After Hurricane Maria hit Puerto Rico in September 2017, news of destroyed homes, power outages, food shortages and slow rebuilding dominated the headlines. Nonetheless, the FPA Crescent Fund established a small position in the island’s municipal bonds later that year and added to it in 2018.

As the managers saw it, the deeply discounted prices more than compensated for the area’s poor balance sheet, and solid interest coverage from sales taxes provided a margin of safety they felt comfortable with. With Puerto Rico’s economy well on the way to recovery, a credit rating upgrade in the future would not be out of the question.

So far, the investment has worked out well: By the end of 2018, the bonds had become one of the fund’s best performers. “Bad news gets punished too much and good news gets a premium that’s too high,” says Brian Selmo, co-manager of the fund since 2013. “We like to arbitrage between perception and reality.” Even though the bonds represent a small fraction of the fund’s assets, adding them to the mix signals its managers’ willingness to deviate from the pack as long as they see both good value and elements that point to a margin of safety.

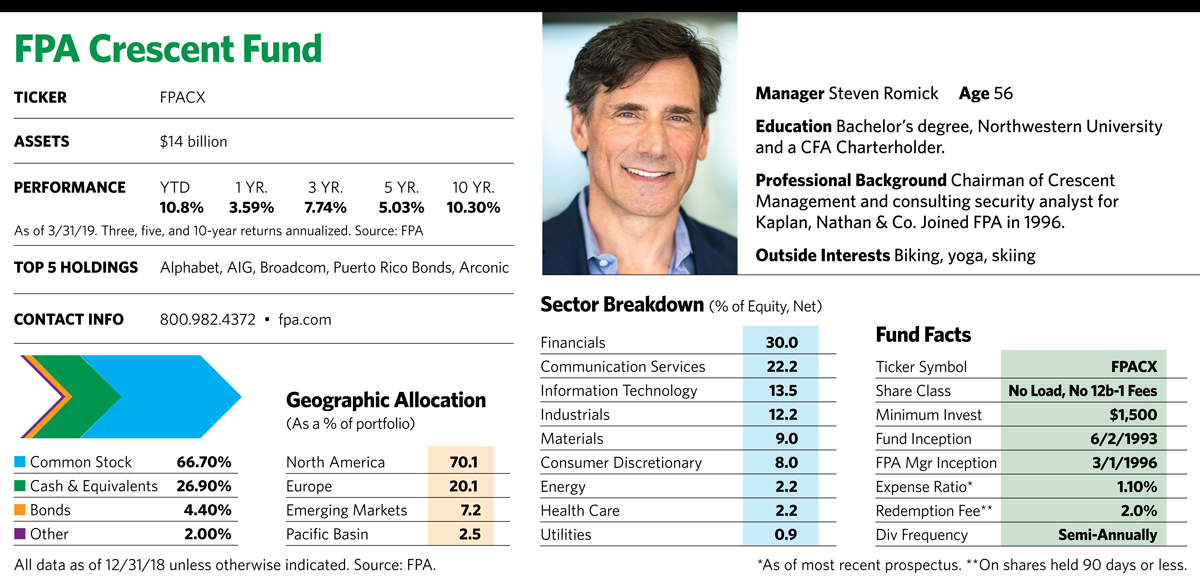

Investors can credit founding manager Steve Romick, 56, who has managed the fund since 1993, with crafting an independent strategy that defies traditional mutual fund style boxes by incorporating a wide array of assets, including stocks, bonds and alternative investments, and by using such tools as short-selling. When he isn’t seeing anything that meets his criteria, Romick may park huge amounts of money in cash—at times in the fund’s history, it’s been north of 40% of assets. These days, he steers the $14 billion fund with the help of co-managers Mark Landecker, 43, and Selmo, 41.

Broadening The Mix

The addition of those two managers coincided with a shift in the fund away from a deep value focus on distressed debt and stocks to a mix encompassing higher-quality companies. That transition picked up steam after the financial crisis left attractive names traditionally identified as growth, such as Microsoft and Oracle, selling at very low prices for their earnings potential. The fund has also expanded its presence in international securities, which now represent about 30% of its equity stake.

“Our definition of value has evolved over time to include quality businesses selling at attractive prices,” says Romick. “Those kinds of companies occupy a larger part of the portfolio than they did in the past.”

Fund holding Altaba, formed after Yahoo completed the sale of its operating business to Verizon Communications in 2017, exemplifies a stock that the managers believe offers both quality and value. After the sale, Yahoo changed its name to Altaba and became an investment company whose main holding is Alibaba, China’s technology, e-commerce and internet giant. “Altaba stock trades at a significant valuation discount to Alibaba’s, so it is a less expensive way to invest in that company,” explains Landecker.

