After Hurricane Maria hit Puerto Rico in September 2017, news of destroyed homes, power outages, food shortages and slow rebuilding dominated the headlines. Nonetheless, the FPA Crescent Fund established a small position in the island’s municipal bonds later that year and added to it in 2018.

As the managers saw it, the deeply discounted prices more than compensated for the area’s poor balance sheet, and solid interest coverage from sales taxes provided a margin of safety they felt comfortable with. With Puerto Rico’s economy well on the way to recovery, a credit rating upgrade in the future would not be out of the question.

So far, the investment has worked out well: By the end of 2018, the bonds had become one of the fund’s best performers. “Bad news gets punished too much and good news gets a premium that’s too high,” says Brian Selmo, co-manager of the fund since 2013. “We like to arbitrage between perception and reality.” Even though the bonds represent a small fraction of the fund’s assets, adding them to the mix signals its managers’ willingness to deviate from the pack as long as they see both good value and elements that point to a margin of safety.

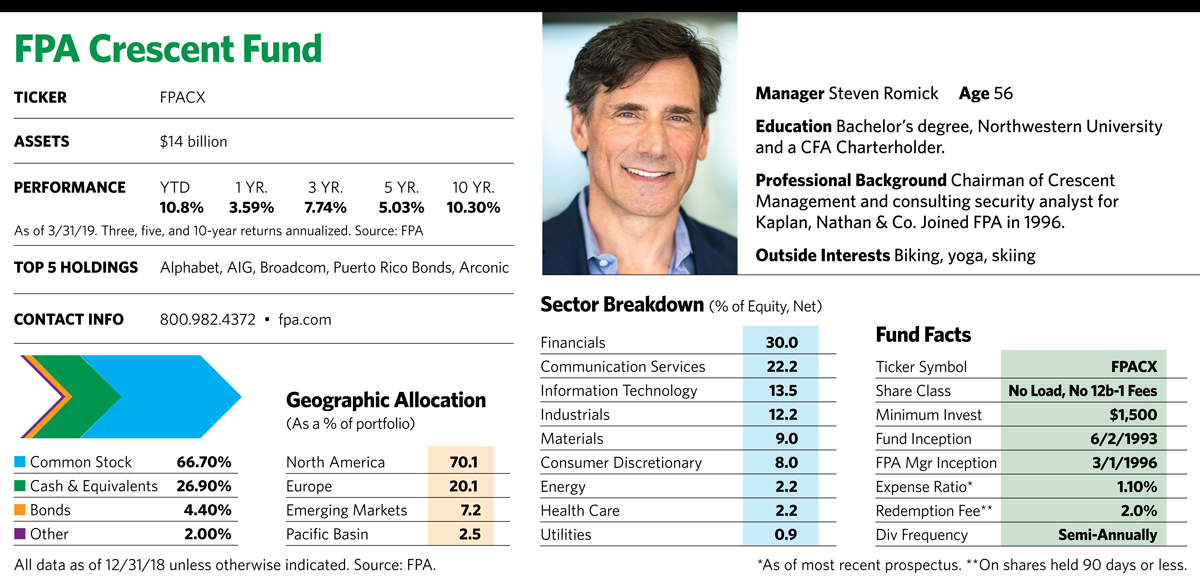

Investors can credit founding manager Steve Romick, 56, who has managed the fund since 1993, with crafting an independent strategy that defies traditional mutual fund style boxes by incorporating a wide array of assets, including stocks, bonds and alternative investments, and by using such tools as short-selling. When he isn’t seeing anything that meets his criteria, Romick may park huge amounts of money in cash—at times in the fund’s history, it’s been north of 40% of assets. These days, he steers the $14 billion fund with the help of co-managers Mark Landecker, 43, and Selmo, 41.

Broadening The Mix

The addition of those two managers coincided with a shift in the fund away from a deep value focus on distressed debt and stocks to a mix encompassing higher-quality companies. That transition picked up steam after the financial crisis left attractive names traditionally identified as growth, such as Microsoft and Oracle, selling at very low prices for their earnings potential. The fund has also expanded its presence in international securities, which now represent about 30% of its equity stake.

“Our definition of value has evolved over time to include quality businesses selling at attractive prices,” says Romick. “Those kinds of companies occupy a larger part of the portfolio than they did in the past.”

Fund holding Altaba, formed after Yahoo completed the sale of its operating business to Verizon Communications in 2017, exemplifies a stock that the managers believe offers both quality and value. After the sale, Yahoo changed its name to Altaba and became an investment company whose main holding is Alibaba, China’s technology, e-commerce and internet giant. “Altaba stock trades at a significant valuation discount to Alibaba’s, so it is a less expensive way to invest in that company,” explains Landecker.

Weighing The Risks

May 1, 2019

« Previous Article

| Next Article »

Login in order to post a comment