Roughly 10,000 baby boomers will turn 65 each day for the next 12 years. With such numbers, it should be no surprise that financial exploitation costs “seniors”—generally defined as those who are 65 and older—at least $2.9 billion annually. In an effort “to showcase the urgency of preventing senior financial exploitation,” the North American Securities Administrators Association (NASAA), an association of state securities regulators, recently polled regulators from all 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Canada and Mexico and published the results in a survey titled “Seniors and Financial Exploitation.”

Of the 36 regulators who responded, the survey found concerns that the rate of financial exploitation among seniors is increasing (29 percent indicated that financial exploitation is increasing, compared with only 3 percent who saw a decrease). Although virtually all of the regulators believed that there is now a greater awareness of senior financial exploitation, the survey found that the vast majority of cases of senior financial fraud “go undetected until too late.” Finally, 75 percent of the regulators who responded believe that broker-dealers and investment advisors are not doing enough to prevent senior fraud.

The federal government has taken some steps to allay these concerns. The Consumer Financial Protection Bureau (CFPB) has published a number of resources available to seniors and their families in an effort to protect against fraud and financial exploitation, including information available at their website. Of course, federal law also criminalizes certain deceptive and fraudulent practices often used to exploit seniors. Recently, the Senate passed the Elder Abuse Prevention and Prosecution Act. It is designed to prevent elder abuse and exploitation and improve the justice system’s response to victims in elder abuse and exploitation cases. The Senate also passed the Seniors Fraud Prevention Act of 2017, which requires the Federal Trade Commission (FTC) “to establish an office within the Bureau of Consumer Protection to advise the FTC on the prevention of fraud targeting seniors and to assist the FTC in monitoring the market for mail, television, Internet, telemarketing and recorded message telephone call (robocall) fraud targeting seniors.” In addition, and as discussed below, the Financial Industry Regulatory Authority, an independent, non-governmental regulator for U.S. securities firms, recently adopted a new rule providing some protections for seniors, though those changes do not go into effect until 2018.

In addition to these federal efforts, state regulators and legislatures have been at the forefront of addressing these issues. In furtherance of its goal of investor protection, NASAA recently passed “An Act to Protect Vulnerable Adults from Financial Exploitation” (the Model Act). The Model Act provides a model for states to use in drafting legislation to protect individuals whose age may make them vulnerable to abuse. In the last 12 months, some states have incorporated most or all of the Model Act’s provisions, but almost half of the states still have not adopted any of the Model Act’s provisions.

The Model Act’s Reporting Requirement

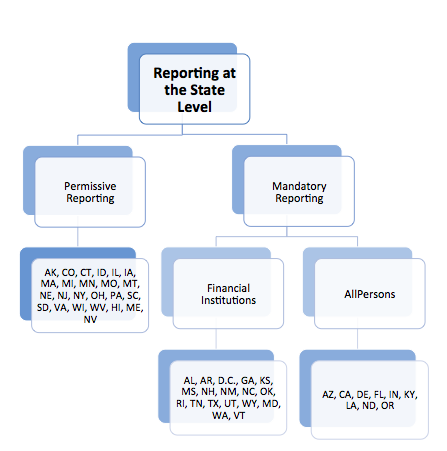

The Model Act recommends mandatory disclosure to Adult Protective Services and/or state securities commissioners by “qualified individuals” if they reasonably believe that an adult over age 65 (or otherwise deemed a senior by state statute) may be a victim of financial exploitation. Qualified individuals include agents, investment advisors, and those who serve in a supervisory, compliance or legal capacity for a broker-dealer or investment advisor. Second, the Model Act recommends that states allow permissive disclosure to a third party, if the third party has been designated by the eligible adult and so long as the third party is not implicated in the financial exploitation.

The Model Act’s Transactional Hold

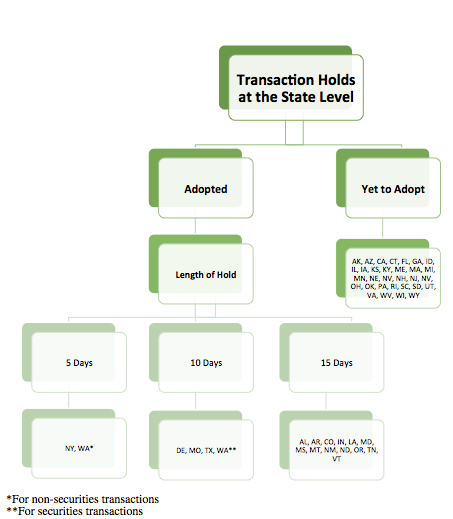

The Model Act permits broker-dealers, investment advisors and qualified individuals (financial services professionals), who suspect financial exploitation, to delay disbursements from the senior’s account. The transactional hold would expire either after 15 days or an appropriate time after a review and conclusion that the disbursement would not result in exploitation—whichever occurs first. Upon the request of Adult Protective Services or the Commissioner of Securities, the 15-day hold may be extended to 25 days. If petitioned, courts can delay the disbursement indefinitely.

