In November, shortly after the 2016 presidential election results became known, Melania Trump announced that one of her key issues as incoming First Lady would be to combat cyberbullying. While you may be familiar with the act of cyberbullying, you may not be aware of resulting insurance and risk management ramifications for those who instigate or are recipients of such actions. And it is likely that your clients are unfamiliar with some of the negative outcomes that can result from these activities.

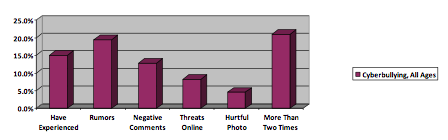

Cyberbullying generally refers to acts taken by young children and involves bullying activities such as harassment, intimidation and threats via use of electronic technology including cell phones, computers and tablets. Methods of engaging in cyberbullying acts often include social media sites, text messages and websites. While cyberbullying knows no age limits, it generally involves acts by young children below age seventeen. According to Statista, the percentage of U.S. middle school students who were cyberbullied as of February 2015 can be seen in the chart below (www.statista.com/statistics/291025/cyber-bullying-share-of-us-students-by-type-of-cyber-bullying/).

As shown above, 15 percent of respondents admitted to having experienced cyberbullying in 2015. Of those, greater than one in five, or 21 percent, revealed they had been cyberbullyed more than twice.

As we have learned from our recent presidential election, statistics can underreport reality. In fact, some estimates state that perhaps one in three children age 6 to 17 years old have been cyberbullied by someone saying threatening or embarrassing things about them online, as reported in 2016 by Sharecare via their topic, "How common is cyberbullying among teens? ‒ Teen Perspective, Bullying" (www.sharecare.com/health/teen-perspective-bullying/how-common-cyberbullying-among-teens).

Cyberbullying can have serious outcomes: there are documented cases of young people who are cyberbullied to the point that they commit suicide. An excellent movie portraying this theme is a 2015 film directed by Amy S. Weber titled A Girl Like Her, which is currently available on Neflix. While suicide and attempted suicide represent extreme results that can come about due to cyber-bullying, several other outcomes are possible due to these activities. While discussing this topic can be somewhat sensitive, you will see that it can have a direct negative impact on your clients' financial well-being. Therefore, as your client's financial advisor it is important to consider initiating a conversation about cyberbullying when children are part of their household.

Specifically, why should you care about cyberbullying? After all, even some clients who have children in their homes might be unaffected by this problematic area. The answer to this question requires an understanding of property and casualty (P&C) insurance and discipline of risk management.

Unlike life insurance, where the peril of death is guaranteed to occur at some point in time, property and casualty insurance and risk management are concerned with pure loss -- which is defined as "loss" or "no loss." In other words, possible outcomes are either adverse if a loss occurs or, at best, neutral if no loss occurs. A P&C insurance policy allows the insured to transfer the risk that certain perils will occur, and subject to policy wording, will make payment if the agreed-upon peril occurs.

As a simple example, if a fire destroys a home, the homeowner policy will pay the policyholder to rebuild because fire is universally covered under homeowners policies. However, fires rarely occur; and when they do, only a very small percentage (less than 5%) involve destruction of the home. Additionally, in the vast majority of situations where fires occur, the resulting damages amount to 20 percent or less of the structure's entire value.

Does this suggest that a homeowner should self-insure their home due to the low likelihood of experiencing significant damages? Of course not. The risk of paying a lot of money out of pocket if a fire should occur far outweighs the cost of purchasing a homeowners policy.

One factor that has a direct impact on the chance of a loss occurring is the number of times the peril at hand has occurred in the past. Paraphrasing the Law of Large Numbers, the more often something has occurred in the past the greater the likelihood that it will occur in the future. Furthermore, the a posteriori method of estimating the probability of a future loss states that observing the number of times an event has occurred in the past relative to the number of possible occurrences can be a strong prediction of future occurrences.

Returning to the issue of cyberbullying, with statistics depicting that as many as one in three children are directly impacted by cyberbullying activities, there is a much higher probability that cyberbullying will occur than a fire.

There are two distinct possibilities to consider related to cyberbullying. First, that a child might be the one that performs such activities. Second, that a child may be the recipient of cyberbullying. Consider the first situation, where one of your clients' children is accused of cyberbullying activities and a lawsuit is brought against them by the parents of the child that has been bullied.