Bottom Line Up Top

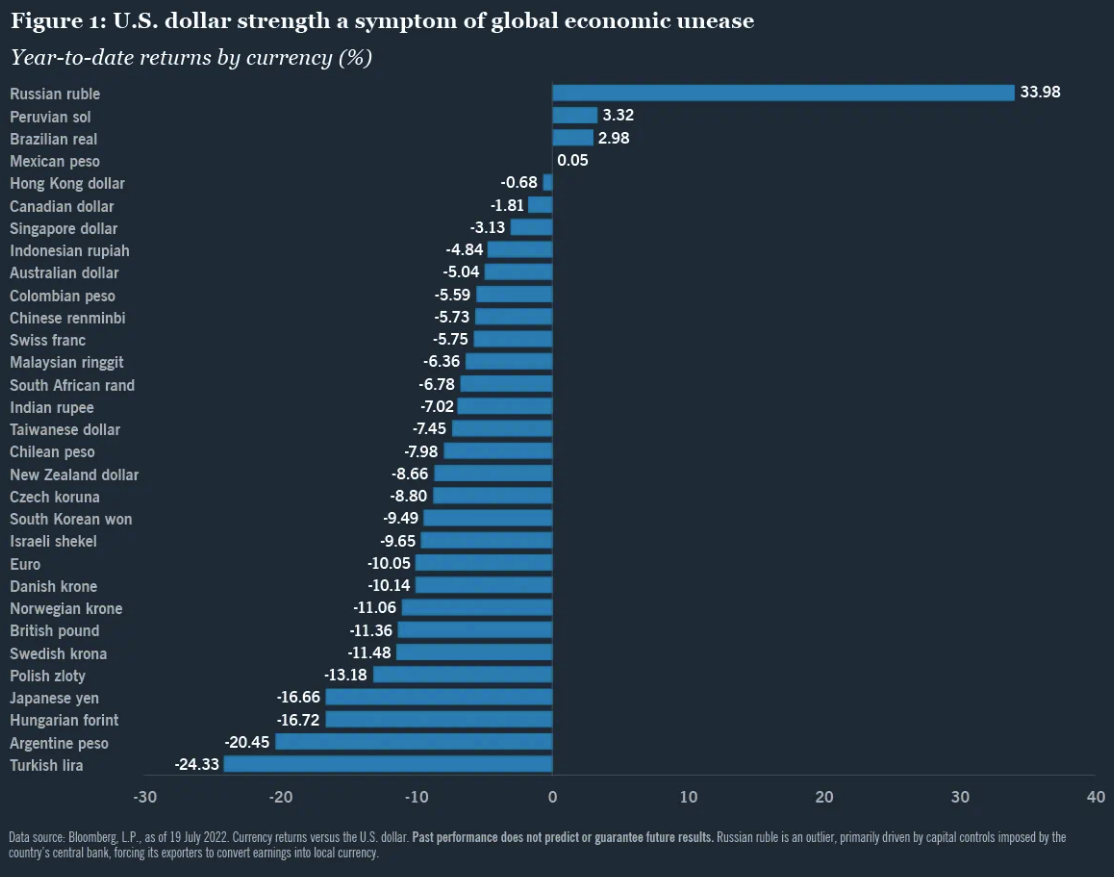

• Multiple drivers, one destination. The U.S. dollar has been on a tear in 2022, leaving most of its international currency peers in the dust (Figure 1). What’s been driving the dollar’s dominance?

• Out of sync central banks. Despite the European Central Bank’s surprising 50 basis point hike last Thursday (vs. an expected 25 bps), the U.S. Federal Reserve’s earlier start and more resolute hawkishness compared to other central banks have boosted interest rate differentials and real U.S. interest rates, contributing to the dollar’s rise. A stronger greenback is an implicit goal of Fed tightening, as it helps reduce inflation.

• Global “risk off” sentiment. Amid decelerating growth and increased recession fears, the dollar has benefited from its traditional role as a safe-haven currency.

• U.S. resilience to commodity price shocks. Russia’s invasion of Ukraine fueled a spike in energy and agricultural commodity prices, but the economic impact in the U.S. was less severe than in Europe, Asia and most emerging markets. More recently, commodity prices have moved lower—historically a favorable dynamic for the dollar.

• A headwind for many risk assets. Broadly speaking, a firmer dollar tends to weigh on higher-beta asset classes. In U.S. equities, dollar strength will probably be cited frequently to justify lower corporate earnings this reporting season, particularly for multinationals that derive a large percentage of their revenue from overseas sales.

