As an advisor, you deliver the services and solutions that your clients most want and expect from you—and you deliver them well. Right?

Don’t be so sure.

Our research found several major disconnects between what advisors promise their clients—and even believe they deliver—and what those clients actually think they get from their advisors. These gaps greatly undermine trust in advisors, and may present a clear and present danger to your client retention, new client acquisition and ultimately, your bottom line.

But it also spells opportunity for you. If you can truly deliver the services and expertise that clients want—are clamoring for, really—you can differentiate your practice, enhance client retention, garner new business and tap into lucrative growth opportunities.

What The Affluent Want

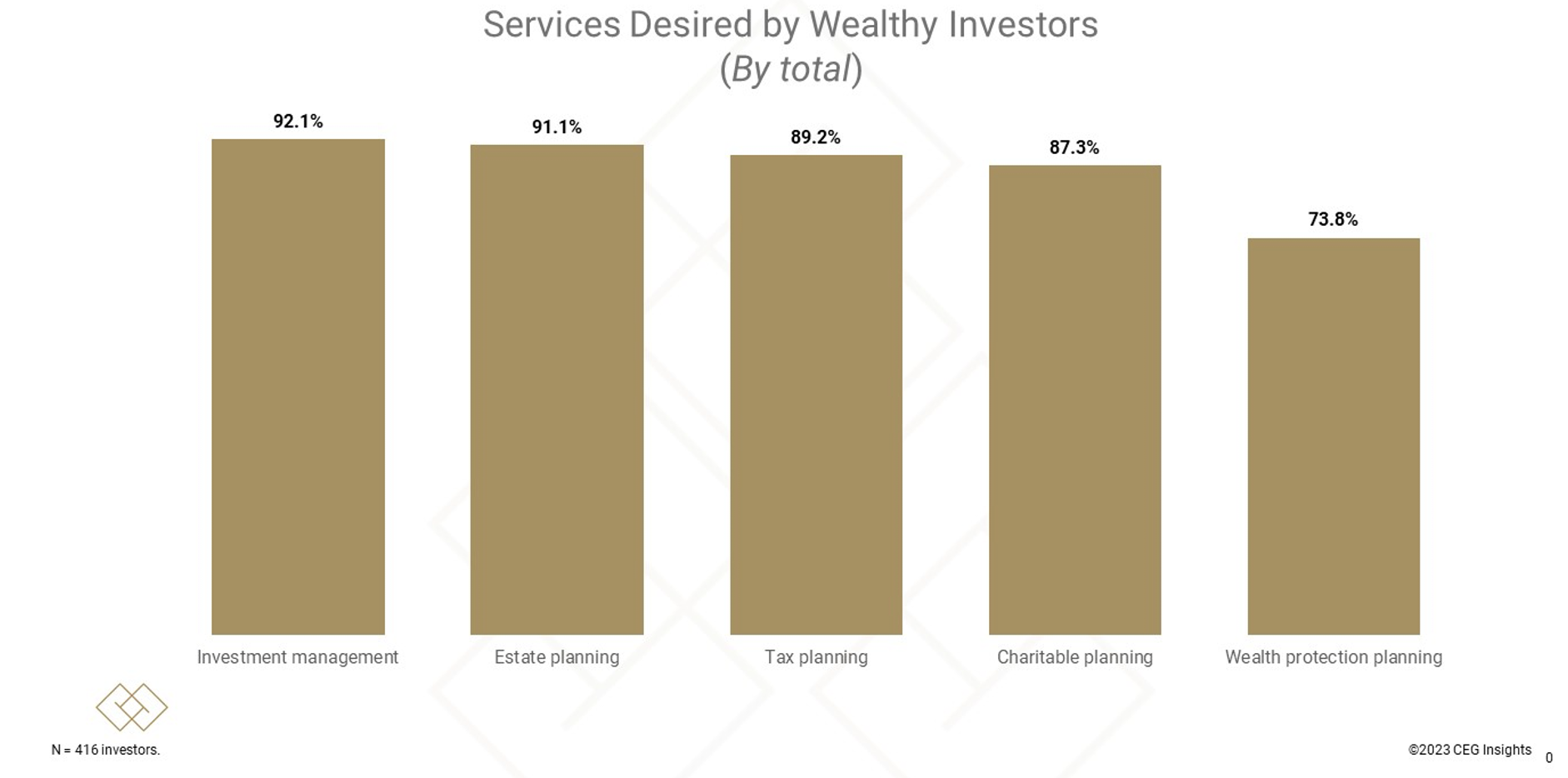

To see the extent of these gaps in service, start by confirming what today’s affluent clients want from you. When CEG Insights surveyed more than 400 wealthy investors, here’s what they told us.

