President Donald Trump hailed the Great American Comeback in Tuesday’s State of the Union address. It came at the end of a 24-hour period that will leave his detractors in a state of almost total despair. The Democrats’ awful fiasco in Iowa leaves the chances of a Trump re-election looking stronger than ever.

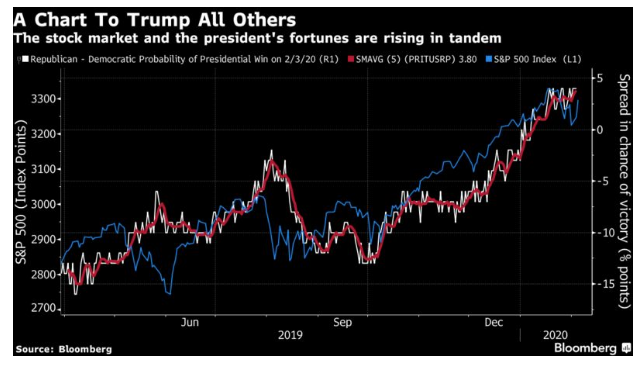

This all wraps together with the stock market, which has been rallying in line with the perceived improvement of Trump’s chances of prevailing in November’s election. The following chart shows the Republicans’ chance of victory minus the Democrats’ chance on one scale, and the S&P 500 on the other. It may be even more unpalatable for Democrats than the farce in Iowa, or the text of the president’s speech:

Trump has that critical quality that Napoleon demanded of his generals: He is lucky. And as ever, some of his claims are stretched. Here is the key passage from the State of the Union on markets:

Since my election, United States stock markets have soared 70 percent, adding more than $12 trillion to our Nation’s wealth, transcending anything anyone believed was possible—this, as other countries are not doing well. Consumer confidence has reached amazing new heights.

All of those millions of people with 401(k)s and pensions are doing far better than they have ever done before with increases of 60, 70, 80, 90, and even 100 percent.

Let’s do some fact-checking. The S&P 500, by far the most widely used measure of the U.S. stock market, is up 54% since Trump’s election on a price basis, and 64% on a total return basis. These numbers are very good. He exaggerated them, but not by all that much. And presumably there must be someone out there who took some extremely risky positions in their 401(k) and managed to double their money in barely over three years, but they needed to gain about 25% a year to do so, so it is unlikely they had many bonds in their portfolio.

It is true that certain areas of the market are performing quite remarkably. It is also true that the U.S. has easily outpaced the rest of the world. It might, however, be wise not to be too triumphant about this, as the gains don’t look sustainable. The rise in the internet-leader FAANG stocks has gone vertical in recent days:

As for the idea that 401(k)s are doing better than ever before, it is nonsense. We don’t have to go back very far at all to find better. Assuming that 401(k)s are 100% invested in an S&P 500 tracker fund, which is the implicit assumption, there have been periods of three years and three months (the period that has elapsed since Trump was elected) under each of his three immediate predecessors when the stock market did even better. Here is a chart, on a log scale so that similar percentage increases all appear equal:

Note that I didn’t even bother to include the ridiculous three years leading up to the top of the dot-com bubble. The best period to invest started with the bottom of the market in 2009 after the crisis, but amazingly the latter Obama years had another rally that was slightly better than the rally of the last three years.

I wouldn’t say that the returns under Trump have transcended anything I thought possible, but I will happily admit that they have been much stronger than I thought likely, for the good reason that he started his term with stocks already expensive (Clinton and Obama both inherited a cheap stock market). As the stock market is already expensive, its continued gains are undeniably impressive. But the longer Trump stays in office, the greater the risk is that he will see markets revert back toward a valuation mean, as they did very violently near the beginning and again near the end of the presidency of George W. Bush.

For now, the president is buoyed by luck, by an economy that has stayed on its positive track, by very positive sentiment, and by opponents who are hopeless. And then of course, there is the macabre effect of the coronavirus, which is fueling an American comeback.

Coronavirus: The Impact So Far

U.S. markets enjoyed a great day Tuesday, trading almost on the assumption that China’s virus epidemic can be contained without breaking out in the developed world. A month ago, reflation appeared to be under way, with emerging market currencies, and commodities, recovering after a long period in the doldrums. That has abruptly reversed:

Can we attribute this to the coronavirus? Probably. We don’t have much economic data yet, but the following charts, produced by Capital Economics Ltd. of London, show that average road congestion and passenger transport volumes in China are down massively this year compared to previous lunar new year holidays. A significant impact on the Chinese economy, and hence on the halo of emerging markets and commodities surrounding it, is a certainty—although the extent of that impact is still unknown.

What has been the impact on markets? As the following chart produced by Torsten Slok of Deutsche Bank AG shows clearly, there have been serious falls for almost anything connected to the emerging world and reflation, along with a pickup in gold and a rise in volatility—and a rally in the S&P 500. At this point, the U.S. is seen as a sanctuary:

Within stock markets, MSCI’s index of the 100 companies within its world index that have the greatest exposure to China makes clear that this is still being treated as a Chinese event. It will have a drastic effect on the Chinese economy, the logic goes, but not on others. This is strange logic given the size of China and its importance to the rest of the world, but at present that is the working assumption:

To view this another way, this is how the S&P 500 has fared compared to the MSCI emerging markets index since Trump was elected. Emerging markets were beginning to make up lost ground at the end of last year, thanks to improving sentiment surrounding the trade conflict between the U.S. and China. That is all over now, and the S&P is at a fresh high relative to emerging markets for the Trump presidency.

There is a problem with all of this, which is that flows seeking a haven tend to strengthen the dollar, which weakens the U.S. trading position. But the Federal Reserve will now, it is thought, feel obliged to loosen monetary policy still further in the face of the epidemic. Meanwhile, the virus, the damage it has done to China’s economy, and the widespread perception that officials concealed the epidemic from the rest of the world, will all serve to weaken the country’s negotiating position in ongoing trade talks. The U.S. is already prepared to levy tariffs in retaliation against currency manipulation, in a clear sign of confidence.

Put all this together and we have a revival delivered by the malign agency of a new epidemic. There are risks. The stock market could overheat. The virus could damage China’s economy so greatly that it brings the rest of the world down with it. Or it could spread into the U.S. The complacent attitude embodied by the gains in the stock market is alarming.

But for now, the coronavirus has helped engineer a great comeback for American markets.

This article was provided by Bloomberg News.