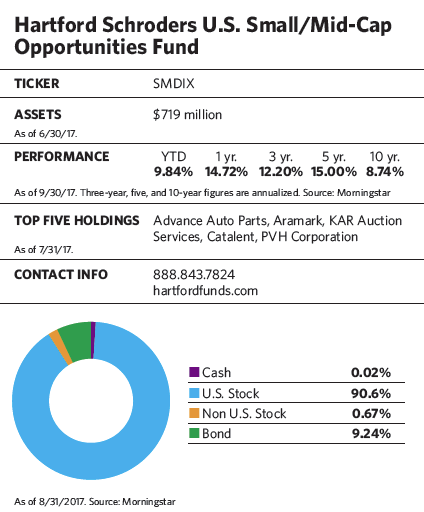

In the world of small and mid-cap stock investing, Jenny Jones’s investment style is a study in contrasts. On the one hand, she operates in a universe that is known for its volatility and unpredictability. On the other, she has managed to navigate that universe with a steady and consistent hand for over 20 years by selecting good stocks, enforcing strict buy and sell disciplines, and being mindful of how portfolio constituents play against one another. Since 2006, that mind set has guided the fund she manages, the Hartford Schroders U.S. Small/Mid Cap Opportunities Fund (SMDIX), through bull and bear markets to outstanding risk-adjusted returns and a notable resilience during tough market times.

In the world of small and mid-cap stock investing, Jenny Jones’s investment style is a study in contrasts. On the one hand, she operates in a universe that is known for its volatility and unpredictability. On the other, she has managed to navigate that universe with a steady and consistent hand for over 20 years by selecting good stocks, enforcing strict buy and sell disciplines, and being mindful of how portfolio constituents play against one another. Since 2006, that mind set has guided the fund she manages, the Hartford Schroders U.S. Small/Mid Cap Opportunities Fund (SMDIX), through bull and bear markets to outstanding risk-adjusted returns and a notable resilience during tough market times.

Over the last five years, the fund has captured 86.3% of the upside of the Russell 2500 Index, a benchmark for small and mid-cap stocks, but only 68.7% of its downside. The fund’s five-year standard deviation (a measure of volatility) is 9.76%, while it’s 11.23% for the fund’s Morningstar peers. Over the same period, the fund’s 1.43 Sharpe ratio (a measure of risk-adjusted return) is well above the 1.10 for the category average.

“We tend to underperform the benchmark when the market is going straight up and stocks with high price/earnings ratios are leading the pack,” says the 59-year-old Jones. “On the other hand, the fund usually outperforms in slack or down markets.”

To cover a range of different stock market scenarios, the fund’s holdings fall into one of three categories that provide uncorrelated sources of potential alpha. The mispriced growth portion of the portfolio, which can range from 50% to 70% of equity assets, concentrates on stocks whose prices understate the growth potential of their companies.

While these names tend to earn the highest returns for the fund in rising markets, they may be less resilient in negative market environments. Steady eddies, which make up 20% to 50% of the fund, are companies with stable growth characteristics, such as recurring revenues and strong cash flows. While their growth rates are typically not as high as those of the mispriced growth stocks, they tend to have more consistent earnings and hold up better in declining markets.

“Turnarounds,” which account for 0% to 20% of fund assets, are stocks of companies that have suffered some type of misfortune and have been punished by overwrought investors, even though they have the potential for improvement. Their performance is less predictable than that of the other two groups when taking overall market conditions into account, but they can pep up performance if a turnaround materializes.

Jones crafted the strategy decades ago; she had realized that market inefficiencies in small caps provided better opportunities for active management than more widely followed large caps, yet she didn’t like smaller companies’ higher volatility. She decided to invest in a way that combined companies with different investment characteristics and risk profiles in order to capture the benefits of active management in small caps without the same risks.

The proportional mix of the three categories at any given time reflects her views of which companies will do well in a particular market environment, as well as where she sees the best values. Before the market downturn in 2008, for example, the percentage of the portfolio invested in steady eddies was relatively high as the consistency of their earnings and their high free cash flows trumped high growth as desirable attributes in a frothy market. That year, the fund fell about five percentage points less than the Russell 2500 Index, and about seven percentage points less than its peer group in the mid-cap blend Morningstar category.

