They say there’s nothing like hearing it directly from the horse’s mouth. And certainly when it comes to growth and marketing, there is nothing like hearing directly from consumers—the people who hire financial advisors.

But we’re often coming up with wrong assumptions and ignoring important things by not listening to the broader audience of present, past and potential future clients. Instead, it appears to me, the conversations and data used by advisory firms often focus on the advisory firms themselves and best practices data gathered within the business community. If clients are ever involved, we tend to gather the opinions of a very biased sample—the people we’re working with now.

That approach has us working in an echo chamber and possibly taking away flawed insights, something that could hurt us if we’re using this information to change or build marketing strategies.

If you’re talking to people already around you—instead of talking to people you’d like to be around—that’s a bit like asking other Americans what their favorite restaurants in Rome are. You might get some good information, but it would be better to ask Romans.

In the last two years, the Ensemble Practice has been surveying different kinds of people: These include those who may become clients of a financial advisor, not just those who already are. We created a sample of 1,000 people with incomes above $100,000. We wanted to hear from those who work with an advisor, who have not yet worked with an advisor, or who had terminated one and never hired another.

Our data suggest there’s a rich opportunity for advisors to grow and reach more consumers. The growth, however, may require examining our generic assumptions: Our potential future clients respond better to more differentiated strategies, things that go beyond asking “How much do you have in manageable assets?”

Men And Women

One of the first things we noticed in our data is a misconception about male and female clients. While men and women are somewhat different in how they approach advisors, they’re not as different as you think.

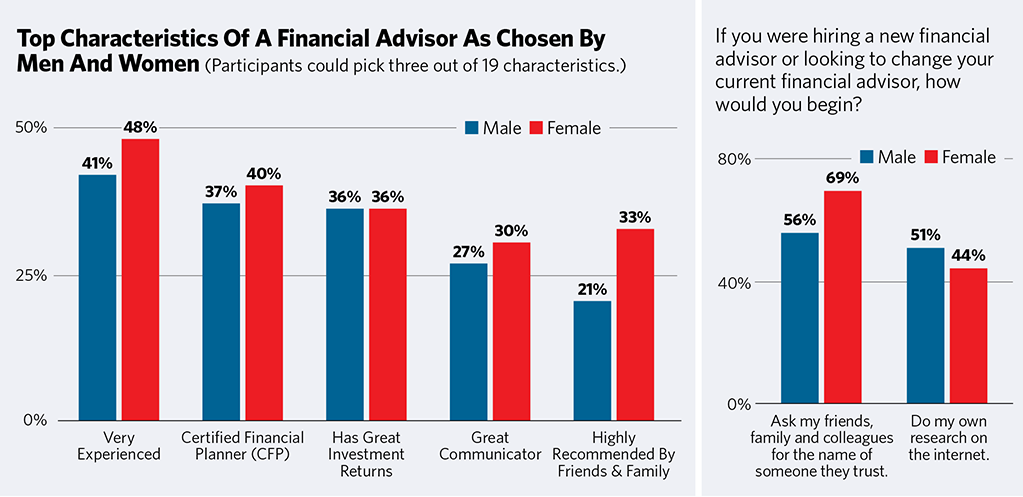

Men and women largely look for the same traits in advisors: We gave survey participants 19 characteristics to choose from in an ideal professional, then asked them to pick their top three. The choices of men and women were very consistent. Both men and women look for somebody very experienced—that’s the overwhelming first choice for both. They also want someone who is a CFP and who has great investment returns. Note that the last characteristic is really discouraging to the planning profession—despite two decades in which we’ve been emphasizing planning, clients still want returns.

The answers start diverging after that, and when we get down to the fourth trait, women start mentioning that they’d like somebody they got through a recommendation. Men start saying they want a “fiduciary.”

What’s almost as interesting is the traits that were not as important to them.

• Female clients did not seem very focused on choosing a female advisor. When given advisor traits to choose from, neither men nor women seem to be focused on gender. Only 6% of women chose “female” as being one of the top three traits of the advisor they wanted to work with (while 3% of males did). This is not to say that it’s never important. A female advisor is more important to female widows and divorcees, But overall, it seemed to be less important in our data.

• Independence does not seem to matter as much. Overall, only 9% of consumers chose “independent” as one of the top three characteristics, and it matters a bit more to men than women (12% versus 6%). We purposefully did not define independent because most advisory firms don’t define it either. Many firms describe themselves as “independent” on their site but don’t say what that means.

• Consumers also don’t care as much if the advisor is published, works with celebrities or has the same hobbies the clients do. All these things were chosen by fewer than 5% of the respondents.

One of the differences between men and women is how they research their advisors. When asked how they begin, both sexes seek out the recommendations of friends or colleagues. After that, men rush online while women rely more on the recommendation (with some online research).

In our sample, 56% of participants were female, and of those, 39% said they work with an advisor while 43% of the male participants did. Female consumers in our survey had less in investable assets: 63% had under $500,000 while 55% of the male consumers did. Female participants in our surveys were also more likely to be employees, 72%, while 68% of the male participants were.