Another tech holding, Broadcom, develops and markets digital and analog semiconductors. The company was acquired by Avago Technologies in 2015 and is headed by Hock Tan, a leading figure in China’s technology industry. Last year Broadcom added to its roster of holdings by acquiring California-based CA Technologies, a leading infrastructure technology firm. Landecker says the company trades at “an attractive multiple to free cash flow, and has an excellent operator at the helm.”

Insurer AIG is more reflective of the fund’s deep value roots. The stock first became part of the portfolio about a decade ago after the massive government bailout for the beleaguered insurer, and the FPA Crescent managers added to the position in 2018. While AIG continues to face a difficult environment for property and casualty insurers, an improved balance sheet and a change in management a couple of years ago have led to signs of a turnaround. A more obscure attraction is AIG’s substantial store of tax losses over the years, which it can use to offset taxes on future profits. “We think AIG, over time, can earn a 10% to 12% return on tangible equity,” Selmo says.

Long Haul Investing

With its diversified strategy covering several asset classes, FPA Crescent is more appropriate for investors who value limiting their losses rather than swinging for the fences looking for returns. That philosophy kicked in well in 2007 and 2008 when signs of trouble in the financial sector led Romick to steer clear of stocks in the financial sector and to short Lehman Brothers. “Over the two calendar years in 2008 and 2009, we were one of the few funds that actually made money,” he says proudly.

The fund’s goal is to generate equity-like returns over the long term, take less risk than the market and avoid permanent impairment of capital, and by those measures it has done an admirable job over the current market cycle. Between October 2007 and December 2018, the fund’s annualized return was 5.56%, while the S&P 500’s was 6.54%. Its maximum drawdown was about half that of the index during the period, and it was about one-third less volatile.

But the last few years have been challenging ones for the fund. As interest rates were scraping the bottom and the bull market continued, the fund’s large cash stake proved to be a drag on its returns. International stocks, an area where the fund is active, underperformed U.S. securities. And except for some brief periods, the yields on junk bonds—once one of Romick’s favored hunting grounds—weren’t that attractive.

Despite these headwinds, Romick points out that the fund’s long equity positions have outperformed the S&P 500 over the last decade. The fund also managed to avoid big land mines, such as beleaguered energy stocks. “Our returns are driven by what we own, and what we don’t own,” he says. “And if we don’t see opportunities we like, we are willing to stay on the sidelines.”

In a candid letter to shareholders, Romick summed up the fund’s strengths and weaknesses in a nutshell. “For more than a quarter century, the fund has leaned into weakness,” he observed. “That is a hallmark of our past success, and we expect it to be no different in the future. We have never been able to dial in timing, however. We habitually buy and sell early, which has led to fund performance untethered from the benchmarks.”

Red Flags For Corporate Bonds, Consumer Staples

Over the last few years, Romick and his team have been paring down what they see as the riskiest asset classes and stock market sectors. The fund has substantially reduced its presence in high-yield bonds and investment-grade corporate bonds, which Romick thinks could hold some unpleasant surprises for investors because of the worrisome levels of debt that governments and businesses now have on their books.

In the corporate sphere, the value of U.S. corporate bonds outstanding has more than doubled from $3.8 trillion in 2008 to the current $8.8 trillion. This 8.8% annual rate of increase is more than two times GDP growth in that same period. While this debt has funded shareholder-friendly activities such as mergers and acquisitions, leveraged buyouts and share repurchases, Romick is concerned that at this point the demand for corporate debt could slacken. Eventually, some companies could have trouble meeting their existing debt obligations if a recession hits, if their cash flow weakens or if investors begin demanding higher coupon rates to justify the perceived risks.

Another area of concern is the consumer staples sector, where the disruption created by internet sales and overseas competition has put enormous pressure on product prices. Romick points to Procter & Gamble as a company in the sector that is overvalued. Despite its earnings growth of less than 2% over the last seven years, its stock trades at roughly 21 times 2019 consensus earnings. “I used to brush my teeth with Crest,” he says. “Now I use one of the brands my kids showed me on Instagram.” He also dislikes real estate investment trusts (REITs) and master limited partnerships because they are so highly leveraged.

Last year was one of the fund’s more active periods on record as the managers took advantage of the volatility to eliminate and reduce certain positions while initiating and increasing others. The fund bought 18 new names and sold or reduced 23 others, some by more than half their stakes. The managers increased exposure to certain financial companies, bought some light industrial and more cyclical businesses and added to some positions in internet platform businesses. When selling off, the managers focused on high-quality businesses that had reached their price targets.

Despite the new buys, the fund still had about one-quarter of its assets in cash by the end of 2018. “To put more capital to work, we require a larger margin of safety than what the market currently offers,” Romick told shareholders.