The Securities Litigation & Consulting Group (SLCG) has done what regulators have repeatedly declined to do — published the worst ranked brokerage firms in the securities industry.

The Securities Litigation & Consulting Group (SLCG) has done what regulators have repeatedly declined to do — published the worst ranked brokerage firms in the securities industry.

“What we found is the worst brokerage firms over the past 10 years which are still in business remain the worst firms,” said Craig McCann, CFA, PhD, and founder of SLCG, said in the firm’s white paper “Rating Brokerage Firms by Their Complaint Histories Rather Than by Their Brokers’ Histories.”

The findings of SLCG’s exhaustive, first-of-its-kind research are explosive and come from the Financial Industry Regulatory Authority’s own BrokerCheck data from 2007-2016, which SLCG has sliced and diced to rank the “Worst Brokerage Firms.”

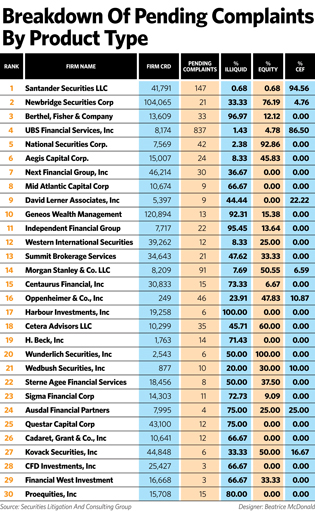

“The worst of these firms are truly extraordinary,” McCann said. While “only 2.6 percent of the brokers at firms with more than 200 brokers have customer complaints, Aegis Capital (24.49 percent) and Newbridge Securities Corp. (24.27 percent) employ bad brokers (with complaints) at nearly 10 times that rate (see Table 1 below),” McCann said. “The worst 12 firms down through Bethel Fisher (Table 1 below) have five times that complaint level” of the industry average of 2.6 percent, he added.

Aegis Capital and Newbridge did not return calls for comment by press time.

Santander Securities LLC said the firm works hard to resolve complaints and has enhanced its compliance, risk management, legal and control functions over the past several years. "The vast majority of complaints referenced in this study are related to Puerto Rico, which has experienced an historic economic downturn," a company statement said. "We do not believe the Puerto Rico complaints represent an accurate measure of SSLLC’s sales or supervisory practices."

TABLE 1

SLCG’s ratings reveal that firms it ranked as:

• The worst brokerage firms over the past 10 years that are still in business remain among the worst firms.

• The worst firms appear to adhere to a high-risk business model, resulting in high continuing investor harm.

• The worst firms in the industry have concentrated their customers’ accounts in a tiny sliver of available investments.

• The worst firms are more than five times as likely to have customer complaints over illiquid investments (30 percent) as all firms (1.16 percent), despite illiquid securities such as variable and indexed annuities, non-traded REITs, oil and gas products, equipment leasing, direct participation products (DPP) and other private placements.

“If Finra unshackled BrokerCheck, researchers would come up with innovative ways to reach and inform unsophisticated investors about high-risk brokers and brokerage firms,” McCann said in the firm’s white paper. The research was originally published in The Journal of Investing in June.

TABLE 2

SLCG also correlated the products brokers are selling to the types of customer abuses and complaints their firm received, including breach of fiduciary duty, misrepresentation, fraud, churning and unauthorized data. Major findings include:

• The more heavily a firm’s customers are concentrated in equity products, the more likely the firm’s misconduct involves excessive trading in client accounts. 76 percent of the customer complaints still pending against Newbridge Securities LLC came from equities, SLCG found.

• The higher the concentration in illiquid securities, the more likely the firm’s clients have suffered from breach of fiduciary duty, misrepresentation or fraud. Nearly 95 percent of the 146 customer complaints pending against Santander Securities in 2016 involved the sale of illiquid securities, SLCG found.

Currently, Finra only makes one broker record at a time available to customers through its BrokerCheck tool (https://brokercheck.finra.org/).

While Finra has admitted it has ranked all 634,000 of the brokers it oversees since 2015, it continues to decline to release bigger-picture complaint and disciplinary data on firms to the industry or consumer groups. Instead, the regulator has created a special exam unit targeting high-risk brokers, said Susan Axelrod, Finra’s executive vice president for regulatory operations at the National Society of Compliance Professionals Conference in Washington, D.C., last week.

Finra did not respond to a request for comment by deadline. “Publishing a list with people’s names, where we haven’t proven any violations, there would be challenges to that,” Axelrod said. “That being said, if we are showing up at a firm asking for information on a particular registered person and coming on site to interview that person, that’s a clue they’re on a high-risk broker list.”

While the industry itself may concur with the secrecy, consumer groups and some securities experts do not. “The problem is by not disclosing the bigger picture to investors, or allowing anyone in the industry to do the analysis, Finra is protecting not only firms but predators and I think someone ought to call them out on it,” a securities analyst who asked to remain anonymous told Financial Advisor magazine.

TABLE 3

McCann said his research on bad brokers, which dates back two decades, shows that instead of leaving the industry, bad apples are often re-employed at lower compensation and by less prestigious firms, than brokers who do not have customer complaints.

“Rather than weeding bad brokers out of the industry, the regulatory environment and labor market sifts bad brokers down the quality ladder over time into brokerage firms with loose hiring practices and law compliance ethics and these bad brokerage firms specialize in preying on unsophisticated investors,” McCann added.

SLCG’s founder says the secrecy surrounding Finra data and the amount of data that Finra expunges on firms’ and brokers’ disciplinary history made this research a “Herculean effort.”

“We have moved significantly closer to a first-best ranking by using information on BrokerCheck reports which identifies the employing firm where the complaint about conduct occurred. It’s a significant improvement over the firm’s previous rankings, but our current measure still misses cases which have been expunged,” McCann says. Arbitration “panels have wiped these cases off brokers’ CRDs and BrokerCheck reports because they found that these firms not the broker were solely responsible, yet they vanish from the public record.”

SLCG hopes its research will spur Finra to release its data so firms such as Lipper and Morningstar can develop methodologies for rating and ranking firms based on their customer complaint track record, McCann said.