Young And Old

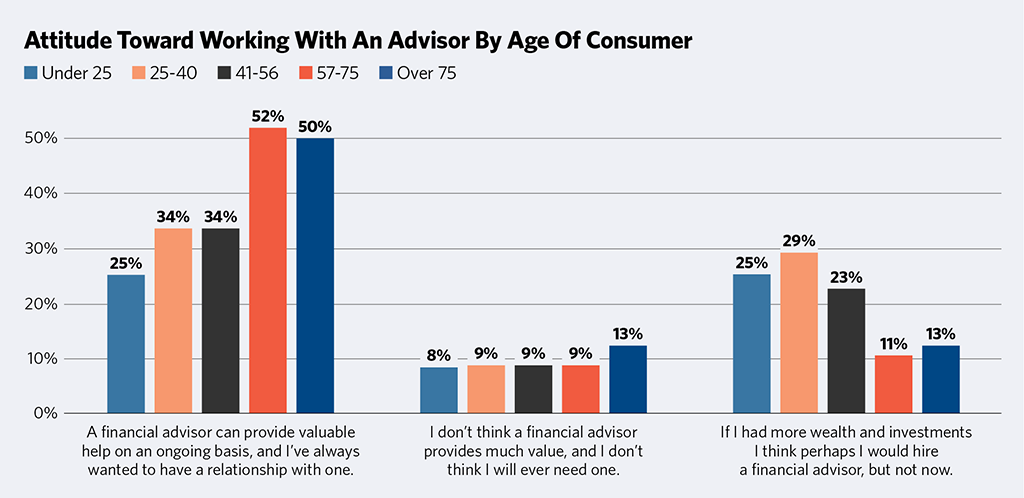

Next we have generational misconceptions. A popular myth is that young consumers are “do-it-yourselfers” and aren’t interested in financial advisors. We came to the opposite conclusion in our research—they’re interested; they just don’t have money yet.

When asked if they would like ongoing help from a financial advisor, younger consumers were predictably less likely to say yes—only 25% of those under 25 said they would, while 34% of those under 40 or under 56 said so. Note how people’s appreciation for financial advice jumps sharply when they reach their late 50s—when they’re staring down retirement, at which point they start knocking on your doors.

More telling, though, is the category of clients who have decided that they will never work with an advisor because an advisor does not add value. Notice that young consumers are not opposed to working with advisors—only 8% said they were. In fact, more retirees said they had made up their mind to not hire an advisor (13%). For the most part, young consumers are likely to hire one, they just need more money (noted by 25% of those under 25 years old and 29% of those under 40).

Another misconception is that young consumers have a preference for working with “young” advisors. (We purposefully didn’t define what “young” meant.) Ten percent of the youngest consumer group (under 25 years old) list “young” as one of the top three characteristics of an advisor they’d like to work with. Seven percent of those between 25 and 40 said a younger person was important. This is still very low when you remember that “experienced” is chosen by 52% of the youngest consumers and is the undisputed first choice of every single consumer category. Young people want experienced advisors, too.

The different generations’ searching and researching habits are also not as clear-cut as you might think.

For instance, it’s not only the young searching for help online. So are grandma and grandpa. While 55% of the youngest consumers are likely to seek out their potential advisors on the internet, so are 47% of those over 75. And just as grandma will ask for a recommendation for an advisor from family and friends (something said by 63% of those over age 75 and said by 65% of those over age 57) so will the young men and women: 60% of people under age 40 begin by asking for recommendations.

But the age groups differ in the next step: While 50% of the oldest consumers will seek out in-person meetings with potential advisors as the first part of their due diligence, only 20% of the youngest consumers do that. They prefer more online research beforehand.

What also changes with age is the attitude toward solicitation. Later in life, consumers become much more skeptical about solicitations from advisors. When we ask consumers how they would react to an invitation to an advisor-sponsored event, only 22% of the youngest consumers said they were skeptical while 61% of those over 75 said they were, as were 48% of those age 57 to 75. This is also true about mailed materials—35% of the youngest consumers “sometimes” open them while only 15% of the oldest do and 31% of those in the 57-to-75 age bracket.

We in the advisory industry may very well be underestimating the degree to which younger consumers are interested in advice and may be badly overestimating how much those in the later stages of their life are interested in hiring an advisor if they have not done it yet.

Rich And Not So Much

Advisors have further misconceptions about how wealth influences the choices of prospective clients. Firms often define their target markets only by asset level. When they do, they miss important nuances.

Our sample was big enough to compare the choices of consumers as their wealth grows (though it wasn’t big enough to trace what happens with people who pass $50 million in net worth). That offered us a glimpse of these trends:

• Richer consumers are much more likely to work with advisors. Sixty-five percent of those with more than $5 million in net worth do while only 53% of those with net worth between $1 million and $5 million do. The figure was 26% for those with less than a million.

• Richer consumers rely less on recommendations of friends and family when looking for an advisor. Many certainly start their search by asking for recommendations from other people, but they do it less so than others. Only 51% of the richer consumers (with $5 million or more in wealth) start with a recommendation while 65% of those in the lowest levels of wealth do.

