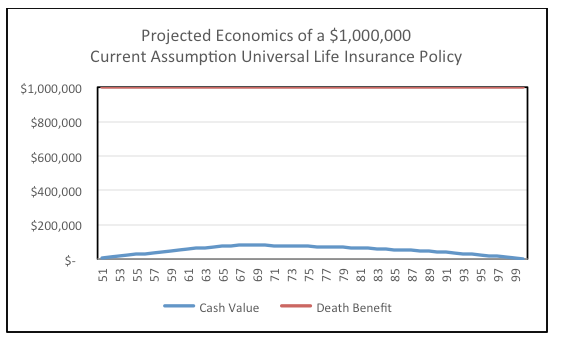

To illustrate this point: A 50-year old man in Preferred health can purchase a $1,000,000 Current Assumption UL policy for an annual premium of $8,808 per year, based on the insurance carrier’s current crediting rate of 3.90 percent. If the crediting rate were to stay level at 3.90 percent, with no changes in scheduled policy charges, the policy’s cash value would gradually rise up to a peak value of just under $79,000 at age 70, and then gradually diminish a little bit each year until falling to only $9 of cash value at age 100. The projected economics of this policy shown in the following chart:

As we can see, everything works out exactly as illustrated as long as the crediting rate stays at 3.90 percent. But what happens when the crediting rate ultimately rises or falls? If the crediting rate falls, absent an adjustment of the premium, the policy cash value will build more slowly, peak sooner than age 70, and drop to zero before the insured reaches age 100 (at which point, the policy will lapse). If the crediting rate rises, then (again, absent an adjustment of premium) the policy cash value will build more rapidly, peak later than age 70, and (depending upon the magnitude of the rate increase) it’s possible that the cash value may never peak at all and could continue to gradually rise indefinitely. While this (having excess cash value) may seem like a great result (and certainly better than watching the policy run out of money and lapse), continuing to pay the same level premium into a policy that’s outperforming expectations is less economically efficient and will ultimately result in fewer total dollars passing to heirs (because those extra premium dollars will not increase the policy’s death benefit).

Managing Policies Efficiently And Effectively

The real lesson here is that Current Assumption UL policies require constant monitoring, and periodic adjustment, in order to enable them to perform as intended – which, as noted, is to provide a death benefit as cost-efficiently as possible in order to maximize one’s return on premium dollars. Modifying the premium (up or down, as applicable) whenever the crediting rate changes will keep policies operating at peak efficiency while avoiding nightmare scenarios (like those described in the Wall Street Journal article) where policies are allowed to become so dramatically underfunded that policyowners can no longer afford to get them back on track when (many years later) they finally recognize there’s a problem.

Insureds who purchased their policies back in the 1980s and 1990s were never promised that policy returns in the high single-digits and above would continue indefinitely. To the extent that some policyowners believed that they were promised such returns, it should reflect poorly not on the underlying insurance product, but rather on the insurance advisor who failed to properly explain the product and then subsequently failed to help ensure that the policy was adequately maintained. This also highlights the importance of conducting a thorough “suitability analysis” to ensure that policyholders will still have the financial ability to maintain their policies in adverse crediting rate environments, and one should never purchase a minimally-funded Current Assumption UL policy that already requires the maximum premium they’re able to afford.

Post-Sale Service Combats Neglect

Is there a way to salvage a Current Assumption UL policy that is underperforming because it has been neglected for many years and multiple crediting rate reductions? Maybe, depending upon the degree of underfunding and how much additional cash the policyowner is willing and able to commit to reviving the policy. It’s also possible that reviving the policy no longer makes economic sense, even if the policyowner can afford to do so. For someone in this situation, the best approach is to have an experienced, independent insurance professional review the policy to determine what options are available. Paying additional premiums is one possible solution, but it may also make sense to consider alternatives such as reducing the death benefit, exchanging the policy for a different product, or selling the policy in a life settlement.

Jordan Smith, J.D, LL.M, is the vice president of advanced design at Schechter, a third-generation boutique financial services firm in Birmingham, Mich. Jordan works with wealth advisors and their clients in the design and implementation of advanced strategies. He provides an important legal perspective to strategies that involve estate planning, taxation issues, trust design and the preservation and transfer of wealth.