Now that the 2020 election has passed, we still face a world of increasing political uncertainty. With so many potential changes, it is helpful to find some guiding principles for business tax planning in the near term.

First, with Congress’s current make-up, it seems unlikely that a federal tax overhaul bill will pass this upcoming session. Without federal tax changes, state income taxes should play more of a role in business decision making.

State Tax Impacts

The 2017 Tax Reform Act capped deductions for state and local taxes to $10,000 for individual taxpayers. Prior to 2017, individuals who itemized could deduct state and local income and property taxes in full against their federal income taxes.

Now, such a significant deduction is no longer possible.

Therefore, living in high income tax jurisdictions such as New York or California, with 12% personal income tax rates, will prove increasingly costly to taxpayers and businesses. It is possible that individuals might choose to live in lower-tax jurisdictions to minimize such expenses. Goldman Sachs Asset Management is considering relocating to Florida, which imposes no personal income tax on residents, from its headquarters in New York, in part for such reason.

Lower Corporate Tax Rates Continue

Second, lower corporate tax rates are likely here to stay and should influence business structuring.

For years, tax advisors have recommended that clients structure their business operations as limited liability companies (LLCs) or S corporations (S corps) rather than as subchapter C corporations (C corps) to avoid the additional federal corporate tax on earnings.

Individual partners/LLC members and S corp shareholders are taxed on income from business operations only once, at their personal income tax rate. The 2017 Tax Reform Act reduced the federal corporate tax rate from 35% to 21%. In addition, the Tax Reform Act allowed corporate taxpayers, unlike individuals, to deduct state and local taxes without limit.

Pass-Through Structures May Become Less Economical

While the 2017 Act allowed individuals to claim a 20% deduction for “qualified business income” (generally, income that is not from services) from pass-through businesses, the reduction of the corporate tax rate as well as the cap on the deduction of state and local taxes for individuals may now make pass-through structures less economical.

Moreover, if President-Elect Joe Biden’s tax reform proposal passes, it hurts pass-through structures more than corporations. The Biden tax proposal would increase the top individual income tax rate from 37% to 39.6% but only raise the federal corporate tax rate from 21% to 28%. In addition, the proposal would phase out the qualified business income deduction for individuals with taxable income from pass-through businesses above $400,000.

C Corp, LLC Or S Corp: Tax Consequences

Operating as a C corp, therefore, may be a more cost-effective approach than operating as an LLC or S corp. Below is an example of the contrast:

A taxpayer, Devon, runs a molding operation to manufacture complex medical devices and draws a salary of $500,000 for managing its operations. She has invested $15 million in the business. If she operates the business in corporate form (with the following assumed projections), below are the tax consequences:

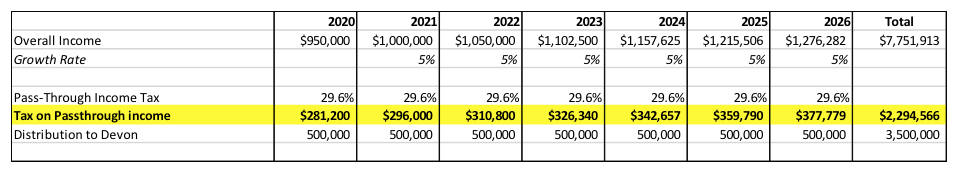

If the taxpayer operates the business in LLC/partnership form and takes a profit distribution but does not draw a salary, below are the tax consequences (assuming she qualifies for the qualified business income deduction for pass-through businesses):

With the facts above, the effective tax imposed on Devon operating the business as a C corp is lower than the tax on operating as a partnership/LLC.

Additional Benefits Of Section 1202

Moreover, Section 1202 of the Internal Revenue Code provides further benefits to individual shareholders in C corps.

Section 1202 exempts individual investors from tax on the gain from the sale of “qualified small business stock.” The gain exemption is limited to the greater of (a) $10 million or (b) 10 times the investor’s stock basis.

This Tax Code section has several technical requirements.

• First, the investor must hold stock in a C corp for more than five years to qualify.

• Second, at the time of the stock’s issuance and immediately after, the corporation must have assets with an adjusted basis of not more than $50 million (and usually a fair market value also equal to $50 million).

• In addition, the corporation must be engaged in the active conduct of a qualified trade or business (which generally excludes professional service businesses, banking and insurance businesses, farming, oil and gas producers, and hotel and restaurant operators).

In the above example, if Devon were to hold onto the stock in her medical device company for at least five years and subsequently sell the stock at a profit, a gain of up to $150 million would be tax-free to her.

Minimizing Administrative Burdens

Structuring a business as a C corp also minimizes the administrative burden imposed on taxpayers who own interests in pass-through entities and often must file tax returns in multiple states as a result of the businesses’ operations in different states. A shareholder in a C corp, by contrast, does not have to make tax filings in states where the corporation operates.

When a member of an LLC sells his or her interest in the company, it is also possible for different states to tax the sale differently (either as tangible or intangible property) in a way that might subject the LLC interest holder effectively to double tax. A shareholder’s sale of stock is generally sourced to the stockholder’s residence and therefore is not subject to additional tax in the state where the corporation does business.

Taxpayers therefore will find it easier to operate as a C corp: only the corporation must file federal and state tax returns for its business operations.

The example above shows it is time for business owners to revisit the structuring of their business operations. If you own an interest in an LLC or S corp, work with your advisors to evaluate the costs and benefits of converting the entity to a C corp.

Rudyard Kipling once advised “keep your head when all about you are losing theirs.” Such advice is sound in these times of uncertainty. Run the numbers and take calculated risks. In this way, you can engage in effective business planning for the future.

Sandra O’Neill is a tax attorney at the Massachusetts law firm of Bowditch & Dewey. She advises clients on federal income tax matters in corporate mergers, acquisitions, joint ventures and planning initiatives including the structuring of cross-border and intellectual property buy-in transactions. She also assists clients with partnership and REIT tax issues in the formation of real estate investment funds.