After the downturn, Jones bulked up on mispriced growth stocks of strong companies that she felt had been punished too severely by the market and would eventually recover. “We’re looking out at what’s going to happen over the next three years, not the next six months,” she says.

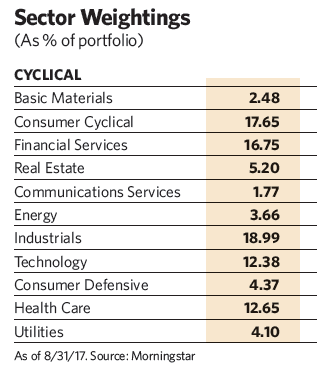

Besides these stock combinations, Jones employs other strategies to smooth out returns and keep the fund less volatile. Each component sector may deviate no more than 10 percentage points from its weighting in the Russell 2500 Index, and no stock can account for more than 5% of equity assets.

The fund also spreads its bets widely over a swath of more than 100 stocks: The top 10 recently accounted for less than 20% of assets. Analysts set exit prices before purchasing a stock, though that target may be adjusted occasionally over time, and they look for a typical holding period of between two and three years. The biggest group of companies are those with $5 billion to $10 billion in market cap, which represented 46.6% of the fund’s assets as of June 30. Companies with a $2 billion to $5 billion market cap make up another 31.3%.

Right now, the fund has a higher than average allocation to steady eddies, a reflection of Jones’s concerns about market uncertainty. On the plus side, smaller-cap valuations are at or below long-term price/earnings averages, unlike those in the large-cap space. Usually, small caps sell at a premium. “The last time we saw this was 10 years ago,” she says. “That’s not to argue that the small-cap space is inexpensive, but it’s not as bad as it appears at first glance.”

She still sees pockets of opportunity for uncovering value. “This is a bifurcated market where certain areas, such as technology, have become quite expensive,” she says. “But others still have mispriced growth stocks that are selling at relatively attractive valuations.”

Some of these stocks can be found in the retail sector, where what she calls “the great Amazon pall” is casting a shadow over some strong companies that will thrive despite the market giant’s increasing dominance. She cites as an example a global apparel manufacturer (whose name she won’t mention because the fund is actively trading the stock), as an undeserved victim of the Amazon threat. She believes the apparel company has better prospects than many people think because it serves both the online and bricks-and-mortar retail establishments.

Earlier this year, the fund invested in companies that provide services to the housing market—from roofing, heating and air conditioning to softer services such as pest control and financing. Despite the Fed’s interest rate hikes, the ongoing demand for housing remains strong, and Jones believes the nascent but meaningful wage growth by millennials, now the largest generation in the U.S., could help the market expand.

Today, small and mid-cap stocks have a yin-yang group of forces working for and against them. On a positive note, optimism among small business owners has been high since President Trump won the U.S. election, according to a survey by a leading small business administration. Because the largest companies already have ample ways to lower their taxes, the president’s signature campaign promise of lower corporate tax rates would be particularly welcome by small and mid-sized companies.

Another plus for smaller companies has been the increasing pace of mergers and acquisitions, which Jones “would not be surprised to see continue, as companies have continued to cull costs and boost margins, and now need alternative paths for growth.” A number of companies in the funds she manages, such as VWR Inc., Parexel, Patheon and Private Bancorp, have already received buyout offers this year.

Nevertheless, the small and mid-cap universe also faces headwinds. While optimism about President Trump’s business agenda and prospects for lower corporate tax rates gave those stocks a big push immediately after the election, large-cap stocks have held the edge in 2017 as hope for reform has faded in the wake of persistent Republican setbacks and deep political division in Washington. A weaker dollar this year has also been a bigger help to large companies with lots of international exposure; those companies are thus reporting better-than-expected numbers, a tailwind that most small and mid-sized companies don’t have since they tend to post most of their sales in the U.S.

Jones takes the change in leadership in stride. “At the end of November, there was a lot of wishful thinking going on,” she says. “It was too much too soon. I feel better now that expectations have come down.”

She won’t say whether she thinks small-cap performance will outpace large caps in 2018, and emphasizes instead that her main focus is looking at stocks on a company-by-company basis. But the fund’s July outlook offers a less circumspect view, noting that, “Given current trends, the potential for a lower corporate tax rate and improved global trade, a shift in allocation to smaller and medium-sized stocks should, in our view, be a profitable move for investors.”