A formal financial plan is a comprehensive analysis of a client’s current and potential future financial situation and recommended courses of action. Formal plans tend to have multiple components, including:

• Net-worth statements

• Cash-flow analyses

• Investment plans incorporating retirement planning

• Risk management plans

• Estate plans

There are other possible components. But what’s of central importance is that these plans are comprehensive. Their aim is to evaluate a number of aspects of clients’ financial lives and provide specific recommendations.

So why are the plans sometimes ineffective or counterproductive? It’s certainly not always the case, but it does happen. And it’s critical for financial advisors to know why and when the plans aren’t working.

Defining Failure

It turns out that sometimes it’s the very comprehensiveness that leads to a comprehensive plan’s failure.

If a client pays for a formal financial plan and does not implement some or any of the recommendations, the plan is deemed a failure. Because without implementation, the plan has no real value.

If a client pays for a formal financial plan and does not implement some or any of the recommendations, the plan is deemed a failure. Because without implementation, the plan has no real value.

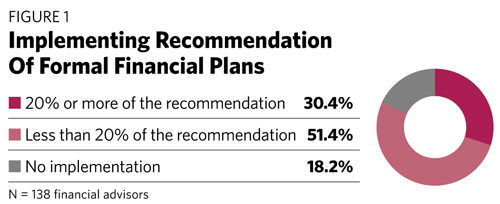

In a survey of 138 financial advisors providing plans for a fee, on average, 30% of their clients implemented 20% or more of the recommendations within six months (Fig. 1). About half of their clients who purchased formal financial plans implemented less than 20% of the recommendations within six months.

Very telling is that nearly a fifth of the clients of these financial advisors did nothing after six months.

Because of the sample size, this study is best thought of as directional, but it is still one of a number of surveys showing that formal financial plans do not always deliver value to clients (aside from producing a document).

True, some financial advisors have very high implementation rates for the formal financial plans they produce. It’s not wrong to provide the plans; it is more about discovering for whom they’re a good fit.

And the answer is knowing who needs a comprehensive plan in the first place. Because in some cases, such plans may be overkill—they are so prodigious the clients find them overwhelming. The plans usually require the clients to take a number of actions and make too many complicated decisions. The result is that many times they do nothing.

A meta-analysis evaluating the clients who do and do not implement plans suggests that certain characteristics make the plans ineffectual, for instance:

• In those client scenarios where there is a pressing need: When clients have particular concerns or desires, concentrating on the specific thing they want to accomplish is the preferable approach. In these situations, holistic is the wrong way to go. The better approach is to tightly center the planning on what the client wants to get done.

• In those client scenarios where there is high complexity: The more complicated the situation, the more formal the financial plans become, the larger the documents, and the more numerous the recommendations. Clients see these as unwieldy and off-putting; evaluating and tackling all these recommendations at once is so arduous that the easier answer is to do little or nothing.

• In those client scenarios where clients are time-deprived: When clients are intensely wrapped up in their own lives, they may have difficulty finding time to address the numerous recommendations found in their formal plan. The result is frequently that they do nothing. They lack the bandwidth.

Consider successful entrepreneurs who are growing businesses. In a study of 83 who paid between $6,200 and $38,600 for formal financial plans, about a quarter implemented three or more of their plan’s recommendations within a year of receiving them (Fig. 2).

Many successful entrepreneurs are starved for time. Between their businesses and the rest of their lives, their financial worlds are usually complicated. They have pressing financial needs for themselves and their companies they aren’t adequately addressing.