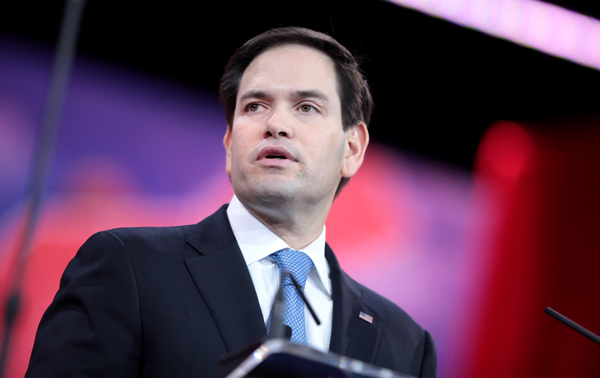

Photo by Gage Skidmore

Photo by Gage Skidmore

Tax reform is only one piece of the overall puzzle needed to revitalize the American economy, Sen. Marco Rubio (R-Fla.) told a group of Washington, D.C., lobbyists and policy analysts this morning at a Politico Playbook Interview sponsored by the Financial Services Roundtable. The other part? Reduce the deficit and offset the cost of the reform, which the Congressional Budget Office estimates at $1.3 trillion.

"The only way you are going to deal with the debt is you have to do two things. ... You have got to generate economic growth because growth generates revenue. But you also have to bring spending under control. And not discretionary spending. That isn’t the driver of our debt," Rubio said.

"The driver of our debt is the structure of Social Security and Medicare for future beneficiaries. We still have time, not just to save those programs, but to responsibly structure them in a way that doesn’t impact current retirees or people about to retire. But it would probably impact it for me and people younger than, in ways that quite frankly you wouldn’t really notice and you wouldn’t really object to because it’s reasonable."

If lawmakers can act strategically sooner rather than later to come up with some combination of reforms to reduce benefits and raise retirement age, the pain of change and reduced benefits will be greatly mitigated, said the lawmaker who ran for president in 2016 and is once again sounding presidential.

“We don’t need to reduce benefits on current retirees or even near-term retirees, but we can make changes for future generations such as mine, and do so in a way that people can prepare for, so the changes will barely be felt,” Rubio said.

As much as 23 percent of Social Security benefits and 14 percent of Medicaid benefits could disappear by 2034 unless Congress acts, according to a the most recent report from trustees. Without a political fix, future retirees could experience a 23 percent reduction in benefits or a 20 percent increase in payroll taxes to fund the shortfalls, the trustee analysis found.

“Tax reform is the economic component of this equation,” said Rubio, who expressed doubts that there will be a government shutdown. “When more people are working, there are more taxpayers and more revenue, but that alone won’t be enough. You are still going to have a debt problem in the absence of spending cuts.”

Pundits are already envisioning Democrats’ ad campaigns in the coming years characterizing Republicans as the party that gutted health care and cut taxes for the wealthy and corporations.

Rubio, however, defended the tax reform plan, not only for companies but for the middle class.

“Look, corporations create jobs,” Rubio said. “The impact this will have on working families will be the most significant that they’ve had in their entire lives.”

To help working families, Rubio said he intends to introduce an amendment that would double the child-care credit to $2,000—a tax change he has been working on since 2015. His aim is to not only double the credit, but also make it fully deductible.

However, later today, President Trump said he doesn't support the plan because Rubio wants the corporate tax rate to be 22 percent to finance the child-care credit.

“The child tax credit is a priority, Rubio said. “It’s not enough to just increase the credit, because the overwhelming majority of Americans don’t benefit because it isn’t fully refundable against the payroll tax. My amendment isn’t a welfare proposal, it just lets working families keep more. The more people who live in your home, the more you have to spend,” Rubio said.

“I’m working to come up with an amendment on the Senate floor that will pass,” the Florida lawmaker said.

Ideally, “the child credit needs to be fully refundable against every penny of payroll tax. We start at $2,500 but we want to get it done. At $2,000, we are doubling the current credit. Yesterday on the Senate floor, I outlined the impact the credit will have on a working-class family. An additional $2,000 or $1,800 a year will not solve every problem they may have, but the credit rewards work and will make a difference. Backpacks don’t last all year, kids outgrow shoes very fast, they eat more as they grow. Even if your kids are in public school, there are expenses.”

How has Rubio liked working with Ivanka Trump on the child tax credit?

“I campaigned on this in 2015 and after the election she expressed an interest in working on the issue of the child tax credit. This is one way we can help families. Paid leave and child-care credit are two other ways.” Rubio said. “She’s become a great ally and advocate.”

Helping working class families will only become more critical as economic changes create vulnerable pockets of the U.S. population. “We really need to take a step back and realize our economy is rapidly changing. People who are in the right careers are doing very well, but 75 percent of Americans in the manufacturing and service sector are struggling, and that will only continue because of technology and outsourcing.

If we don’t address these changes, it leaves us very vulnerable to ethnic nationalism and socialism, Rubio said. “Geopolitically, the post-WWII order is coming to an end. China has clearly accelerated their plan to replace us and we see [Russian President] Putin positioning himself to be a better ally than the U.S. Right now, both parties have boring 20th century answers that don’t address these problems,” said Rubio, sounding presidential again.

Will he run for president again in 2020? “I haven’t ruled it out,” Rubio told the crowd. “The presidential campaign was one of the best things I’ve ever done. Every day was a good day until the day everyone voted,” he joked. “I hope to be the best senator Florida has ever had for the next six years. I’ll decide after that.”

This article was revised from an earlier version to correct a quotation by Sen. Marco Rubio.