Is your client a fixer, a protector or a survivor?

Is your client a fixer, a protector or a survivor?

It's a question advisors and their clients can benefit from by finding an answer together, said Chris White, author of "Working With The Emotional Investor: Financial Psychology For Wealth Managers."

White believes these personality types, shaped by a person’s earliest life experiences, affect investment decisions. The processing of figuring them out can be a trust builder between clients and their advisors, he said.

White, a senior portfolio manager at Hemenway Trust Company with over 25 years of experience in financial services, has long been interested in social psychology.

White's book is based on social psychologist David Kantor’s development of several models of behavior. In fact, his book is based on Kantor’s three hero types, or personality types, as White prefers to call them. The book also touches upon research by economists Daniel Kahneman and Amus Tversky on loss aversion.

“The grief associated with loss is twice as painful as the pleasure derived from gain,” said White in summarizing the work of Kahneman and Tversky. “I’ve noticed that sort of response very clearly in my clients when they are faced with losses or gains.”

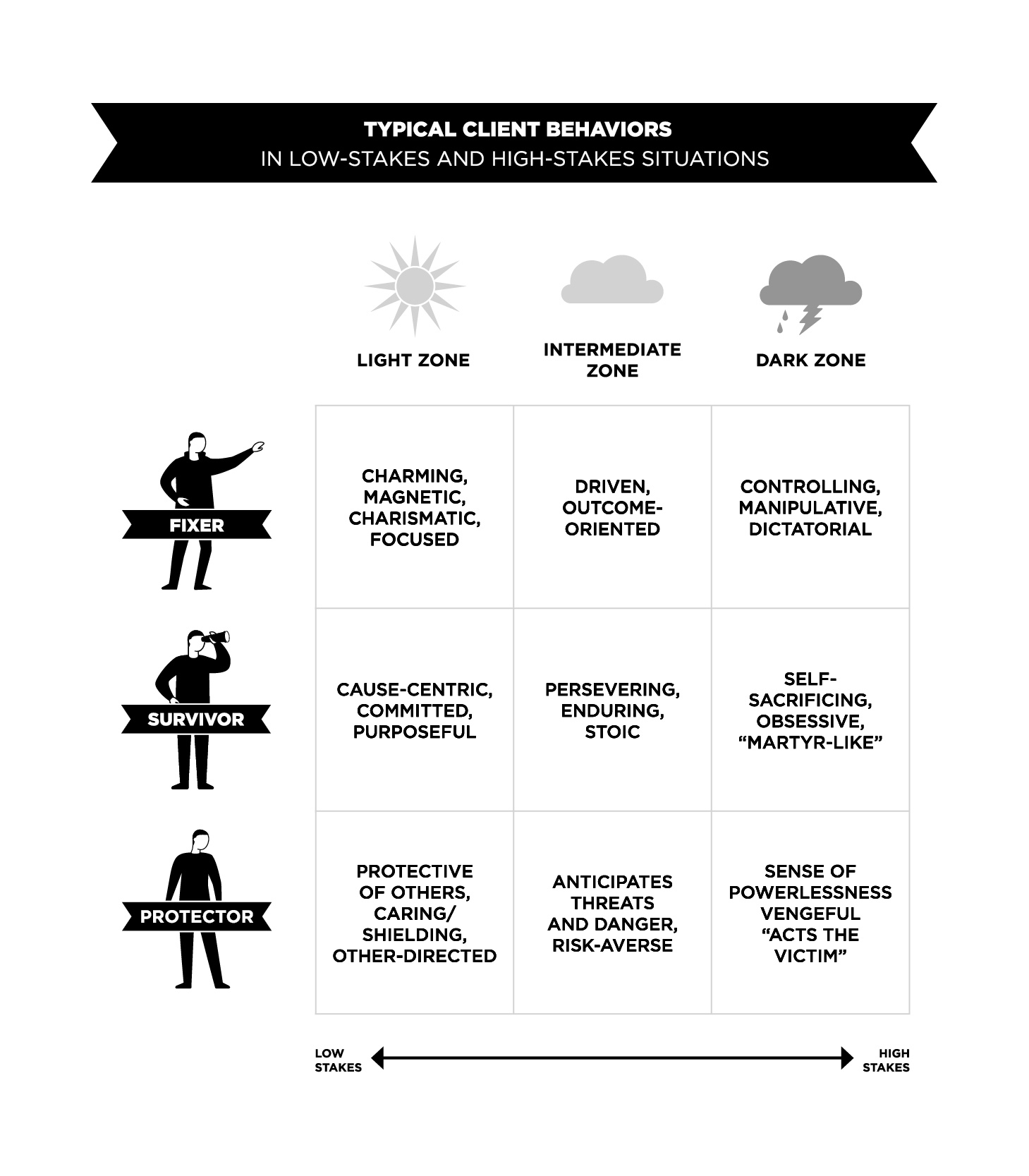

Kantor, meanwhile, concluded that people live in two worlds: the light zone, where there are low stakes and comfortable interactions, and the dark zone, where the stakes are high and people begin to feel threatened.

“Finance taps into our feelings of insecurity, [therefore] it lies in the dark zone,” said White.

Advisors can start assessing what kind of client they have by asking, “What’s the purpose of the money?”

A fixer will say it’s to make more money.

Fixers love to win and they tend to be charismatic when they are in the light zone. However, once the stakes increase and they feel threatened, they can become controlling. White cited Donald Trump as an example of a fixer. He said when the market goes off, a fixer wants to win at all cost and will turn into risk-seekers to do so. They'll use available cash from portfolios to buy a stock they find attractive or double up on a stock that already exist in their portfolio because the share price fell.

“The [asset] manager has to counsel a fixer to keep their powder dry" until the target is right in front of them, suggested White. "The fixer may well be too early to buy stocks because the fixer believes the market is wrong."

Asked what their money is for, a protector will say something like, “It’s to take care of my special needs son.”

Protectors are very caring in the light zone. When stakes rise, a protector will get anxious, anticipating threats. In the dark zone, they tend to feel powerless. Think Mother Teresa, said White. A protector is risk averse and will try to sell everything in a down market to relieve the pain they feel.

White thinks a protector’s sensitivity to threats could be useful information for advisors.

A survivor will say money is “to get my family and me through the next 30 years until I die.”

A survivor is cause centric and tends to be good at saving. When stakes increase, a survivor becomes stoic, keeping his or her head down. In the dark zone, survivors are risk indifferent and transform into martyrs for their goal. White named English polar explorer Ernest Shackleton and activist Nelson Mandela as examples of survivors.

Since survivors know that they will survive because they have planned for the worse and saved towards it, advisors have to advise them to de-risk their portfolios and trade their stocks into bonds.

White warns that clients may present themselves as a combination of the three types during the light zone, which is a perfect zone to build trust in. But advisors will clearly see what type of client they have when the stakes are high.

“It’s in the dark zone that the personality becomes really clear,” said White.