Over the course of 2022, public asset classes experienced a “valuation reset,” or a market correction. We saw valuations move materially lower over the last year, with bond valuations resetting the most on the back of rates rising from 0% to 4.5% through 2022 (Source: Bloomberg, iCapital Investment Strategy, as of January 12, 2023). Equities also reset lower and at current, do not appear as expensive as they were before (Source: Bloomberg, iCapital Investment Strategy, as of January 9, 2023).

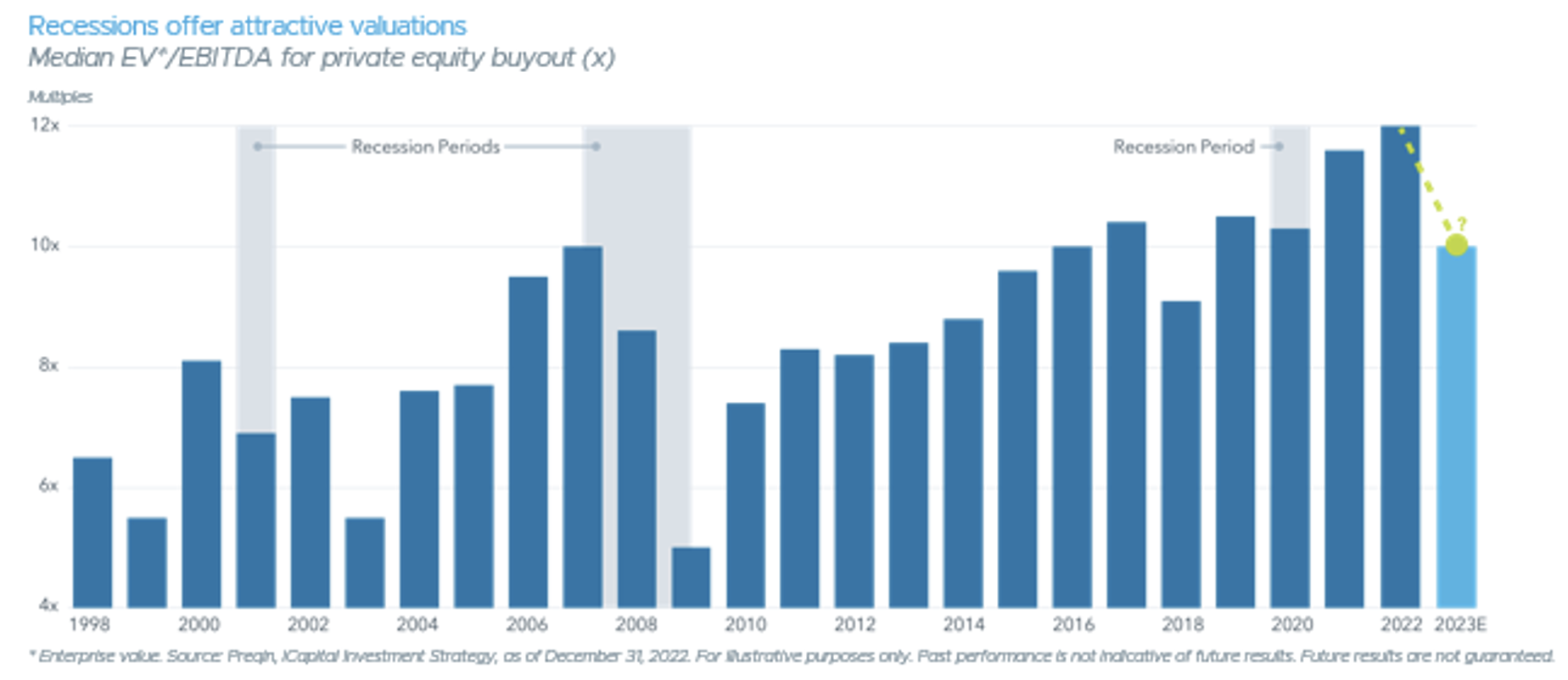

This current dislocation in the public equity markets will continue to impact private market valuations in the coming quarters, presenting an attractive opportunity for investors to take advantage of the reset in valuations in the private equity space. Given the timing and information lag inherent in private markets, this dynamic has not yet been fully realized at the deal level, but further contraction in multiples is expected. While this may lead to multiple compression in existing portfolios, a valuation reset may create an attractive buying environment.

Historically, private markets take six to 12 months to fully reflect the valuations environment in the public markets. We are in the midst of this private markets valuation correction, and the pricing expectations of buyers and sellers have begun to converge. We may not see the full extent of valuation correction of public markets in the private markets, as private markets valuations are generally based more on underlying company fundamentals rather than sentiments that often impact public markets for short periods of time. Further, private markets have historically grown at a faster rate than public markets. Thus, a faster-growing private company with stronger fundamentals is not likely to be priced as low as observed in public markets.

