The U.S. these days has a testy geopolitical (and economic) relationship with China and Russia but investors don’t seem to share those qualms, at least as shown by a roster of the 10 best performing exchange-traded funds that invest in equities in international countries or regions. According to data from XTF.com, ETFs investing in these two countries combine to comprise more than half of the top 10 performers year to date through October 16. But the top performing ETF might come as a surprise. Below is the top 10 list, in ascending order:

10. Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) - YTD return of 27.9%

This fund tracks an index composed of the 300 largest and most liquid stocks in the China A-Share market. A-Shares are equity securities issued by companies incorporated in mainland China and are denominated and traded in renminbi on the Shenzhen and Shanghai Stock Exchanges.

![]()

9. BlueStar Israel Technology ETF (ITEQ) - 28.4%

Fund literature for this product quotes Warren Buffett’s comment about Israel being “the leading, largest and most promising investment hub outside the United States.” ITEQ is a passive fund targeting the Israeli technology sector and includes companies involved with cyber security, autonomous driving, artificial intelligence, cleantech, defense-oriented tech and 3D printing.

8. VanEck Vectors ChinaAMC SME-ChiNext ETF (CNXT) - 28.8%

CNXT follows an index containing the 100 largest and most liquid China A-share stocks listed and trading on the Small and Medium Enterprise (SME) Board and the ChiNext Board of the Shenzhen Stock Exchange. According to ETF Research Center, this A-shares product has only a 14% overlap by weight with the Xtrackers ETF that’s 10th on this list.

7. KraneShares MSCI All China Health Care Index ETF (KURE) - 29.2%

A very specific focus on health care helps this fund stand out from the crowded field of China ETFs. Its underlying index comprises securities listed in mainland China, Hong Kong and the U.S.

6. CSOP MSCI China A International Hedged ETF (CNHX) - 30.6%

Another fund with exposure to China’s A-share market. But in the case of CNHX, it’s based on the MSCI China A International with CNH 100% Hedged to USD Index that tracks the equity market performance of large-cap and mid-cap Chinese securities listed on the Shanghai and Shenzhen Stock Exchanges, while at the same time neutralizing exposure to the fluctuations of the renminbi with a currency hedge to the U.S. dollar.

5. Global X MSCI China Consumer Discretionary ETF (CHIQ) - 31.3%

Chinese consumers are the focus of this fund, which follows a free float-adjusted market cap-weighted index where the recent largest holdings were Alibaba, JD.com and TAL Education Group.

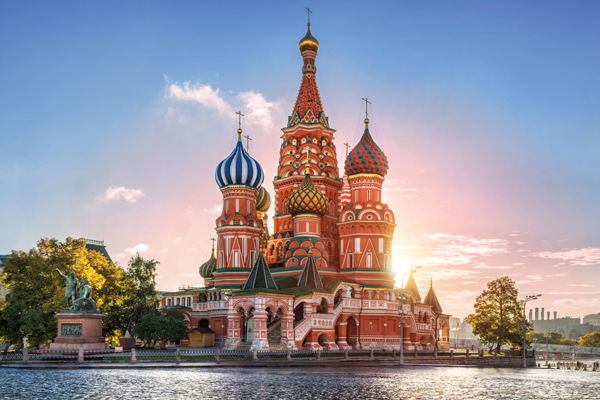

4. iShares MSCI Russia ETF (ERUS) - 31.6%

The Russian economy has been hammered during the past five years by low oil prices, along with sanctions imposed following Russia's invasion and annexation of the Crimean Peninsula in 2014. But cheap valuations of Russian stocks, plus a halt in new sanctions that has helped strengthen the ruble, have triggered a rebound in the country’s equities. ERUS invests in a broad range of companies, but it’s no surprise that energy is the largest sector weight at about 47%. The fund’s collective portfolio trades at a measly price-to-earnings ratio of 5.5.

3. Franklin FTSE Russia ETF (FLRU) - 32.5%

A different index provider—FTSE for this fund versus MSCI for the ERUS fund—is one main differentiator between these two Russia ETFs. The other big difference is price: FLRU charges 0.19% compared to 0.62% for ERUS.

2. CSOP FTSE China A50 ETF (AFTY) - 33.1%

Yet another China A-shares fund (you spotting a trend here?). CSOP’s underlying index comprises the 50 largest companies in the China A-Shares market. Financials are the largest sector weight by far, at 52%. As such, three of the top four holdings are in the financial sector.

1. Global X MSCI Greece ETF (GREK) - 39.6%

Investors have reacted favorably to Greece’s efforts to get its economic act together. And they especially like the recent election as prime minister of Kyriakos Mitsotakis, a Harvard-educated former banker and leader of the center-right New Democracy party. Expectations are high for him to follow through on promises to cut red tape and taxes for businesses, and to boost export-driven sectors.