There’s no question that technology and wealth management have become inextricably linked. Investors are increasingly weaving tech tools into their financial journey and looking for advisors to support them by doing the same.

But not all technology is especially valued or welcome by today’s affluent investors. What’s more, the acceptance and usage of specific types of technology often differ based on factors like clients’ age and net worth.

The upshot: More than ever, advisors need to deploy technology intelligently within their client service offering. That means focusing not only on what tech tools are important to various client segments today, but also on the emerging tech that may help advisors deliver a more robust experience to their future ideal clients—and differentiate themselves from the pack.

CEG Insights recently surveyed 1,313 wealthy investors about their views on fintech and their advisors’ use of it. Here are some of our key findings.

Tech And Client Communication: Legacy Meets Modern

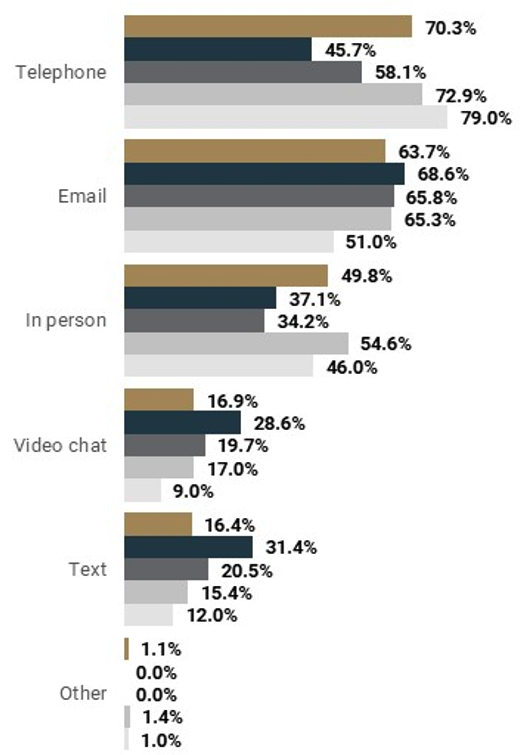

Overall, phone calls and emails are the preferred methods of communication with advisors (see Exhibit 1). But while older generations still lean toward these traditional outlets, younger cohorts (millennials, in particular) are driving a clear shift towards digital—with preferences for text (31.4%) and video chats (28.6%). These clients’ proficiency with digital tools has led them to prioritize platforms that merge technology with expert financial guidance.

Exhibit 1: How Investors Want To Communicate With Advisor (By Age)

Tech And Client Education: Improvements Needed

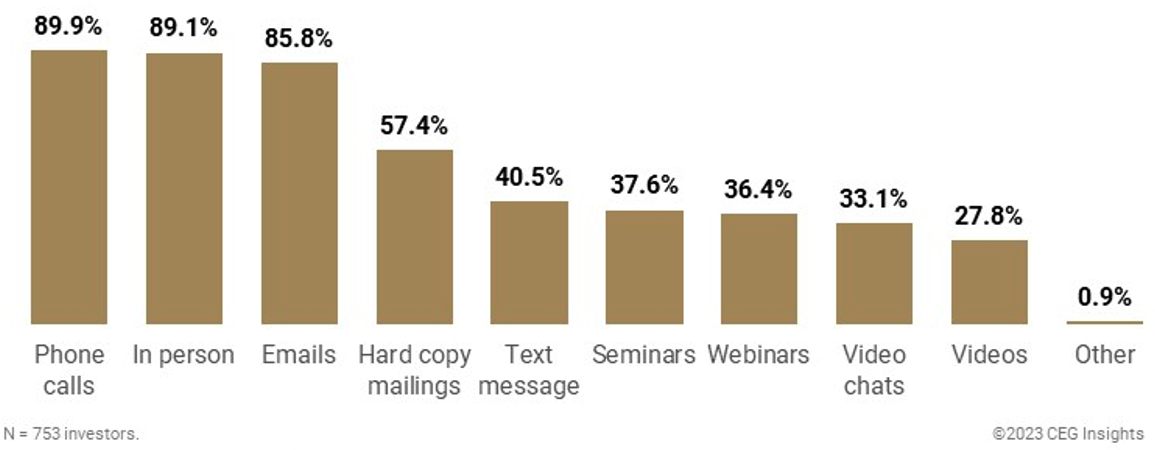

When it comes to learning more about financial—or investment-related topics through their advisors, the vast majority of clients (85% or more) cite the effectiveness of phone calls, in-person meetings and emails (see Exhibit 2).

Note, however, that approximately one-third of clients rate digital formats such as video chats, webinars and seminars as effective—suggesting a growing receptivity towards digital education tools. Unfortunately, only around 30% of clients rate advisor's videos as high quality—a sign that there’s significant potential for improvement in advisors’ digital content offerings.