Immunity Under The Model Act

The Model Act grants immunity to financial services professionals for any reasonable, good faith disclosure and delayed disbursement. Immunity extends to any administrative or civil liability that could otherwise arise for disclosure or delayed disbursement.

States’ Incorporation Of The Model Act’s Provisions

1. Reporting

A. Required or Permissive

In the past year, several states have adopted the Model Act’s recommendations, in full or in part. Some states require all persons who reasonably suspect abuse, neglect or exploitation of a senior to report such a suspicion to Adult Protective Services; others, make such reporting permissive. All of the adopting states, however, extend immunity for reporting.

The chart below summarizes the reporting laws adopted by the states as of September 2017:

B. Third Party Disclosures

The Fifteen states integrating the Model Act’s third party disclosure provision allow financial services professionals to disclose suspected abuse to certain trusted persons, even if they are not a legal owner of the senior investor’s account. Eight states (Alabama, Colorado, Indiana, Missouri, Montana, North Dakota, Tennessee and Texas) permit disclosure to anyone reasonably or closely associated with the eligible adult; Six states (Arkansas, Louisiana, Maryland, Mississippi, Oregon and Vermont) permit disclosure only to third parties previously designated by the eligible adult; and one state—New Mexico—not only permits disclosure to reasonably associated third parties, it requires disclosure to designated parties.

In response to these laws, many financial services firms have adopted some form of “emergency contact” or “trusted contact” authorization form. This form allows senior clients to designate trusted third parties to contact when concerns about abuse arise. Mike Rothman is the NASAA President and also Minnesota’s Commissioner of Commerce. Mr. Rothman has suggested that all firms adopt the use of these forms to combat the financial exploitation of seniors. The Securities Industry and Financial Markets Association (SIFMA) has developed a customizable form for firms to use. The form is available at: www.sifma.org/seniorinvestors/toolkit/.

2. Transactional Holds

Eighteen states now permit financial services professionals to delay disbursement of funds from a senior’s account when there is suspicion of exploitation. States vary, however, on how long such a hold may last. Some states use the Model Act’s 15-day hold, while others permit delays of only 5 or 10 days. In states where a hold is permitted, state agencies, including the state’s Adult Protective Service agency, can extend the hold for an additional 10 to 30 days, depending on the state. A further extension is possible upon application to the court. Importantly, each of the states adopting these measures extend immunity to those financial services professionals holding or delaying disbursements in good faith. The following chart summarizes the state provisions:

3. State Initiatives Extending Beyond The Model Act’s Provisions

Some states have gone beyond the Model Act’s recommendations to protect seniors. Though the vast majority of broker-dealer firms have already instituted some form of training for their employees on issues related to the financial exploitation of seniors, few appear to have specifically addressed each of the Model Act’s recommendations in their training programs. Connecticut, New Mexico, Nevada and Washington mandate training on the detection and reporting of financial exploitation. Alabama has recently gone further, in what could set the path for other states, by drafting a guide that firms can use to facilitate training. The guide is available here. It focuses on steps that financial services firms can take to identify and respond to red flags indicative of financial exploitation. Several states have also established task forces whose purpose is to evaluate the impact of elder abuse and related current policies, and to make recommendations to their legislatures based on their findings. Some states have also organized public education campaigns and provided 24-hour toll-free hotlines to facilitate the reporting of abuse.

4. FINRA Adopts A Version Of The Model Act’s Hold Provision

In March of 2017, the SEC approved the adoption of FINRA Rule 2165, which adopts and expands upon the Model Act’s hold provision. The FINRA rule goes further than the Model Act, by permitting member firms to delay disbursement for an additional 10 days if, following an internal review of the circumstances, a reasonable suspicion of abuse remains. Rule 2165 also requires firms effectuating a transactional hold under the rule to “develop and document training policies or programs reasonably designed to ensure that associated persons comply with the requirements of this Rule.” Finally, the SEC also approved an amendment to FINRA Rule 4512, requiring member firms to make reasonable efforts to obtain the name and contact information of a trusted third party for each customer’s account. These new FINRA provisions will be effective as of February 5, 2018.

5. What This Means For Financial Services Firms

Based on the growing senior population, the statistics showing an increase in the number of reported cases of abuse, as well as the state and federal interest in protecting seniors, financial institutions should expect significant scrutiny of their efforts to mitigate the financial exploitation of seniors. Therefore, financial services professionals would be wise to closely monitor state and federal laws and regulations, implement compliance policies and require training aimed at protecting senior investors.

Richard Szuch, a principal at Bressler, Amery & Ross P.C., has been practicing law for 30 years. Szuch is a former prosecutor and focuses most of his time on issues related to the financial services business.