As we move away from the financial crisis and as policies normalize, it is a good time to take a look at what the removal of those policies might mean. After all, many of the actions taken in the aftermath of the crisis were explicitly designed to do certain things. If those actions were successful, then presumably their reversal would have the opposite effect.

Specifically, a Commonwealth advisor asked me about the effect of the Fed’s decision to buy bonds in order to drive interest rates down—known as quantitative easing (QE)—and that is now being reversed, in quantitative tightening (QT). But what does that reversal mean for the market?

First, Some Context

After the crisis, the Fed wanted to support faster growth, so it cut rates. When that didn’t work how it wanted, the Fed looked for other ways to act. The strategy it chose was to buy hundreds of billions of dollars of bonds. By putting more demand into the system, while the supply of bonds remained relatively constant, the Fed forced prices up—meaning that yields, or interest rates, went down. This was the point of the entire exercise: lower rates make it easier and cheaper to borrow, which can spark economic growth.

So far, so good. But with lower interest rates came a much larger balance sheet at the Fed; it more than quadrupled to a level of trillions of dollars. This was, of course, an emergency measure. Indeed, there were—and are—many worries about the consequences of this explosion of the balance sheet. While none of them have come true, the Fed understandably wants to reduce its holdings to something like normal. As such, it is now slowly allowing its holdings to mature, which over time will reduce them. This is the transition from QE (which built up the balance sheet) to QT (which is reducing it).

What About Stock Prices?

Indeed, QE did succeed in reducing interest rates. So, QT can reasonably be expected to push them back up, which is arguably just what we are seeing. There is another potential consequence, however, that we should keep an eye on. That is, you could argue that QE also indirectly pushed stock prices up—and that QT could help push them down.

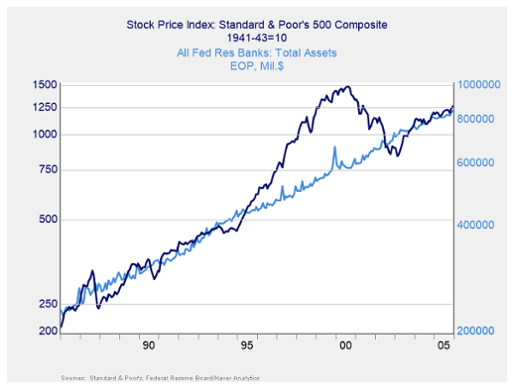

Let’s take a look at why that could be. In the decades leading to the crisis, both the Fed’s assets and the stock market generally rose in tandem. Even the dot-com boom and subsequent bust passed, leaving the two in line. This makes economic sense, as both the stock market and the Fed’s balance sheet are reflections of the underlying economy. They should move in tandem.