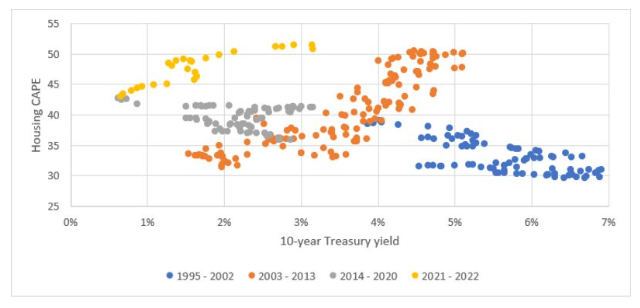

Two years ago, looking at the grey dots from 2014 to 2020, I argued that housing prices had returned to their normal relation with rates. That led me to predict valuations would fall gradually as rates rose—either due to monetary tightening or, if that didn’t happen, increased inflation expectations.

But then the yellow dots happened. Home valuations increased as rates increased, just as in the housing bubble. Perhaps that is turning around now, as housing prices are beginning to decline (typically before we see large price declines we see softening markets—fewer buyers and sellers, longer delays between listing and sales—as have been happening in the last few months) and the Fed is raising rates. But looking at the data so far, it looks like a bubble.

Maybe you shouldn’t pay much attention to what I think now, since I was exactly wrong two years ago. But I’m still not panicking about a housing crash. I expect valuations to revert to long-term mean because rents will continue to increase rapidly, meaning no dramatic drop in home prices is necessary. I base that on expectations for more legal immigration and legalization of existing undocumented immigrants and lifestyle changes—mainly more working from home—triggered by the pandemic, but not reverting to past practices.

Other factors are the eviction moratoriums of the last two years discourage renting and construction of rental housing, and the massively inflated money supply has to go somewhere. I think the student loan forgiveness increases home buyers’ expectation of mortgage forgiveness if prices decline. After all, that almost happened in 2008, and it will be hard for politicians to ignore the cry, “You bailed out rich college graduates, why not hard-working middle-class homeowners?”

But if I’m wrong about a rapid escalation in rents, everything seems to be in place for a historic crash in housing prices, inflicting broad economic damage.

Aaron Brown is a former managing director and head of financial market research at AQR Capital Management. He is author of The Poker Face of Wall Street. He may have a stake in the areas he writes about.

Unless Rents Rise, Housing Is Set Up For An Epic Crash

September 22, 2022

« Previous Article

| Next Article »

Login in order to post a comment