My good friend Ryan is lucky. His parents bought him a one-bedroom apartment in Boston’s once-gritty South End last year. He promptly quit his job and rented out his condo through Airbnb to support a year of travel. This made him think that real estate is a great investment. Though Ryan and I are both 27, I see it differently.

My parents have a close friend whose net worth is mostly tied up in a Connecticut home that she bought in the 1980s. The house’s value has declined substantially, and she’s finding it hard to sell. Her story, along with my five years of experience working in the financial-services industry, has taught me to invest as much and as early as I can—mostly in stocks.

More Americans agree with Ryan than with me, it seems. Asked in a recent survey what they thought was the best way to invest money not needed for more than 10 years, 28 percent said real estate. Another 23 percent said cash (savings accounts and CDs). Only 17 percent said stocks, slightly more than said gold. Just 4 percent chose bonds, fewer than those who opted for “other.”

Other surveys have found that millennials—people in their twenties and early thirties, such as Ryan and me—are particularly prone to favor real estate and cash over stocks and bonds. To find out why, I did an informal survey of about 10 of my friends. A majority of them said that, given the choice between investing in the stock market and buying a home, they would buy a home. Their reason: The home would be an investment that would (hopefully) appreciate over the long term, and they could either live in it or rent it out to generate income.

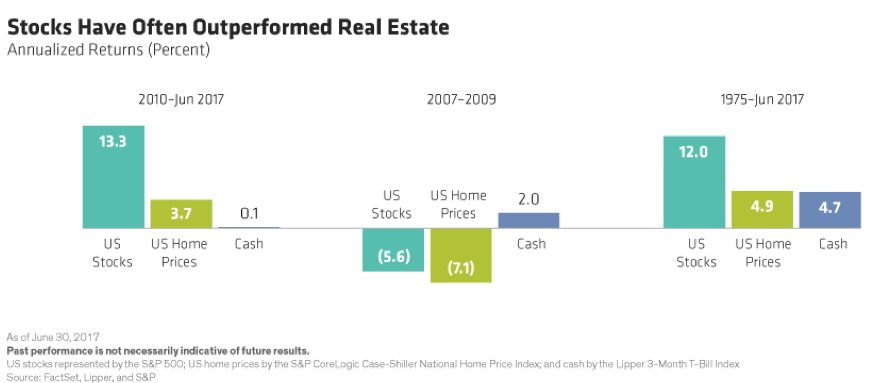

I can see their point, but I think that they are overestimating housing returns. While the housing market has done well in recent years, stocks have done even better. From the beginning of 2010 through the middle of 2017, the Case-Shiller National Home Price Index rose 3.7 percent a year; the S&P 500 Index of U.S. large-cap stocks returned 13.3 percent a year, more than three times as much, as you see from the bars on the left side of the display. The return on cash was barely positive.

Some of my friends also said that they were scared by the last financial crisis. But from 2007 through 2009, the S&P 500 fell 5.6 percent, annualized, and the home price index fell 7.1 percent, as the bars in the middle of the display show. Cash, the “safe” asset class, returned 2 percent in that period.