Many clients—and some advisors—think that insuring for long-term care (LTC) is something that is primarily needed by the middle class and that more affluent clients can afford to “self-insure.” In truth, affluent clients should consider purchasing LTC coverage as well. For purposes of this paper, “affluent clients” will be considered singles with a net worth of $1.5 million to $4 million, and couples with a net worth of $3 million to $8 million.

This client group, who can generally afford better health care, are more likely to deny the need for LTC. But studies show that the longer you live the more likely you will need LTC, according to a 2016 report by Council on Aging, “Should I Buy Long Term Care Insurance?”; thus in reality, the good health these clients enjoy may bring a greater chance of needing LTC in the future.

Affluent Clients May Pay More For LTC

In addition, LTC services are likely to cost more for affluent people. According to LTC industry expert Claude Thau, one might take the position that affluent clients are not only more likely than a middle class American to need LTC services in their lifetime, but the cost of their care may be more expensive. The reasons for this assumption are:

a) The affluent tend to want better quality LTC, which will be more expensive.

b) The affluent are more likely to stay at home regardless of the cost to do so.

c) Affluent people entering a facility are more likely to live in a more costly private room.

d) The affluent are more likely to select an upscale facility or one in a more expensive area of town.

e) Affluent people may be less likely to receive care from their children. Their children often have higher profile and/or demanding jobs; and they may have relocated for career advancement.

Many of these clients hope they will never need care, but believe if they do, they can afford to pay for care out of their own pocket. Thus, a “traditional” LTC discussion centered around the risk of needing long-term care—and the need to insure that risk—may not go very far with affluent clients. Remember, because they are “healthy and in good shape” they are more prone to denying that LTC will be part of their future. What is more likely to have impact is discussing the consequences to the client’s portfolio if a LTC event comes at an inopportune time to market performance. In other words, concentrate the discussion on insuring the portfolio, not the person!

Insuring The Portfolio Against An Unexpected LTC Event

These clients have likely lived through the Dot Com crash of 2000, the 2008 crash blamed on the real estate and banking industry debacle and perhaps even the market crash referred to as “Black Friday” on Oct. 19, 1987. Ask your client if they believe the market could take yet another tumble. With a likely answer of “yes,” your affluent client may better respond to a discussion about “insuring the portfolio against an unexpected extended health care (LTC) event at a time when the market and account values are down.”

And while one cannot predict how and when an account will recover from such events, an advisor may want to remind the client that…“it could be hard to build your account value back up when you are withdrawing substantial amounts of money from your account to pay for the type of care you want and need.”

These people can likely afford to self-insure their potential LTC expenses, yet, “there is no guarantee such an event will come at a time that is convenient to market performance and your portfolio.”

Remind the client that…“it’s my job to discuss ways to help protect and grow your assets, not watch them decline.”

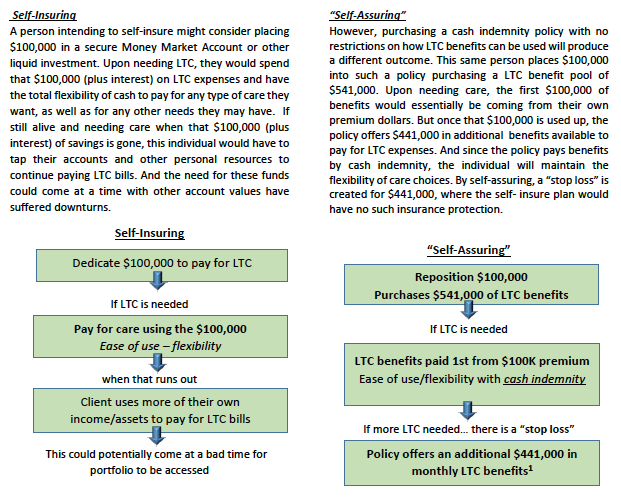

Affluent clients may find a discussion centered on protecting the portfolio to be of more interest. It all comes down to how to “self-insure.” Agree with your client that they can afford to self-insure, but then add that there is more than one way to self-insure and you would like to show them a more cost efficient way to do it. Have your affluent client think in terms of “SELF-ASSURE” instead of self-insure.

LTC solutions will be dictated by assets or income the client may have available and/or other financial needs the client should address. The client may have more need of life insurance coverage now with a need for LTC funding later. Or the client may be in a position where LTC specific coverage may be more appropriate. There are LTC solutions in the market place that can handle the various combination of needs your client may have.

Let’s look at an example using a cash indemnity linked benefit policy and how it would play out in a self-insure scenario vs. a self-assure scenario. This example uses smaller numbers for simplicity, and assumes a 55-year-old female, couples rate, non-tobacco, 6-year benefit duration, and no inflation option. (Stated benefit amounts are based on hypothetical examples, and actual benefit amounts received will vary with changes to age and ratings.)

Summary

When discussing long-term care with affluent clients, the key to a successful conversation ending with your client taking action may be to center the discussion on portfolio success and the use of insurance that can help protect the portfolio with a “stop loss” against LTC expenses. By doing so, you can help lead them through the back door to purchasing LTC coverage.

Shawn Britt, CLU, CLTC, is the director of long-term care initiatives for Nationwide Financial.