• Non-U.S. equities generally don’t benefit from of a robust dollar, although companies that export goods to the U.S. may welcome the currency exchange impact. Emerging markets (EM) equities, in aggregate, rarely produce positive returns when the dollar is appreciating materially. EM debt, specifically dollar-denominated issues, may also be pressured. Meanwhile, commodities typically have an inverse relationship to the dollar, so there’s no advantage for the asset class itself when the dollar appreciates. But there is a broader silver lining: downward pressure on commodities prices should help temper overall inflation.

• Odds favor stronger for longer. We expect the dollar to remain strong or climb even higher in the near to medium term, bolstered by still-elevated inflation and aggressively tighter monetary policy. From a portfolio perspective, this supports our general preference for U.S. over non-U.S. investments, credit sectors over equities and a diminishing reliance on commodities as an inflation hedge.

Portfolio Construction Considerations

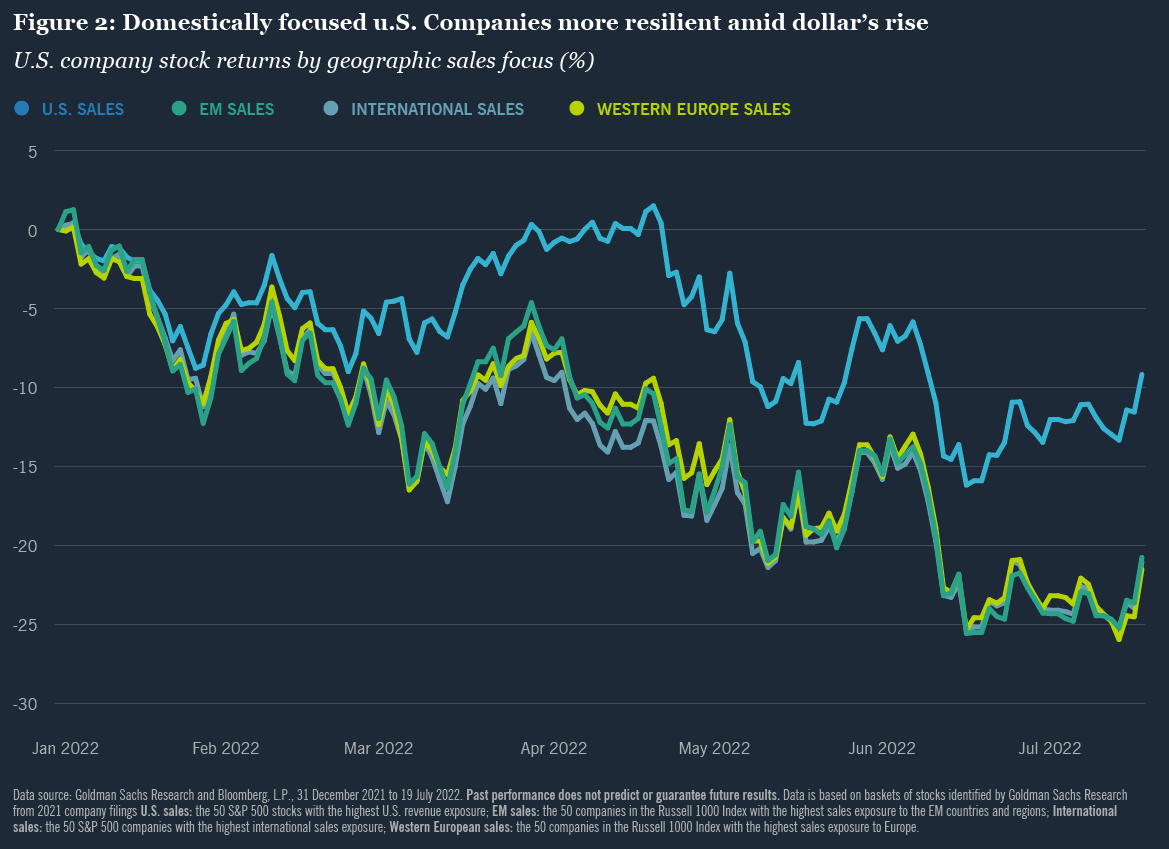

Within the S&P 500 Index, returns diverge between U.S. companies sourcing most of their sales domestically and those that rely more heavily on non-U.S. customers in various regions of the world (Figure 2). Given today’s strong-dollar market, we generally favor the former group.

Narrowing our preference further, we continue to like dividend growth equities, which historically have outperformed during periods of higher interest rates and inflation. Dividend-growing companies are usually supported by healthy balance sheets that can help them better cope in a rising rate environment. Additionally, their dividends are a more reliable component of total return than price performance—a key consideration amid high levels of uncertainty.

Saira Malik is chief investment officer at Nuveen.