The deal activity is likely to be lower in the first half of 2023, as the market works to find its footing. Fund managers are becoming more selective, which is understandable given the pessimistic macro backdrop, leading to flight to safety mindset. As valuations begin to reset in the buyout market, we see an opportunity to acquire strong businesses at lower valuations than have been available in recent years. One of the major advantages of buyout investing is the ability to control/ influence the strategic direction of underlying businesses and create long-term value (e.g., enhance the return potential). This approach could be attractive in today’s environment where strong management teams, with the support of capital and advice from experienced buyout fund managers, can use their strength to gain market share and expand.

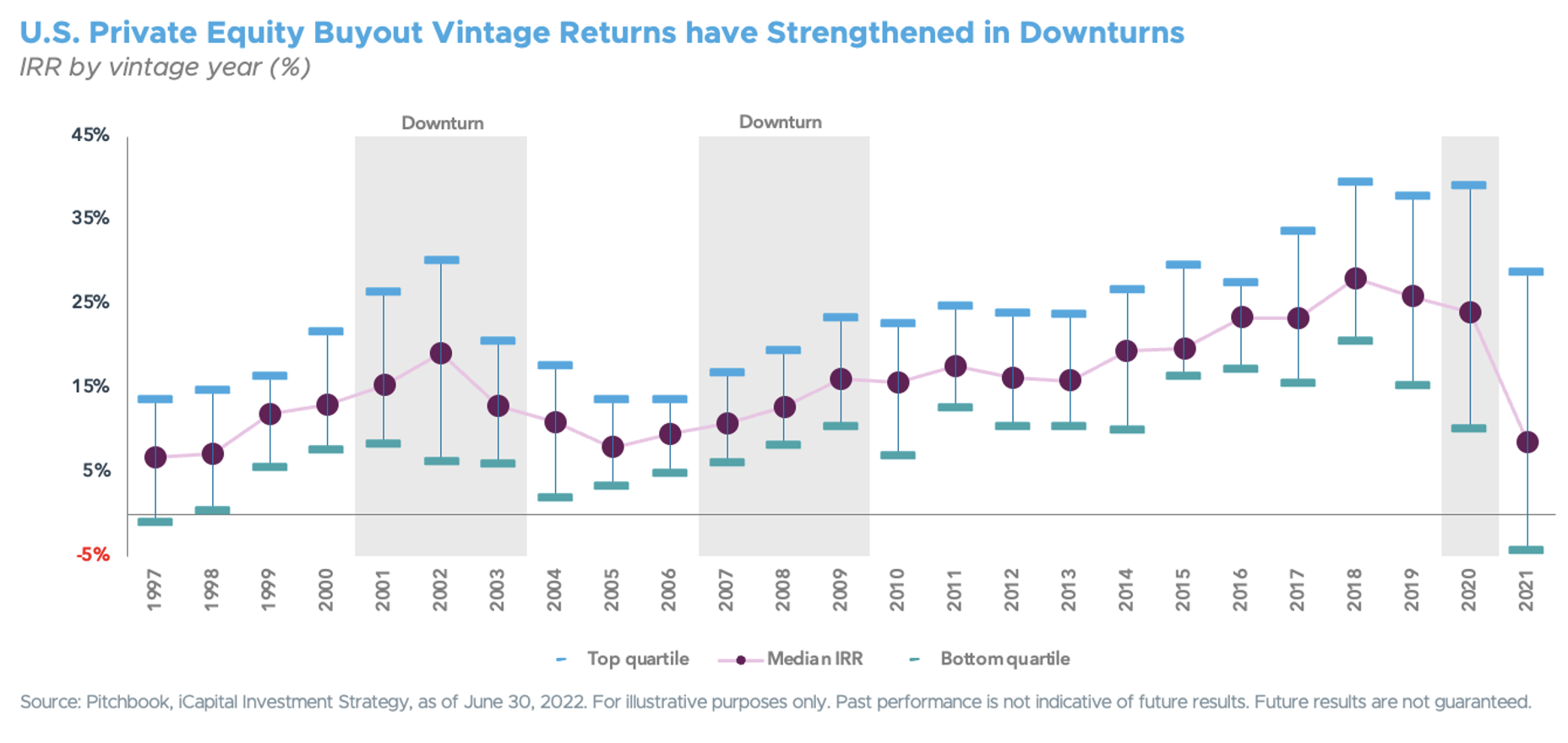

Past cycles have shown that buyout performance improves during recessionary periods, and we believe that 2023 is poised to become one of the better vintage years for deploying capital. The reset in valuation combined with, arguably, an opportunity to invest in a higher quality business is often a major reason behind why years of economic slowdown/recessions are stronger vintage years. Further, a higher quality business bought during a weaker environment will obtain a better exit price when the market rebounds a few years later if the business performs as expected and gains market share.

We remain bullish for buyout investing in today’s market. In fact, we are seeing this trend today from sophisticated investors in the institutional market, who are either increasing their allocations to private equity or restructuring portfolios to generate cash that can be deployed in 2023 and 2024 private equity vintages. And our view is after the valuation reset in the public market, this year presents investors with a fresh and much better entry point in private equity.

Kunal Shah managing director and head of private markets research at iCapital.