Still trying to define smart beta? Rest assured that you are in good company, as many investment managers may not realize they have run a smart beta fund for years—until they were informed by a marketing person! Perhaps that is why investors find the term “smart beta” to be confusing, misleading or even meaningless, which is compounded by the interchangeable use of the term “strategic beta” by many investment professionals.

As there is no universally agreed upon definition in the investment world, smart beta has become a catch-all category. Any new investment vehicle/fund seems to be labeled—or become—a smart beta product, rather than accurately referred to through the type of index at the foundation of the product. When firms utilize smart beta they may be referring to a product based on single or multiple factors, strategies, themes or any number of other ideas.

Defining smart beta often falls across a spectrum. On one side, some believe it only encompasses factor indexes, whereas on the other end, some believe it is simply any alternative to market cap indexes. The simple definition of “everything but market cap indexes” captures the many different types of strategies included in smart beta, but then excludes different types of indexes such as volatility, options based, risk control and hedging. The one common characteristic all smart beta indexes share is that they are rules based. While most investors only think about smart beta in equities markets, similar approaches also exist in other asset classes and are growing in commodities and fixed income.

Smart Beta Background

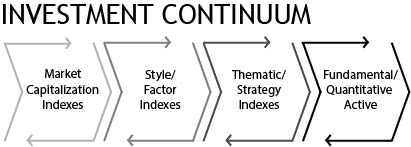

In the 1960s, leading academics identified “factors” as drivers of equity returns. Shortly after, factor indexes, such as style indexes and equal-weighted indexes, were created as performance benchmarks, not for investible products (like most indexes). Now indexes have become the growth driver in product innovation. I like to think of investing as a continuum with “passive” market cap indexes on the left hand and active management on the far right. The source of returns also follows that continuum, with beta originating from a market capitalization index and alpha (from security selection and market timing) as the goal of active management. By this accounting, the rules-based indexes of smart beta are trying to enhance returns, reduce risk or provide returns of an uncorrelated nature.

Why Is There So Much Interest In Smart Beta?

Investors want the option to invest in funds beyond pure market cap indexes, or active management, and smart beta offers that alternative. It has been estimated, on average, that one new smart beta ETF has come to market every week in the last three years, and that the total number of smart beta ETFs tops 500. Ignore the smart beta label and these ETFs become investible products tied to single- or multi-factor indexes such as size, momentum, high dividend, minimized volatility, etc. They bring the benefits of “passive investing” such as lower fees, taxes, holding costs and increased transparency, together with the outperformance potential of active investing.

Should You Recommend Smart Beta Indexes To Your Clients?

Investors understand the underlying reasons for investing in products that track passive market capitalization indexes as well as products that are actively managed. If smart beta takes positive features from both types of investing, it makes sense to investigate smart beta as another tool in an investing toolkit. But while the vast range of strategies that fall under the term smart beta may seem overwhelming, parsing through the information to uncover potential products should be a process similar to making other investment decisions. When considering the objectives and goals of clients, many advisors will find that various smart beta funds can be used as a core holding, a complement to existing holdings, to replace market cap or active managers, or as a tool for risk reduction. To find the smart beta fund that fits a specific objective, advisors need to contemplate the expense and tax considerations, an expected holding period and how a product would perform in different market cycles—the same diligence expected for an active investment or market cap fund. The decision to invest in smart beta products is as much an implementation decision as the investment decision.

How To Decide To Use Specific Smart Beta Products?

Once you have decided a smart beta product works well for your client, the deciding factor in choosing a specific product hinges on an understanding of the fund’s underlying index methodology, specifically how it works and its precise exposure. A transparent index methodology from a trusted independent index administrator should provide more information to make that assessment than what would be typically provided by an active manager. An advisor should focus on investigating several areas of the underlying index, such as:

-

How reliable is the underlying price data from the underlying securities?

-

How often is the underlying price data provided?

-

Are the prices from a regulated trading venue?

-

How was the back test created?

-

How transparent is the back test?

-

Does the back tested data cover multiple market cycles?

-

Does the index seem to be over-engineered to create a specific outcome?

-

Does there seem to be some economic rational to the index?

-

Does the index add or reduce risks to the existing portfolio?

-

Does the cost/ benefit tradeoff compared to market cap and active management seem worth it?

-

Does the outperformance come purely from increased risk (Sharpe ratio) ?

-

Does the index come from an independent administrator?

While there is still no universally accepted definition for smart beta, advisors should note that the separation and independence of the product provider and index administrator should provide an extra level of comfort in making the decision to invest in strategic beta products.

Richard Redding is the CEO of the Index Industry Association (IIA), becoming its first CEO in 2012. In addition to his role of promoting education for market participants, he has been working with IIA’s members on global advocacy issues including the IOSCO Principles for Benchmarks and the forthcoming EU Benchmark Regulation. Redding spent most of his career in senior leadership roles with The CME Group (CME), a leading provider of benchmark futures and options products and an innovator in futures trading.