The ER has a triage system to separate the bumps and bruises from what’s truly life-threatening, and the moment he described his symptoms and the numbness in his hand, they immediately took him back to the treatment area. The rest of us went to the waiting room. Roughly an hour later, the doctor came out and told us that it was a good thing we brought him in that day. He was having a heart attack known as “the widowmaker.” Because we acted within an hour of symptom onset, his life would be saved. This window of time is known as the “golden hour.”

What if we told you that the research shows there is a serious, even life-threatening, illness in virtually all advisors’ practices—when top clients consider leaving. And worse still, unlike a heart attack, it has no warning sign. An ACAT is all too often the first symptom. That’s the bad news.

Here’s the good news. It turns out that there is also a “golden hour” in financial services during which the client relationship can also be saved—that is, if the right amount of aid and, just as important, the right type of aid is administered.

In our surveys, financial advisors say that acquiring new clients tops their list of concerns. There is no question that getting high-quality new clients is one of their most difficult jobs. Most of them only add about two new high-quality clients each year. Part of the reason this number is so low is that client defections cause us to start efforts at growth in deficit territory. But it doesn’t have to be that way. As we will see, there is a systematic process you can use to accelerate growth by stopping client defections.

Anchor Clients

Most every financial advisory practice has a number of key clients that by far represent most of the revenue. We will refer to these critically important people as “anchor clients.”

When we ask financial advisors to name their No. 1 client, with only rare exceptions do they have a problem answering. When asked who their No. 20 client is, some of them struggle to come up with the name. When we ask them about client No. 43, however, almost all of them have problems. While it may seem arbitrary to cite 43 clients, there is an important reason.

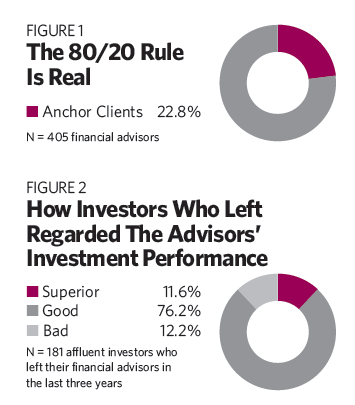

In a survey of 405 financial advisors, the average practice had 189 clients or households—43 of which were considered “anchor” clients. We asked them: “How many of your investment clients are very important, if not critical, to the success of your practice?” They responded (on average) 43, which is 22.8% of their entire clientele (Exhibit 1). This finding aligns with the Pareto principle, the classic rule that 20% of the input gets you 80% of the result.

A few years ago, my boss came into our Monday morning staff meeting. He’s normally energetic, positive and funny, but on this day, he came in late and hunched over. He was sweaty, his color was off and he was moving slowly. He took his normal seat and said he just felt awful. Immediately, someone asked, “Do you have chest pain?” He said, “No, but my left hand is numb.” One person immediately recognized this as the warning sign of a heart attack and we took him to the ER.

A few years ago, my boss came into our Monday morning staff meeting. He’s normally energetic, positive and funny, but on this day, he came in late and hunched over. He was sweaty, his color was off and he was moving slowly. He took his normal seat and said he just felt awful. Immediately, someone asked, “Do you have chest pain?” He said, “No, but my left hand is numb.” One person immediately recognized this as the warning sign of a heart attack and we took him to the ER.

Ways To Retain Top Clients Before They Leave

January 2, 2018

« Previous Article

| Next Article »

Login in order to post a comment