Now that the 2020 election has passed, we still face a world of increasing political uncertainty. With so many potential changes, it is helpful to find some guiding principles for business tax planning in the near term.

First, with Congress’s current make-up, it seems unlikely that a federal tax overhaul bill will pass this upcoming session. Without federal tax changes, state income taxes should play more of a role in business decision making.

State Tax Impacts

The 2017 Tax Reform Act capped deductions for state and local taxes to $10,000 for individual taxpayers. Prior to 2017, individuals who itemized could deduct state and local income and property taxes in full against their federal income taxes.

Now, such a significant deduction is no longer possible.

Therefore, living in high income tax jurisdictions such as New York or California, with 12% personal income tax rates, will prove increasingly costly to taxpayers and businesses. It is possible that individuals might choose to live in lower-tax jurisdictions to minimize such expenses. Goldman Sachs Asset Management is considering relocating to Florida, which imposes no personal income tax on residents, from its headquarters in New York, in part for such reason.

Lower Corporate Tax Rates Continue

Second, lower corporate tax rates are likely here to stay and should influence business structuring.

For years, tax advisors have recommended that clients structure their business operations as limited liability companies (LLCs) or S corporations (S corps) rather than as subchapter C corporations (C corps) to avoid the additional federal corporate tax on earnings.

Individual partners/LLC members and S corp shareholders are taxed on income from business operations only once, at their personal income tax rate. The 2017 Tax Reform Act reduced the federal corporate tax rate from 35% to 21%. In addition, the Tax Reform Act allowed corporate taxpayers, unlike individuals, to deduct state and local taxes without limit.

Pass-Through Structures May Become Less Economical

While the 2017 Act allowed individuals to claim a 20% deduction for “qualified business income” (generally, income that is not from services) from pass-through businesses, the reduction of the corporate tax rate as well as the cap on the deduction of state and local taxes for individuals may now make pass-through structures less economical.

Moreover, if President-Elect Joe Biden’s tax reform proposal passes, it hurts pass-through structures more than corporations. The Biden tax proposal would increase the top individual income tax rate from 37% to 39.6% but only raise the federal corporate tax rate from 21% to 28%. In addition, the proposal would phase out the qualified business income deduction for individuals with taxable income from pass-through businesses above $400,000.

C Corp, LLC Or S Corp: Tax Consequences

Operating as a C corp, therefore, may be a more cost-effective approach than operating as an LLC or S corp. Below is an example of the contrast:

A taxpayer, Devon, runs a molding operation to manufacture complex medical devices and draws a salary of $500,000 for managing its operations. She has invested $15 million in the business. If she operates the business in corporate form (with the following assumed projections), below are the tax consequences:

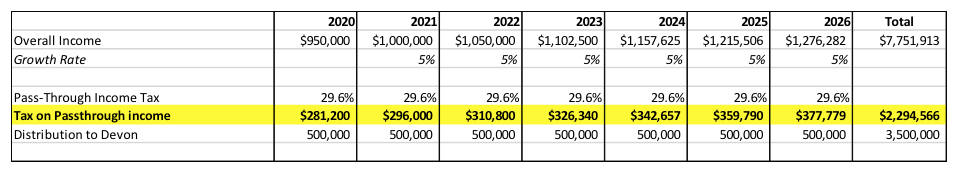

If the taxpayer operates the business in LLC/partnership form and takes a profit distribution but does not draw a salary, below are the tax consequences (assuming she qualifies for the qualified business income deduction for pass-through businesses):

With the facts above, the effective tax imposed on Devon operating the business as a C corp is lower than the tax on operating as a partnership/LLC.