with more than 1,100 stores in 49 states.

18. Las Vegas Sands Corp, (LVS): 5.6%; YTD price return: 2.7%

Las Vegas Sands develops resorts, which often include casinos, throughout the world. Some of its properties include the Venetian Resort and Sands Expo in Las Vegas and the iconic Marina Bay Sands in Singapore.

17. AbbVie Inc. (ABBV): 5.8%; YTD price return: -20.2%

AbbVie is a global pharmaceutical company that develops therapies for some of the world’s most complex and critical health conditions.

16. Gap Inc. (GPS): 5.9%; YTD price return: -37.8%

Gap, the well-known jeans maker, produces clothing, accessories and personal care products that are sold in more than 90 countries under various brands, including Old Navy, Gap, Banana Republic, Athleta, Intermix, Janie and Jack, and Hill City.

15. Kraft Heinz Co. (KHC): 5.9%; YTD price return: - 37.9%

Kraft is a global producer of foods under many well-known brand names, including Oscar Mayer, Kool-Aid, Jell-O, Philadelphia cream cheese, Maxwell House coffee and many more.

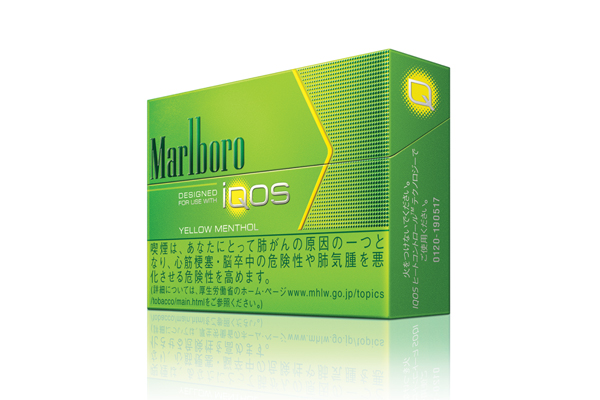

14. Philip Morris International Inc. (PM): 6.1%; YTD price return: 14.4%

Long known as a global cigarette company with some of the most famous brands sold in more than 180 markets, the company has made a big shift into smoke-free products such as e-cigarettes for vaping.

13. Schlumberger NV (SLB): 6.3%; YTD price return: 6.3%; YTD price return: -14.9%

Schlumberger is the world’s leading oil field services provider and employs about 100,000 people around the world. According to Reuters, Schlumberger’s new CEO, Olivier Le Peuch, plans to restructure the company by exiting unprofitable businesses and restructuring some units.

12. Williams Companies Inc. (WMB): 6.5%; YTD price return: 3.9%

Williams Companies is an energy group that focuses on natural gas processing and transportation. Williams owns and operates more than 30,000 miles of pipelines systemwide and handles approximately 30% of U.S. natural gas.

11. L Brands Inc. (LB): 6.5%; YTD price return: -31.0%

L Brands is a fashion retailer whose flagship brands include Victoria’s Secret, Pink and Bath & Body Works. The company operates nearly 3,000 company-owned specialty stores in the U.S., Canada, the United Kingdom, Ireland and greater China, and its brands are sold in more than 650 franchised locations worldwide.

10. Nielsen Holdings Plc (NLSN): 6.7%; YTD price return: -13.1%

Nielsen is a global measurement and data analytics company that operates in more than 100 countries and employs about 44,000 people worldwide. It measures what consumers watch on various mediums and what they want to buy.

9. Ford Motor Co. (F): 6.9%; YTD price return: 11.6%

Ford’s history as a U.S. auto maker dates back to 1903. Today, it is focused on increasing the technology used in the cars and trucks it sells and testing and building autonomous vehicles.

8. Occidental Petroleum (OXY): 7.5%; YTD price return: -33.5%

Occidental Petroleum is an oil and gas exploration and production company whose activities are concentrated in the United States, the Middle East, Latin America and Africa. It also markets, transports and stores related products and is a leading manufacturer of chemicals used in pharmaceuticals, water treatment and plastics.

7. Iron Mountain Inc. (IRM): 7.6%; YTD price return: -1.3%

Iron Mountain is a global business that stores, manages and protects information and assets, including business data, geological samples, fine art and more.

6. Helmerich & Payne Inc. (HP): 7.6%; YTD price return: -23.6%

Helmerich & Payne is a drilling rig company for the oil and gas industry. Its operations are in the U.S., South America and the Middle East. It also has offshore drilling in the Gulf of Mexico.

5. Invesco Ltd. (IVZ): 7.9%; YTD price return: -8.1%

Invesco is an investment management company that has offices in 25 countries. As of September 30, its assets under management totaled $1,184.4 billion.

4. Altria Group Inc. (MO): 8.0%; YTD price return: -15.0%

Altria is one of the largest producers of tobacco, cigarettes and smokeless tobacco products. It also either owns or has significant investments in alcohol and cannabis companies.

3. CenturyLink Inc. (CTL): 8.7%; YTD price return: -25.1%

CenturyLink provides information technology, hosting and managed services for businesses, and high-speed internet, television and voice services for home users.

2. Macy’s Inc. (M): 10.0%; YTD price return: -50.2%

Macy’s is a well-known U.S. department store retailer with about 130,000 employees. The company has 680 department stores and approximately 190 specialty stores in 43 states.

1. Macerich Co. (MAC): 10.4%; YTD price return: -36.0%

Macerich is a real estate investment trust that invests in shopping centers. It is the third-largest owner and operator of shopping centers in the United States. As of December 31, 2017, the company owned interests in 55 properties.