The real estate market in New York’s Westchester County, home to the country’s largest property-tax burden, has been on a roll. After a tax overhaul that saddles residents with even higher costs, everyone’s wondering: Can it continue?

Sales were brisk in the fourth quarter, with houses, condos and co-ops getting scooped up after being listed for 82 days on average, the fastest year-end pace since 2010, appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate said in a report Thursday. And prices jumped 8.4 percent from a year earlier, to a median of $475,000.

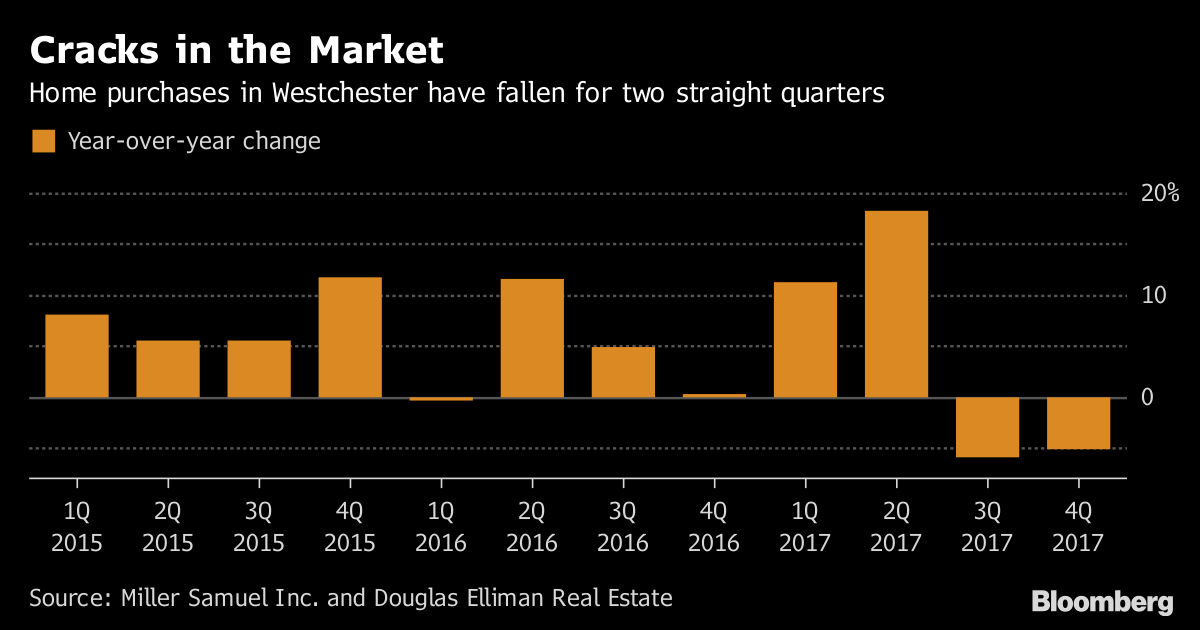

But cracks are already forming. The number of completed sales dropped 5.2 percent, the second straight quarter with a decline, the firms said. Purchase contracts, a better gauge of current demand, are down too, falling 4.2 percent for single-family homes, brokerage Houlihan Lawrence said in its own report. Those might be the first signs that buyers are wavering, and that prices may need to adjust to reflect the now-higher costs of owning a home in the well-to-do suburbs.

“Right now, everyone’s calling their accountant,” said Scott Durkin, president of Douglas Elliman. “We could see a period of indecision on both the sellers’ and buyers’ side. Buyers will be looking for a formula that allows them to afford their home.”

Hit Hard

The tax changes hit Westchester -- just north of New York City and home to many Wall Street executives -- especially hard. Only $10,000 of state and local taxes can be deducted on federal returns, potentially raising the income-tax burden for the 73 percent of Westchester homeowners whose local levies exceed that amount, according to ATTOM Data Solutions.

Homeowners in Westchester already pay the highest property taxes in the U.S., with an average annual bill of $16,493 in 2016, according to ATTOM, which studied 586 counties with populations of 100,000 or more. The mortgage-interest deduction is also capped in the tax overhaul, at new loans of $750,000. More than 19 percent of homeowners in Westchester had mortgages larger than that in 2017, compared with 3.9 percent nationwide, the real estate analytics firm said.

“This is something we’re showing sellers: You need to realize your buyer has less purchasing power for your home,” said Chris Meyers, president of Houlihan Lawrence, which has offices across Westchester. “I would be surprised if this doesn’t apply some downward pressure on the higher side of the market.”

Houlihan Lawrence is equipping its brokers with tools to figure out how the new law alters carrying costs for buyers of any given listing, Meyers said. About 250 agents attended a seminar this week on how to navigate the changes.

Higher Taxes

A hypothetical $3 million home in Larchmont carrying $70,000 in yearly property taxes could mean an additional $22,000 hit on the owners’ federal return, assuming they are subject to the new top income-tax rate of 37 percent, Meyers said.

The law’s consequences will be greater for the move-up market, as people consider whether upgrading to a larger home is worth the added costs, according to Meyers. Demand for lower-priced properties, which have drawn buyers seeking refuge from lofty New York City prices, is likely to stay strong, assuming there’s enough inventory, he said. Last quarter, there was a 24 percent decline from a year earlier in listings under $499,000, which resulted in almost 14 percent fewer pending sales in that price range, according to Houlihan’s report.

“The reasons people buy homes, at the end of the day, are rarely driven by tax considerations,” Meyers said. “A change like this on the margins is not likely to discourage people from making what are fundamentally lifestyle decisions, rather than tax decisions.”

Lara Casano might agree. The commercial real estate executive and her husband decided to upgrade to a bigger place in New Rochelle last year, and even gambled on a quick sale of their existing home.

Trading Up

After agreeing to buy a 4,350-square-foot (404-square-meter) house, the couple discovered getting a mortgage was contingent on them selling their old one. They didn’t want to lose the deal, Casano said, so they offered the seller a $50,000 deposit, with $20,000 of that non-refundable if they couldn’t find a buyer within a month.

The strategy worked: Douglas Elliman broker Owen Berkowitz listed their 1,962-square-foot house for $629,000, and it got multiple bids before selling for $636,500 after just three weeks on the market.

The sale was completed in November and Casano, managing partner of New York-based Raem Capital, closed on her new home two weeks later. The couple will pay $24,000 a year in property taxes, up from $13,000 on their previous house, she said.

“I think we can just live with it,” Casano said. “People still need a place to live, and they’re going to chalk up tax reform as a cost of living.”

This article was provided by Bloomberg News.