In November, shortly after the 2016 presidential election results became known, Melania Trump announced that one of her key issues as incoming First Lady would be to combat cyberbullying. While you may be familiar with the act of cyberbullying, you may not be aware of resulting insurance and risk management ramifications for those who instigate or are recipients of such actions. And it is likely that your clients are unfamiliar with some of the negative outcomes that can result from these activities.

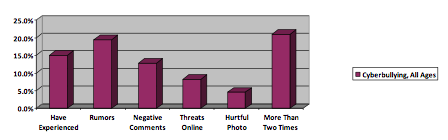

Cyberbullying generally refers to acts taken by young children and involves bullying activities such as harassment, intimidation and threats via use of electronic technology including cell phones, computers and tablets. Methods of engaging in cyberbullying acts often include social media sites, text messages and websites. While cyberbullying knows no age limits, it generally involves acts by young children below age seventeen. According to Statista, the percentage of U.S. middle school students who were cyberbullied as of February 2015 can be seen in the chart below (www.statista.com/statistics/291025/cyber-bullying-share-of-us-students-by-type-of-cyber-bullying/).

As shown above, 15 percent of respondents admitted to having experienced cyberbullying in 2015. Of those, greater than one in five, or 21 percent, revealed they had been cyberbullyed more than twice.

As we have learned from our recent presidential election, statistics can underreport reality. In fact, some estimates state that perhaps one in three children age 6 to 17 years old have been cyberbullied by someone saying threatening or embarrassing things about them online, as reported in 2016 by Sharecare via their topic, "How common is cyberbullying among teens? ‒ Teen Perspective, Bullying" (www.sharecare.com/health/teen-perspective-bullying/how-common-cyberbullying-among-teens).

Cyberbullying can have serious outcomes: there are documented cases of young people who are cyberbullied to the point that they commit suicide. An excellent movie portraying this theme is a 2015 film directed by Amy S. Weber titled A Girl Like Her, which is currently available on Neflix. While suicide and attempted suicide represent extreme results that can come about due to cyber-bullying, several other outcomes are possible due to these activities. While discussing this topic can be somewhat sensitive, you will see that it can have a direct negative impact on your clients' financial well-being. Therefore, as your client's financial advisor it is important to consider initiating a conversation about cyberbullying when children are part of their household.

Specifically, why should you care about cyberbullying? After all, even some clients who have children in their homes might be unaffected by this problematic area. The answer to this question requires an understanding of property and casualty (P&C) insurance and discipline of risk management.

Unlike life insurance, where the peril of death is guaranteed to occur at some point in time, property and casualty insurance and risk management are concerned with pure loss -- which is defined as "loss" or "no loss." In other words, possible outcomes are either adverse if a loss occurs or, at best, neutral if no loss occurs. A P&C insurance policy allows the insured to transfer the risk that certain perils will occur, and subject to policy wording, will make payment if the agreed-upon peril occurs.

As a simple example, if a fire destroys a home, the homeowner policy will pay the policyholder to rebuild because fire is universally covered under homeowners policies. However, fires rarely occur; and when they do, only a very small percentage (less than 5%) involve destruction of the home. Additionally, in the vast majority of situations where fires occur, the resulting damages amount to 20 percent or less of the structure's entire value.

Does this suggest that a homeowner should self-insure their home due to the low likelihood of experiencing significant damages? Of course not. The risk of paying a lot of money out of pocket if a fire should occur far outweighs the cost of purchasing a homeowners policy.

One factor that has a direct impact on the chance of a loss occurring is the number of times the peril at hand has occurred in the past. Paraphrasing the Law of Large Numbers, the more often something has occurred in the past the greater the likelihood that it will occur in the future. Furthermore, the a posteriori method of estimating the probability of a future loss states that observing the number of times an event has occurred in the past relative to the number of possible occurrences can be a strong prediction of future occurrences.

Returning to the issue of cyberbullying, with statistics depicting that as many as one in three children are directly impacted by cyberbullying activities, there is a much higher probability that cyberbullying will occur than a fire.

There are two distinct possibilities to consider related to cyberbullying. First, that a child might be the one that performs such activities. Second, that a child may be the recipient of cyberbullying. Consider the first situation, where one of your clients' children is accused of cyberbullying activities and a lawsuit is brought against them by the parents of the child that has been bullied.

The first thing most people do when they have been served a summons to appear in court is to contact an attorney. Often times the attorney then has their client contact their insurance agent to submit a liability claim. The primary reason for doing so is to obtain payment from the insurance company for both defense costs and for potential judgment(s) that may be rendered in court against your client. Once the claim has been made it is submitted to the insurance carrier that writes the homeowners policy. The claim may also be submitted under an umbrella policy if your client has purchased this coverage.

The homeowners policy provides protection against certain types of personal liability, generally for damages because of "bodily injury" or "property damage" caused by an "occurrence" to which coverage applies. The insurance company adjuster will obtain all relevant facts applying to the claim from their insured (your client) and then makes a determination as to whether or not to offer defense of the lawsuit.

