A new study by the American Enterprise Institute says that 10 cities are facing a threat to their real estate markets because of the higher number of homeowners behind on their mortgage payments. That trend not only threatens the 10 markets but much of the country, says the conservative think tank.

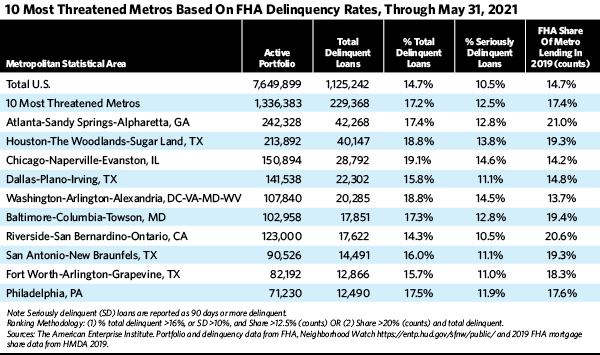

The most delinquent owners are those with mortgages backed by the Federal Housing Administration (FHA). About 14.7% of the 7.6 million FHA mortgages outstanding nationwide were delinquent as of May, up slightly from the previous month, the institute found. Atlanta and Houston were the cities most at risk.

Delinquent mortgages are those with payments 30 days or more past due.

Some 10.5% of the FHA loans were seriously delinquent, meaning they were 90 days or more past due and the borrowers were in danger of going into default.

“A buyer’s market could develop in ZIP Codes with heavy exposure to such borrowers,” wrote the authors of the study—the institute’s housing center director, Edward Pinto, and research fellow Tobias Peter.

Atlanta had a default rate of 17.4%, while Houston’s was 18.8%.

These are the metro areas most at risk:

In April, Philadelphia replaced Orlando, Fla., on the list of the 10 most threatened areas.

Homeowners who aren’t able to sell or modify their loans are likely to face foreclosure or other financially challenging options, such as a short sale, the researchers warned.

“The group of borrowers who voluntarily choose to sell or who lose their home to foreclosure or other disposition will be adding to supply,” the institute said, and that could trigger buyer’s markets in areas with high concentrations of FHA loans and other high-risk mortgages.

The institute took into account mortgages that were part of the forbearance programs lawmakers and regulators set up at the onset of the Covid-19 pandemic. These programs allowed homeowners to put their mortgage payments on pause. The application period was extended until September, and borrowers accepted for forbearance can delay mortgage payments for anywhere from six to 18 months. Not all applicants have even applied yet, let alone worked their way through the system.

The overall number of Americans requesting forbearance declined in recent weeks, but the number of borrowers facing financial challenges remains higher among FHA borrowers, the American Enterprise Institute said.

The Federal Housing Administration program itself is designed for borrowers at higher risk, who have lower credit scores and less money saved for a down payment on a house. “These ZIP Codes contain high percentages of households of color and high levels of mortgage risk as defined by the stressed Mortgage Default Rate (MDR),” the institute said.

When their forbearance period ends, most FHA borrowers can successfully restart mortgage payments or modify loans.

“If a modification is unable to address the delinquency, the next option is for the borrower to sell the home,” Pinto and Peter wrote. “Given the rapid level of home price appreciation, this alternative should allow many distressed owners to avoid foreclosure, pay off the mortgage, cover selling expenses and maintain one’s credit record.”

How good is the American Enterprise Institute at predicting mortgage default rates? “Our recent research has confirmed that MDRs, calculated solely on the basis of loan characteristics present at origination, are highly predictive of default rates in a stress delinquency environment, such as the one caused by the pandemic,” the authors wrote.

In fact, the correlation is 99.9%. “This was found to be the case even though the size and nature of the pandemic is fundamentally different from the financial crisis in the ’00s, upon which the MDRs were based,” the institute found.

As a result, the findings provide unique insight into which areas of the country could face greater exposure to price declines due to increasing supply—as borrowers voluntarily choose to sell or lose their home to foreclosure or disposition.

The foreclosure rates will depend on borrowers’ ability to restart payments and the sustainability of recent home price increases, which will give those who want to sell the ability to pay off their mortgage and cover sales commissions and closing costs.