Doveryai, no proveryai —The Russian proverb that President Reagan commandeered in the 1980s to explain his cold war negotiating strategy—trust but verify—is an apt description of how the Small Business Administration approached the launch of the Payroll Protection Program (PPP). In order to compress its legacy loan approval programs from months to days, the Federal Government through the Treasury Department and SBA enabled lenders to fund PPP requests with minimal documentation.

In the scramble to secure a portion of the first funding allocation, borrowers scooped up $349B in less than two weeks. Then, as the rules for eligibility, fund usage and loan forgiveness became clearer, several prominent businesses returned the loans. With the second funding round of $310B, savvy lenders started to require borrowers to provide core documentation, particularly around payroll reports and tax forms documents. Lenders that made documentation an integral part of the PPP application process will have fewer issues than lenders that didn’t document their loan underwriting.

At Ocrolus, we saw first hand how important documentation was to lenders that have always provided same/next day business loan underwriting: fintech lenders. To date, we have processed documentation for over 500,000 PPP loans, representing more than 4M pages. While most fintech lenders were excluded from the initial funding event, many began to participate in partnership with SBA-approved banks. (Square and Celtic Bank, for example, was one highly productive fintech/bank partnership.)

Our experience with digitizing documentation and extracting decisionable data for the front-end of the PPP program has Ocrolus well-positioned to help lenders validate borrower eligibility for loan forgiveness. This week, we released our PPP Loan Forgiveness Program, a comprehensive solution purpose-built to automate loan forgiveness reviews. The system captures data showing the use of funds, as well as a compliance report, which shows lenders an at-a-glance snapshot of supporting documentation and demonstrates that the lender performed due diligence and can produce a documented audit trail.

What Constitutes Due Diligence?

Last week the SBA published the loan forgiveness form and schedules, which borrowers need to submit to the originating lender. There are a number of requirements placed upon the borrower for compliance, but there are also four key actions that are the responsibility of the lender:

1. Confirm receipt of borrower’s certifications described in SBA Form 3508 (the Loan Forgiveness Application Form & Schedule A.)

2. Confirm receipt of the documents that verify payroll and non-payroll costs.

3. Confirm that the borrower’s calculations on the Form 3508 are accurate.

4. Confirm that 75% of the funds being forgiven are associative with payroll.

While lenders are not required to independently verify the borrower’s reported information, lenders will have to return their loan processing fees, if the SBA determines that the borrower was not eligible to receive the loan, notwithstanding whether this was the fault of the bank or not.

Points two and three above are critical to demonstrating due diligence. We are already beginning to see cases of fraud emerge, many see the cases as just the tip of the iceberg. Initially the SBA has held the position that lenders will be held harmless if they follow CARES program guidelines. Points two and three indicate that lenders should be in a strong position if they collect the appropriate documents to show the PPP funds were used for payroll (in the correct proportion,) utilities, rent and/or mortgage payments, and that the figures provided can be verified.

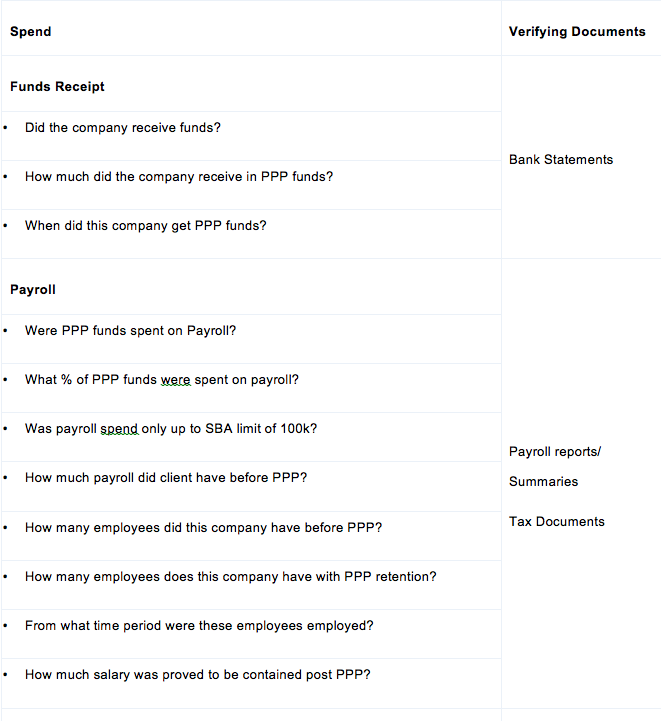

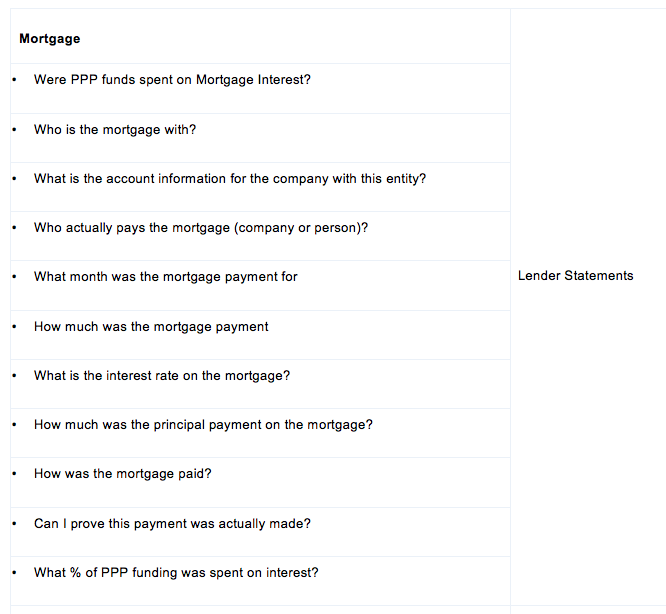

At Ocrolus we have developed a program for lenders that begins with collecting data from core documents to address the list of questions that lenders should be able to answer from borrower-provided documents:

Finally, lenders can satisfy the due diligence consideration by producing a documentation report that shows that the numbers provided are rational and that the documents are associated with the borrower.

Loan Verification Best Practices

The list of questions is not meant to be comprehensive, however the documentation and report act as a defensible structure to protect lender interests. We developed the PPP Loan Forgiveness Program as a cloud service to capture and verify loan documentation, providing third-party integrity and an audit trail to back program compliance. Ultimately, automated document verification gives lenders a structure to remove the administrative burden of due diligence, preserve loan fees and ultimately provide assurance to lenders’ valued customers that they are eligible for their loans to be converted to forgivable grants.

Ethan Schwarzbach is SBA lead at Ocrolus.