Soon after receiving this type of claim, and prior to the adjuster's in-depth claim investigation, it is likely that your client will receive a document from the insurance company known as a "reservation of rights" letter. This allows the insurance company to investigate the claim at hand without committing to payment for the claim. In other words, the carrier may determine as a result of its investigation that their policy does not cover the claim that was made.

If this is the case, a denial letter will be sent to their insured (your client). When a claim is denied the homeowner (your client) must pay attorney fees, litigation costs and for all adverse judgments awarded against them. As reported by Claire Zillman in Fortune, attorney rates are now topping $1,500 per hour for law firm partners in some parts of the country (www.fortune.com/2016/02/09/lawyer-hourly-rates/). At these rates it will not take long for your clients to spend tens of thousands of dollars in defense costs alone. On the other hand, should the insurance company determine that coverage does exist under their insurance policy they will agree to provide defense and liability payments. The reservation of rights letter allows them the flexibility to go either way after determining whether or not coverage exists under their insurance policy.

Many variables exist in cyberbullying claims and each claim has unique characteristics. As the adjuster begins their file investigation, here are some of the areas that may be considered:

• State laws that may apply (34 of 50 states have adopted anti-cyberbullying legislation and many states specify ages when juveniles lack the ability to reason and to form criminal intent, known as mens rea).

• Number of individuals taking part in the cyberbullying (individual act vs. group act).

• How the insurance carrier defines personal injury, physical injury, emotional distress, defamation, invasion of privacy

and intentional act.

• Number of cyberbullying posts made or other bullying activities involved.

• Policy endorsements (such as whether a personal injury endorsement has been added to the standard policy).

• Additional insurance policies that may exist (i.e. an umbrella policy).

Where the child is the recipient of cyberbullying, there are several areas that may adversely impact the child. Things such as damage to the reputation of the child (or their parents) which results in financial loss and/or emotional harm; wrongful termination; false arrest; wrongful discipline in an educational institution, and mental injury resulting in lost time at school or at work. Some of the expenses involved can include mental health professional services, lost wages, temporary relocation expenses, educational expenses, public relations expenses, cyber security expenses, and more.

Situations involving cyberbullying differ considerably, as can insurance protection. Insurance policies can vary from company to company and different insurance carriers may interpret similar policy language differently. While many insurance companies issue homeowner policies that follow Insurance Services Office (ISO), some issue policies containing proprietary language. Where proprietary policy language applies it is important to read not only the language that provides possible coverage for cyberbullying but to also read policy exclusions and limitations that apply.

In addition, be aware that even though some insurance companies profess to offer coverage related to "cyber offenses," these policies may not include cyberbullying. Rather, they may only cover occurrences such as computer attacks, data breaches, online fraud and other types of examples of cyber liability claims. Again, it is important to refer to the policy's actual wording to determine coverages provided by these companies.

Since there is a possibility that insurance coverage will not apply to cyberbullying occurrences, what can you do as a financial advisor to offer substantive advice to your clients on this topic? Here is where risk management comes into play. There are two important areas that you can discuss with your clients: first, educate them so they are aware of the proliferation of cyberbullying in today's society and what it entails; second, encourage them to initiate open and honest communications with their children about this topic. If one of their children is the target of cyberbullying help them to understand actions that they can take to stop further cyberbullying. If one of their children is the cyberbullying aggressor, stress that the mindset of "kids will be kids" is not an adequate legal defense for hurtful actions. Let your client know how serious this situation is and that high dollar financial out-of-pocket payments may be involved. You can also suggest that they seek advice from experts in this field to help them address this situation.

Among traditional risk management techniques that include areas such as avoidance, loss prevention and loss reduction, avoidance is without equal. By preventing the activity from occurring in the first place it is probable that no further action will be required. However, since it is unrealistic to think that children's interaction with all social media can be avoided, the best fallback risk management technique to apply to cyberbullying becomes loss prevention. Loss prevention involves taking actions that seek to reduce the probability that an event will take place.

With the explosion of electronic technology and applications cyberbullying is unlikely to go away anytime soon. Therefore, as advisors who develop comprehensive financial plans for your clients by utilizing life insurance, investment advice and other methods to achieve financial goals, it is prudent to also include P&C insurance and risk management ‒ including discussions related to cyberbullying ‒ and to coach your clients by offering proactive steps that they can take to further protect their financial assets.

©2017 Kevin L. Glaser, CPCU, CIC, SCLA, ARM, AAI, AIC, ARM-P, AIS. He is a nationally recognized speaker on the topics of insurance and risk management and is author of Inside the Insurance Industry - 3rd Edition. He is president of Risk & Insurance Services Consulting LLC, a national fee-only P&C insurance consulting and expert witness firm, and Right Side Creations LLC, owner of the RISC Analyzer,© a product that allows financial advisors to identify client P&C insurance and risk management exposures. He can be reached at [email protected] or 262-569-0929.