1. Investment management. Not surprisingly, nearly all wealthy clients—92.1%—place a premium on investment management strategies. These clients are in pursuit of advisors capable of crafting portfolios that are aligned with their financial aspirations.

2. Tax planning. At the heart of wealth preservation lies effective tax planning, a service sought after by 89.2% of affluent clientele. They are searching for advisors proficient in navigating the complex tax terrains using an integrated approach that seamlessly marries tax planning with other financial avenues.

3. Estate planning. A notable 91.1% of wealthy clients prioritize safeguarding their wealth for forthcoming generations, highlighting the prominence of estate planning in their financial narratives. They are drawn towards comprehensive services that ensure the smooth transition and protection of assets while fostering a robust legacy

4. Wealth protection. In a world of uncertainties, a significant 73.8% of wealthy clients are inclined towards advisors capable of devising sturdy wealth protection strategies. They expect these strategies to shield their financial assets from potential risks and unforeseen adversities.

5. Charitable planning. Philanthropic endeavors hold a special place in the hearts of wealthy clients, with 87.3% expressing a desire to make a meaningful impact through charitable activities.

What Advisors Claim To Offer

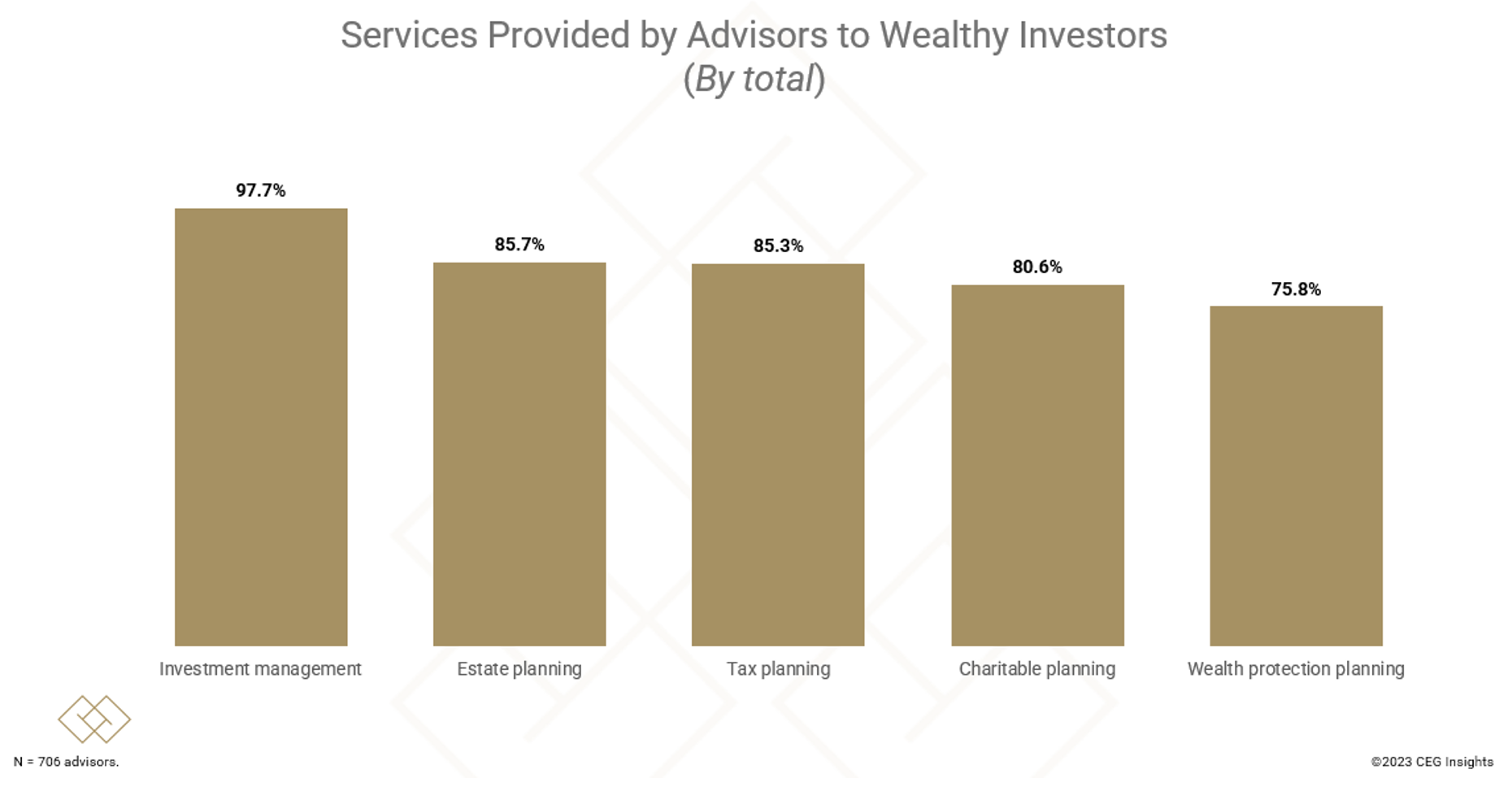

On the surface, it would seem that financial advisors are deeply in sync with their affluent clients’ needs. Consider what they told us when we surveyed 706 financial advisors in the financial industry with a minimum of one year in the industry.

1. An overwhelming majority of advisors—97.7%—note their acumen in investment management. These professionals assert their ability to develop investment strategies that support the financial objectives of wealthy clients.

2. An impressive 85.3% of advisors underscore their proficiency in tax planning, which is rooted deeply in wealth preservation.

3. A significant proportion of advisors, 85.7%, highlight the vital role of estate planning in safeguarding the wealth intended for future generations. These advisors pledge comprehensive services to facilitate smooth asset transitions and foster legacies that withstand the test of time

4. A full 75.8% of advisors report standing ready with robust wealth protection strategies designed to shield clients' financial assets from potential risks and unforeseen adversities.

5. Philanthropy is a focal point in advisors’ offerings, with 80.6% keen on making a significant impact through charitable initiatives.

Reality Check

Diving deeper, however, we see profound gaps between the services that financial advisors believe they’re offering and what investors perceive they’re getting. These discrepancies highlight the urgent need for advisors to develop better communication strategies while ensuring that their offerings are aligned with client expectations and needs.