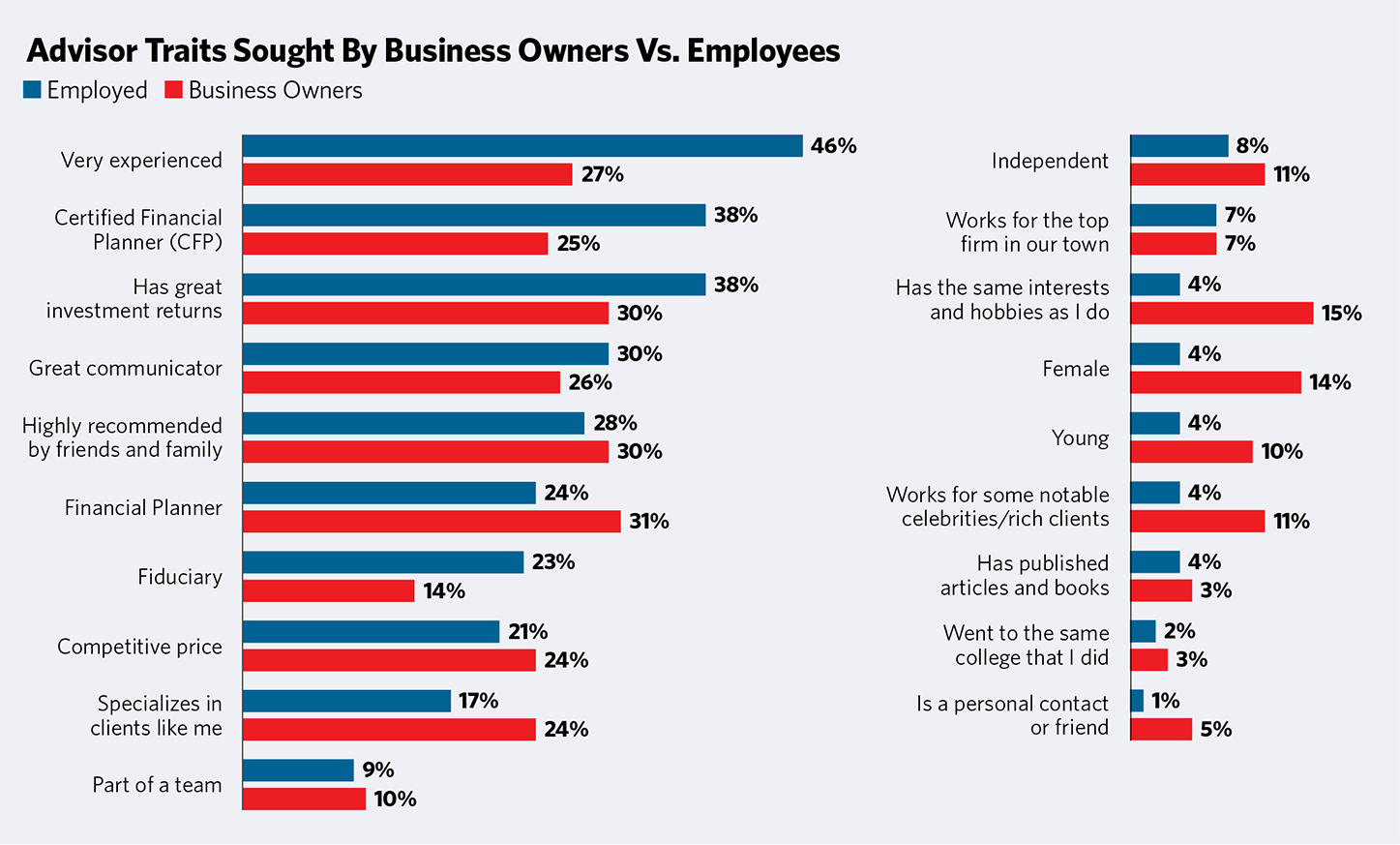

• Richer consumers are more likely to look at a brand they know (something 50% of them said) or go to their brokerage firm (mentioned by 41%). Independent advisory firms will not like to hear this, but the good news is that business owners like the term “independent” more—13% included that term among the top three traits of an advisor while only 8% of employees did.

People with more than $5 million in net worth are greatly prized as advisory clients. The conventional wisdom is that they are elusive. But they may not be as elusive as we think, or at least not at the $5 million level. They show a similar if not higher tendency to go to events and read materials, and they have an interest in articles and financial programs. But they do tend to prefer their own sources to solicitations.

Business Owners

Business owners are a category all their own. To begin with, more than half of them (52%) work with an advisor, while only 34% of those getting most of their income as employees do.

The way in which business owners choose their advisor is also very different. While business owners also ask for recommendations (something 63% say they do) 51% speak with their CPA while only 32% of employed people do. Business owners are also much more likely to seek advice from a known financial services brand—most likely their bank, something 45% of them said they do while only 33% of employees did.

Overall, business owners look for more varied characteristics in a financial advisor—not only the advisor’s experience as a planner, but his or her great communication skills, published material and fame.

Philip Palaveev is the founder of the G2 Leadership Institute, a two-year leadership and management program that trains and develops the next generation of leaders of advisory firms.