What do you do when you’re a fund manager free to invest in stocks and bonds to achieve a decent level of income, but both types of securities look expensive? Mark Saylor and George Cipolloni, who manage the Berwyn Income Fund, think the best move is to take a risk-off stance, be patient and wait for better opportunities to come along. “We believe strongly in being patient in the short term if we do not see much value relative to risk in any segment of our investable universe,” says Saylor.

A couple of years ago, the managers’ willingness to sit things out became apparent when they let their cash build up to 25% of assets. “At the time, the only way to get 3% to 5% yields was to go out longer on the yield curve or lower credit quality,” says Cipolloni. “We weren’t willing to do either.”

The managers have set flexible investment parameters that allow them ample room to make judgment calls in both their asset allocation and individual security decisions. They can invest a maximum of 30% of assets in small-, mid- or large-cap equities that pay dividends.

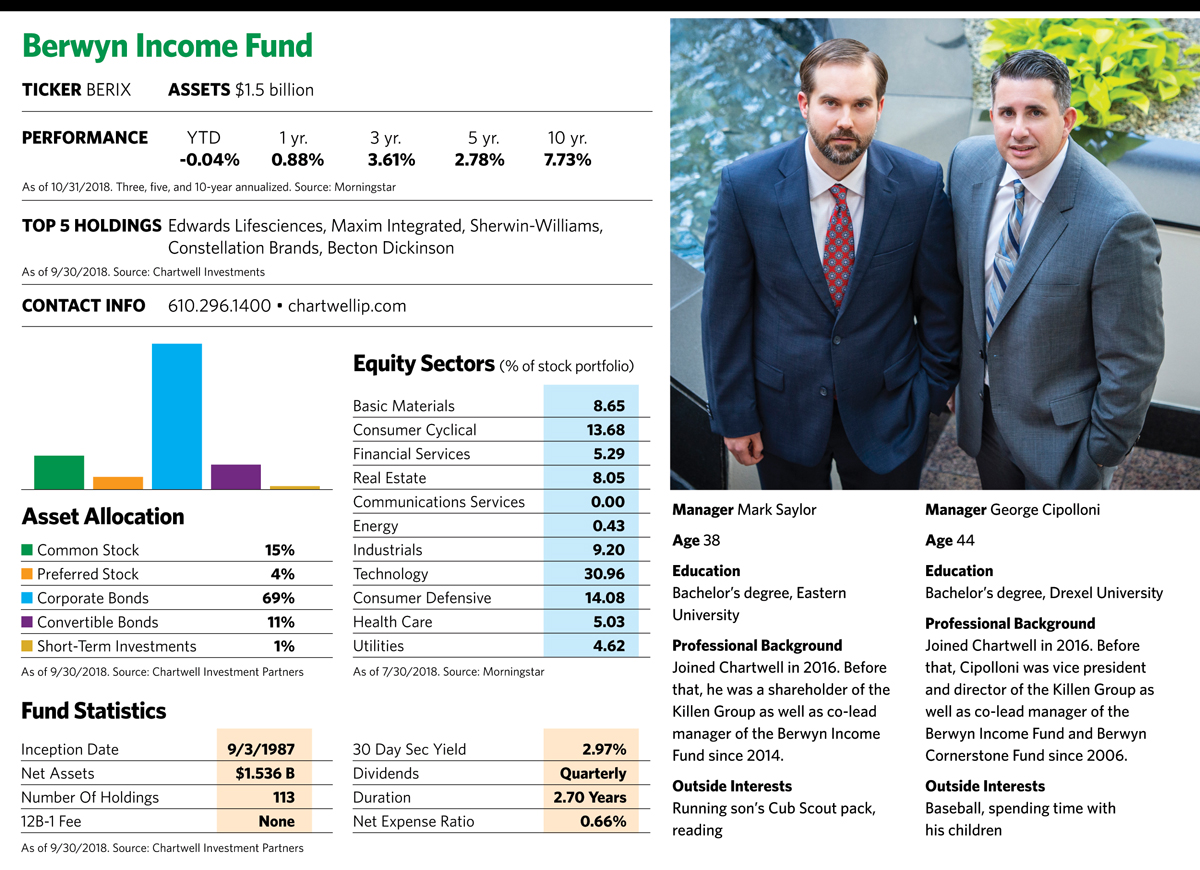

Still, on September 30, the stock allocation for the 31-year-old fund stood at a near historic low of 15%. The last time it was that meager was in 2008, before the stock market crash. The fund also has its lowest allocation ever to junk bonds, which tend to follow the stock market but also get hobbled by rising interest rates.

The managers can put up to 70% of their assets in fixed-income securities—investment-grade bonds, high-yield bonds, convertible and preferred securities, asset and mortgage-backed securities, Treasury and agency bonds, and cash.

A big chunk of the fund is in very short-term investment-grade bonds, which the managers believe offer the best risk-reward trade-off in the fixed-income universe right now.

“We can capture 100% of the yield of a 10-year Treasury bond in a 12- to 18-month corporate investment-grade bond,” says Saylor. “The bonds we invest in have yields of 3% to 3.5%, are highly rated and have strong interest coverage.” Recently added holdings in the fund fitting that profile include issuers Eastman Chemical, Lam Research and the J.M. Smucker Co.