Exhibit 2: Investor Opinion On Effectiveness Of Advisor’s Educational Methods (Highly Effective/Somewhat Effective—By Total)

Tech And Financial Planning: The Young And The Wealthy

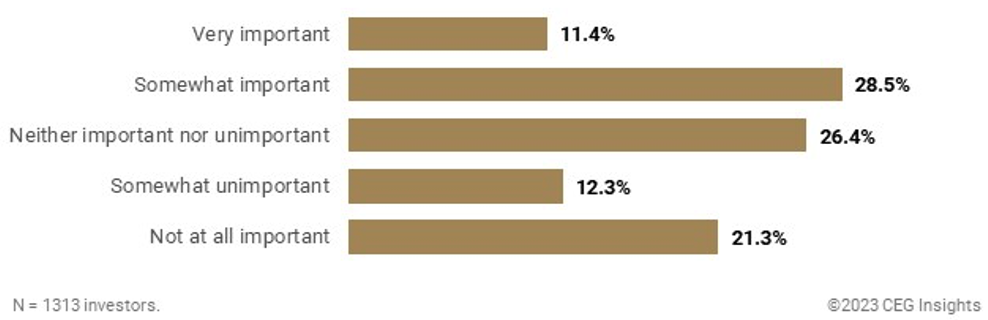

We also see significant client interest in digital tools for financial planning, particularly among specific demographics. Overall, roughly 40% of clients say it’s important to have access to financial planning software (see Exhibit 3).

Exhibit 3: Importance Of Access To Financial Planning Software (By Total)

Digging deeper, however, we find greater demand from two distinct groups:

1. Younger clients. 63.5% of millennials, along with 49.5% of Gen-Xers, want access to financial planning software.

2. Wealthier clients. 47.3% of the wealthiest clients ($10 million - $25 million in net worth) want access, versus 36% of clients with $1 million to $2.9 million.

The data suggests a tangible opportunity for advisors to demonstrate the value of financial planning software, showcasing its benefits in efficiency and customization.

Tech And Advisor Credibility: Social Media Risks

While social media outlets like Facebook and YouTube may seem ubiquitous in our lives, advisors need to tread carefully in this area. The reason: Many clients view advisors who are active on social media with significant suspicion.

Consider that a full 78.9% of clients believe that advisors on social media are either not very professional/credible or not at all professional/credible (see Exhibit 4).

Exhibit 4: Investor Perception Of Professionalism And Credibility Of Advisor On Social Media (By Total)

Perhaps not surprisingly, the wealthiest investors and the oldest investors (baby boomers and older) are more likely to be skeptical of advisors on social media. But that said, even 45% of millennials—the heaviest users of social media—say they question the credibility of advisors on social media.

AI And Emerging Tech: The Next Stage

Emerging technology such as artificial Intelligence (AI) is revolutionizing wealth management. This technology can enable advisors to glean profound insights and develop deeply personalized client experiences.

It’s clear that investors are paying attention to developments with AI. A sizable percentage of clients overall (43%) are at least somewhat open to their advisors using cutting-edge technology in investment selection and wealth management—underscoring the growing importance of AI in data analytics and advisory services. Once again, millennials reported the most enthusiasm for an AI-enabled experience—with 70.3% at least somewhat open to the idea.

Exhibit 5: Openness To Advisor Using Cutting-Edge Technology In Investment Selection And Wealth Management (By Total)

Action Steps

These findings suggest advisors strongly consider a few key action steps regarding their use of technology going forward:

1. Leverage digital platforms. Millennials are digital natives. Explore strategies to diversify your communication approaches to cater to evolving preferences—such as video chat tools and texting to maintain communication in a way that works for younger investors.

2. Deliver relevant content digitally, in high-quality. Think about doing webinars, podcasts or videos on topics that will be of high interest to your clients. And invest in professional audio/video equipment so you can deliver a high-quality finished product.

3. Select the right software platform. Research and identify the specific requirements and preferences of your clients. Weigh the cost of software against the expected benefits, ensuring it aligns with your firm‘s budget and anticipated ROI.

4. Approach social media with caution. Understand that investors are still looking at their advisors‘ social media presence with concern and skepticism. You should claim your name and profile on all the major social media sites, but develop a strategic content plan before posting content.

5. Test out AI. Advisors who harness AI early stand to gain a competitive edge. The enthusiasm for technology in investment selection suggests that early adopters will be viewed favorably. By integrating AI, advisors can automate mundane tasks, devote more time to clients, and provide sophisticated, data-driven advice. This proactive use of technology bolsters efficiency and cultivates trust with clients who value forward-thinking and innovative approaches to wealth management.

The Evolution Continues

For financial advisors, the future hinges on a proactive, innovation-driven mindset. Staying current with emerging technologies, regularly enhancing digital offerings and committing to continuous learning is integral to navigating the evolving financial terrain. It's about crafting a brand that speaks to the tech-empowered investor without losing sight of the personalized, trust-based rapport that is the cornerstone of client relationships. Such a strategy can best ensure that advisory practices flourish as the digital age of wealth management evolves.

George Walper and Catherine McBreen are managing principals with CEG Insights (formerly Spectrem Group), leading innovators in wealth management research. Dive into our exclusive insights and strategies with our latest "Play to Win" Report. Unlock Your Path to Success–Download Now!