Because the phrase “Trade War” has been in the news so consistently of late, investors have naturally felt the need to ask us, given that we manage an international mutual fund, how the trade wars could affect our fund. It is impossible to say with any high degree of specificity given we don’t know how these trade disputes will turnout. However, looking at our investment approach and style could be helpful in gauging any potential impacts from these disputes.

First, let us preface our comments by saying that we are “free traders” at heart. The imposition of tariffs certainly can cause economies driven by global trade to be less robust. While free trade is a “good thing,” unfettered free trade may not always be in the best interests of a particular country. Frankly, world governments do not allow unfettered free trade. Ultimately, erecting trade barriers (or their removal) are politically-calculated decisions designed to appeal to different constituencies at a point in time.

The issue is not really about free trade versus tariffs but changing the current tariff regime. These potential changes undoubtedly can have adverse impacts on certain industries and global trade in general. However, it is instructive to note that much of the trade noise we hear is to some degree part of the current negotiation strategies being carried out between countries. Usually this process takes place behind closed doors, and when tariffs or penalties are imposed, it typically doesn’t garner much press.

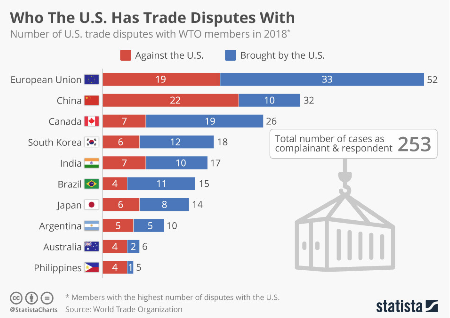

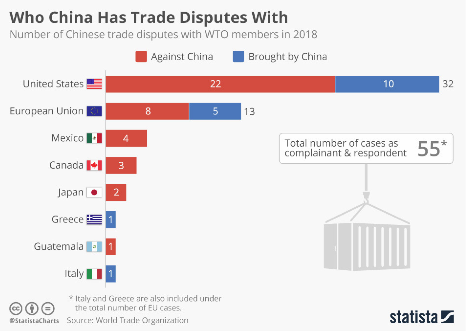

The frequency of trade disputes can be seen in the World Trade Organization (WTO) data as of April 30, 2018:

Political motivations are also why countries such as China and Mexico favor imposing tariffs on industries viewed as heavily populated by the current administration’s political base. Meanwhile, in news last week, European automakers agreed to the removal of trade barriers for U.S.-manufactured cars, while $34 billion of Chinese tariffs and their retaliation went in to effect. Markets reacted positively to both events.

Experts suggest a full trade war between the United States and China could slow the rate of economic growth by 0.7 percent for the United States and for China by 0.6 percent. For an all-out global trade war scenario, the same experts suggest U.S. real Gross Domestic Product (GDP) could slow by as much as 2.2 percent and for China GDP by as much as 1.7 percent.

As a reminder, the above numbers are an estimate of the potential slowdown in the rate of GDP growth. To gauge the impact, the United States is estimated to have real GDP growth of around 3 percent this year, while China’s real GDP growth is expected to come in around 6.5 percent.

Effects On Companies

Companies, when directly impacted by a change in tariffs, have a few options in the short term: 1. Pass the change in tariffs on to the end consumer with an increase in price, keeping margins stable; 2. Eat the price increase from tariffs and suffer reduced margins; 3. Some combination of the two in order to balance unit sales and profit margins.

In the longer-term, say 1-3 years, companies have the ability to adjust their supply lines to increase local content and lessen the impact of any change in tariffs. After the tariffs have been put in place and base year effects kick in, there should be less impact to GDP growth in future years.

Most companies around the globe shouldn’t be directly impacted by a change in tariffs, but could be affected by the overall slowdown in GDP growth rates. If a company were directly impacted by a tariff change, the impact would naturally be greater. However, there are some winners too. Companies based in other locales or which provide more local content could be helped in an equally positive direction with higher prices, more demand, or a combination of both.

Impacts To The Buffalo International Fund And Its Holdings

The first tenant of our investment approach is to identify companies with structural tailwinds driven by secular growth trends. We generally believe these trends will continue to push the underlying fundamentals of our companies throughout the economic cycle, and through any economic turbulence caused by changing tariff regimes. Because we invest with an eye toward secular growth, we naturally have limited exposure to commodity-type products or heavy industries that are the typical focus of most trade actions.

We are focused on owning companies with wide economic moats and strong intellectual property which, while not immune, have substantial barriers to competitive pricing dynamics and we think should benefit from a strengthening of intellectual property rights. We also don’t look favorably on companies that benefit from governmental largess, as regimes change and politically-erected barriers can easily be dismantled.

This isn’t to say that our portfolio is completely immune to a slowdown in global economic growth, or that none of our companies might be the subject of a trade dispute. It’s simply that the underlying trends driving the fundamentals of the companies we own should be less exposed to direct impact of trade disputes and should over-time be able to better weather any potential set-backs caused by escalating trade tensions.

Example From Bufix Portfolio

Sartorius is a company we’ve owned in the Fund for quite some time. Sartorius provides equipment for the manufacture of biologic pharmaceuticals. The company is exposed to a few secular growth trends which should help drive their fundamentals:

• Increasing use of new biologic agents to combat disease;

• The increasing penetration of bio-generics, requiring increased technical manufacturing capability; and

• Aging demographics where populations are more exposed to diseases where biologics are gaining a strong foothold (cancers, Alzheimer’s, immunodeficiency as examples).

There is strong intellectual property and few competitors capable of providing the government approved technical equipment for the manufacture of biologics the barriers to entry are high.

Sartorius is expected by analysts to grow revenue by more than 8% this year, driven by demand from the trends indicated above, and have little to no exposure to the general economic cycle. We don’t see any avenues where their products are easily substitutable or where competitive pricing dynamics could be upset in the advent of trade actions. Any trade disputes that do come along shouldn’t have a material impact on the longer-term outlook for their business. That said, market volatility driven by a tariff scare could cause the price of Sartorius stock to drop, which, to our way of thinking, might allow us the potential opportunity to add to shares at a price that we otherwise wouldn’t have been able to achieve, all else being equal.

Bottom Line

Recent trade tensions and the worry surrounding the potential for an all-out trade war have certainly contributed to the increase in market volatility around the globe in recent months. So far, we see little in the way of direct impact to the business models for the majority of our portfolio holdings. The increase in volatility may provide us access to lower prices, which theoretically should open the Fund to opportunities to generate more attractive risk adjusted returns.

Yes, we worry about global trade disputes, but we think the impacts to the portfolio are likely to be short-lived and relatively limited. Should trade disputes impact the markets to any significant degree, the volatility just may provide us the opportunity to identify additional attractive investment opportunities.

Bill Kornitzer, CFA is a portfolio manager for the Buffalo International Fund (BUFIX) at Buffalo Funds in Mission, Kansas.