The average duration of the bonds in the portfolio is 2.7 years, a record low, and short-term fixed income securities make up nearly half of the assets. The managers expect duration to remain at the short end of the fund’s historical range until rates on longer-term bonds rise and provide an incentive for the managers to move in. Roughly 48% of the fund’s assets mature by the end of 2019 (or in the case of convertible bonds, allow the manager to put the security back to the company by that time).

With most rate increases at the short end of the yield curve over the last couple of years, reining in duration has proved to be a good income-generating move. The fund’s 30-day SEC yield on September 30 was 3%, up about a percentage point since last year.

Saylor and Cipolloni’s desire to avoid risk and sit out hot markets has both helped and hurt the fund over the years. In 2008, its low allocation to stocks helped limit its decline to 10%, which was mild compared to the 16% decline for its Morningstar peers and the 37% drop in the S&P 500. The fund also performed well in 2013, when it loaded up on stocks and convertible bonds. But the fund’s high cash position and low allocation to equities in 2017 led it to underperform its peers.

This year, the fund has been light on stocks and that’s helped shareholders on down days in the market; it could pay off again if markets take a turn for the worse. On October 10, when stock markets tumbled over trade war tensions and concerns about rising interest rates, the S&P 500 fell 3.29%. Balanced mutual funds dropped about half as much, while the Berwyn Income Fund fell a mere 0.37%. The next day, when the index fell 2.06%, the fund fell just 0.15%.

Over the years, Cipolloni says, investors have gravitated toward Berwyn Income because of its strong performance in difficult markets. A few years ago, the fund had $2 billion in assets, and at one point it closed because so much new money was coming in. But it’s shrunk to $1.5 billion as the bull market has lured investors toward riskier fare. “Our hope is that as the markets get more volatile, we will attract more investors,” he says.

Taking A Contrarian Stance

The fund’s allocation changes and security selection are in line with the managers’ insistence on going where they think the best values are and avoiding risk. “This fund moves away from areas that are very popular and overvalued,” says Saylor. “Our asset allocation and security selection [are] a byproduct of what’s making it through our screens.”

The managers research companies first, then determine whether their stocks, bonds, convertibles, or preferred securities represent the best buy on the asset spectrum. Any investment in equities must be able to achieve at least a 50% total return over three to five years. Companies whose bonds make it into the fund must have improving credit strength, substantial free cash flow and improving margins.

Over time, the stock side of the portfolio has undergone a shift in character. In 2009, the managers invested heavily in what are now considered growth stocks, things such as Microsoft and Intel, because they were so cheap. Over the last few years, a contrarian value flavor has taken hold as the managers gravitate toward cheaper stocks that have lagged or been unjustly punished by the market.

Last year, Saylor and Cipolloni saw a buying opportunity in apparel retailers Macy’s, DSW Inc. and American Eagle Outfitters, whose pressured stocks endured worries about the future of the industry and competition from online sellers. Since then, the three retailers have seen better-than-expected same-store sales, profitability has improved, and the stocks have rebounded sharply.

The fund tilts toward contrarian value stocks, so it hasn’t ridden the growth train led by Netflix and Amazon. Those market favorites, along with many other technology stocks, have been just too expensive for Saylor and Cipolloni’s taste.

“For contrarian value investors like us, these are lean years when traditional ideas are ridiculed and the emerging technology like blockchain wins favor and attention,” says Saylor. “People need to remember that risk matters, balance sheets matter, and debt levels matter. The price an investor pays for a security matters.”

Portfolio holding Ericsson typifies the classic beaten-up turnaround that Saylor and Cipolloni tend to be attracted to. For many years the Swedish communications equipment company’s growth failed to live up to expectations, and the stock was trading well below its historical price-to-sales and price-to-book ratios when they purchased it in March 2017.

A number of events have brightened the picture considerably this year. With the recent consolidation of the European network/communications industry, Ericsson is one of only a few big players left to compete with the new Chinese entrants. The company has accelerated much needed cost reductions, improved profit margins, and has a large cash cushion that should help it weather any unexpected delays in its upcoming 5G rollout.

Another holding, Molson Coors, is one of the world’s largest beer brewers, serving customers primarily in the U.S., Canada and Europe. In recent years sales stagnated, and high raw materials costs ate into profits. By the time the stock was added to the portfolio in May 2018 it had declined over 40% from its 2016 high and was trading well below its historical price-earnings ratio. Saylor and Cipolloni think the company’s partnership with a Canadian cannabis company to release an infused beverage in early 2019, along with improving sales, lower production costs, and efforts to reduce debt, should improve the company’s fortunes going forward.

AT&T was added to the Berwyn fund in the third quarter of this year. A self-described “modern media” company, it offers telecommunications, broadband internet, satellite TV and, with its recent Time Warner acquisition, paid cable content. The company is pursuing a strategy to use its scale, rebuild its financial strength and grow revenue. The stock has a dividend yield of more than 5% and a historically low price-to-earnings multiple.

For now, though, stocks are taking an allocation back seat to short-term corporate bonds that can ride rising rates without too much risk.

The fund’s third-quarter letter to shareholders put it this way: “In an environment like this one, an investor is faced with two options: pay up for securities or be patient. We are contrarian, value investors and believe in our investment process. Sometimes, the most difficult thing is to do nothing.”