In addition to asking affluent clients of advisors which services they desired, we also asked them to tell us which of the services they actually receive from those advisors.

The results—summarized in the chart below—reveal often-wide chasms between perception and reality. For example:

• While (as noted above) 89.2% of clients want adept tax planning services, just 24.8% of those clients reported that they receive these solutions from their advisors.

• Only 22.5% of clients confirm receiving estate planning services—despite the fact that 91.1% of them said they want help with estate planning.

• Although 87.3% of clients want charitable planning guidance from their advisors, a mere 6.0% report receiving these benefits.

• Nearly three-quarter of clients (73.8%) expect robust strategies to shield their wealth. The percentage of clients who say they’re actually getting those strategies: 7.5%.

Shockingly, there’s even a significant gap in the category of investment management—which could reasonably be assumed to be a core component of every advisor’s offering. While 92.1% of wealthy clients seek investment management strategies, only 72.1% of clients confirm getting them.

Clearly, there are enormous opportunities for advisors to ramp up their efforts to meet their affluent clientele’s high expectations. In some cases, this might mean providing services clients want but aren’t actually getting. In other instances, advisors may need to better communicate to clients the services they’re receiving and the value that is created from those services.

Bridging The Gaps

We see the virtual family office business model as the key to bridging these gaps. VFOs mirror the approach of single-family offices long used by the world’s wealthiest people by providing services and specialized expertise that were once reserved exclusively for the upper echelons of wealth. As such, they bring single-family office capabilities to a wider group of affluent investors and families.

VFOs are characterized by their robust networks of professionals working in concert on clients’ needs. Through collaboration with high-caliber professionals, VFOs enable advisors to widen the range of services or advice they can offer clients—and the professionals can refer the advisors to their networks in return.

The upshot: A high-performing VFO is capable of optimizing clients’ financial world by addressing their core financial matters and the many (and varied) non-financial wishes and concerns that are tied to those financial components. Because VFOs encompass wealth management, administrative services, lifestyle services and special projects, they can be extraordinarily valuable to clients with complex financial lives—and enable advisors to deliver the services those clients want most.

George Walper and Catherine McBreen, managing principals at CEG Insights, leverage their extensive industry experience to drive organic growth and excellence in wealth management. Dive into our exclusive insights and strategies with our latest "Play to Win" Report. Unlock Your Path to Success – Download Now!