The title, of course, is a reference to the Ford administration’s Whip Inflation Now campaign (with buttons).

Central banks have been trying to Whip Deflation Now, but WDN is not as good an acronym.

Japan went to negative rates, so there is lots of talk about how low these negative rates can go.

In the case of Japan, the rate cut turned out to be completely counterproductive, as USDJPY actually traded lower, so many people think Japan is stuck.

Japan is not stuck. Keep in mind that Japan is where unconventional monetary policy was born. They can do all sorts of things. They can cut rates to negative 1%. Or negative 2%. Or do something called OMT (Outright Monetary Transactions). Try to keep up with the acronyms. Look it up.

And since everyone is trying to competitively devalue, it is a race to the bottom in interest rates. Could get even weirder.

Also, it is unlikely that the Fed hikes again this year.

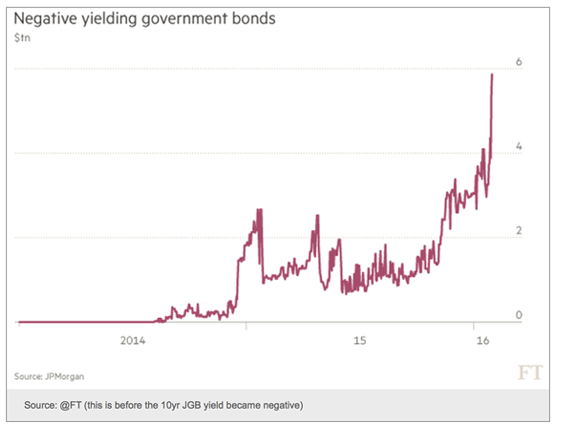

$6 trillion of global bonds now are trading with negative yields. Just let that sink in for a bit.

Inflation Is Back