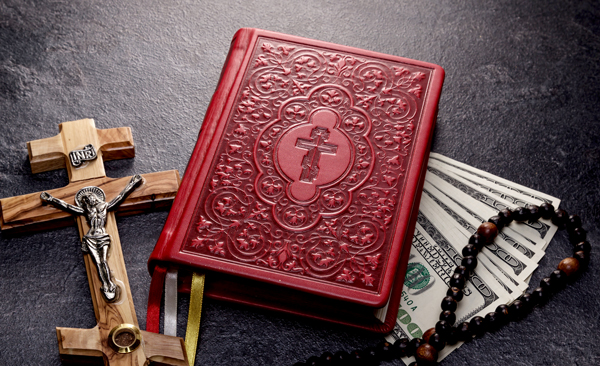

The pastor of one of the nation's largest Protestant churches defrauded elderly investors of $3.4 million in an investment scheme involving pre-Communist era Chinese bonds, according to a federal indictment.

The pastor of one of the nation's largest Protestant churches defrauded elderly investors of $3.4 million in an investment scheme involving pre-Communist era Chinese bonds, according to a federal indictment.

Kirbyjon Caldwell, senior pastor at Windsor Village United Methodist Church in Houston, orchestrated the scheme with financial planner Gregory Alan Smith, 55, of Shreveport, La., who was permanently barred from the securities industry in 2010 by Finra, according to the U.S. Justice Department and the SEC.

Caldwell, 64, was accused by federal authorities of abusing the trust engendered by his status as a high-profile clergyman, noting that he used religious references to deflect investors' complaints about not getting their money back.

"Caldwell took advantage of his victims, encouraging them to remain faithful even as he and Smith broke faith, stealing from elderly investors in an outright fraud," Eric I. Bustillo, director of the SEC's Miami regional office, said in a prepared statement. The SEC filed civil fraud charges against Caldwell and Smith in U.S. District Court in Shreveport on Friday.

In addition, Caldwell and Smith were indicted by a federal grand jury in Shreveport on Thursday and face 13 criminal charges, including six counts of wire fraud.

The scheme targeted 29 investors, many of them elderly people, some of whom liquidated their annuities to invest in the scheme, according to the SEC.

In an interview with ABC News in Houston, Caldwell contended the bonds were legitimate and none of the investors were members of his church.

"I am absolutely innocent," he said.

The SEC alleges that between 2013 and 2014 Smith recruited people, with the help of Caldwell, to invest in Chinese bonds that date back before 1949, when China came under Communist control. The SEC noted that the bonds have been in default since 1939 and unrecognized by China's Communist regime, making them mere collectible items with no investment value.

Smith, who was barred from the securities industry for allegedly misapproriating investor funds, lured investors by telling them he could resell the bonds to third-party buyers for large returns, according to the SEC. Smith told one woman she would receive 15 times her investment back within 30 days, the agency said. Caldwell assisted in the recruitment by falsely claiming he was a large investor in the bonds and telling investors they were backed by gold or silver, according to the SEC's complaint.

"Although many investors did not understand the investment, they ultimately trusted Smith and took comfort in the fact that a high-profile pastor was offering the investment," the SEC said in a civil complaint filed in U.S. District Court in Shreveport.

Instead of reselling the bonds, Caldwell and Smith used much of the money for themselves, according to the SEC. Caldwell and Smith pocketed $1 million and $760,000, while a company controlled by Caldwell received about $1 million, the SEC said. The remainder of the investor funds went to offshore third parties, including at least one in Mexico, according to the SEC.

Caldwell used the money for his mortgage payments, while Smith used the investors' money to buy luxury automobiles, the SEC said.

Throughout 2014, as investors were increasingly complaining about not getting a return on their investments, Caldwell and Smith continually fielded calls and sent out "lulling" emails that contained false assurances that the bonds would be sold, the SEC contended in its complaint.

Caldwell repeatedly told investors to "remain faithful" that they would receive their money, but the bonds were never sold, the SEC alleged.

"No investor to date ever received any return on his or her investment," the SEC said in its complaint. "The great majority of investors have never even received their principal back."

In his TV interview, Caldwell contended that, "To date, everyone who has asked for a refund has received a refund in full."

A third party to the alleged scheme, attorney Shae Yatta Harper of Monmouth Junction, N.J., was also sued by the SEC for drafting the bond purchase agreements and overseeing the banks accounts used by Caldwell and Smith in the scheme, according to the SEC. Accused of aiding and abetting the fraud, Harper agreed to a settlement in which she neither admitted to nor denied the allegations. She agreed to pay a $60,000 penalty and to being suspended from acting as an attorney before the SEC, with the right to request reinstatement after five years, according to the SEC.

If convicted of the criminal charges, Caldwell and Smith each face 20 years in prison for the wire fraud charges, 10 years for money laundering and $1 million in penalties, according to the U.S. Attorney's Office in Shreveport.