On Wall Street, the conventional wisdom is that once the Federal Reserve finally starts to whittle down its crisis-era debt investments, U.S. Treasury yields will have nowhere to go but up.

But to some bond investors, history suggests the consensus couldn’t be more wrong.

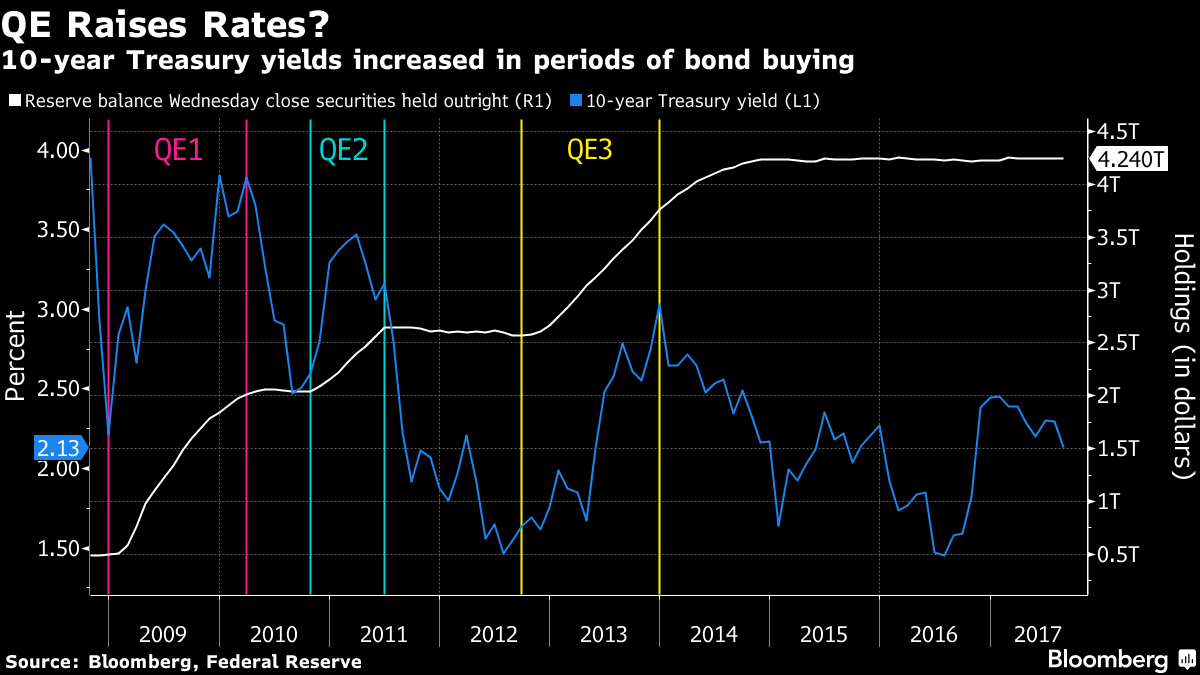

During each of the Fed’s quantitative-easing cycles, yields rose when the central bank was buying and then fell after it stopped. That ran counter to what many expected based on simple supply and demand as the Fed amassed $4.5 trillion of debt and became the single biggest holder of Treasuries.

The lesson, investors say, is that what really matters to the bond market isn’t so much what the Fed is doing, but what the policy changes mean for the U.S. economy in the months and years ahead.

In the case of QE, the Fed’s stimulus brightened the outlook for growth and inflation, while the periods in between refocused investors on the mediocre state of the post-crisis economy. Now, as the Fed embarks on its long-awaited QE unwind, doubts about the strength of the eight-year expansion may arise once again and push investors toward the safety of fixed income.

“During QE, the important thing was the signaling effect -- the Fed was going to come in and reflate the economy, provide stimulus and higher rates of growth, and dissuade people from owning Treasuries and force them into other markets,” said Brian Nick, the chief investment strategist at TIAA Investments. “Now on the way out, if the idea is that the Fed is not as stimulative as it once was, it might have the effect of depressing” bond yields.

While the Fed has lifted interest rates three times since December, 10-year yields have fallen as expectations for faster inflation and fiscal stimulus from the Trump administration proved to be short-lived. They ended at 2.23 percent on Monday. At the start of the year, they were closer to 2.5 percent.

The Big Unwind

Fed officials are expected to announce more details regarding their balance-sheet plans on Sept. 20. In June, the Fed laid out a framework for reducing its holdings. It called for letting as much as $6 billion of Treasuries and $4 billion of mortgage-backed securities run off each month, raising that cap quarterly.

In the past, the yield curve, or the gap between rates on short- and long-term Treasuries, has reliably narrowed as the Fed raised rates to cool growth. But the risk now is that the QE unwind could inundate a market that many already consider to be stretched.