Baby boomers may be set to pass along $41 trillion to their Generation X and millennial heirs over the next 30 years, but that doesn’t mean most financial advisors are ready for the greatest wealth transfer in history.

A mini-cottage industry of consultants is springing up to address this transfer. One of them, Richard Orlando, founder of Legacy Capitals, has built a consulting firm that specializes in teaching advisors how to engage clients’ heirs in whole-family financial planning discussions. The firm conducts workshops for advisors showing them how to engage and do financial planning with clients’ spouses and heirs so they don’t lose their business.

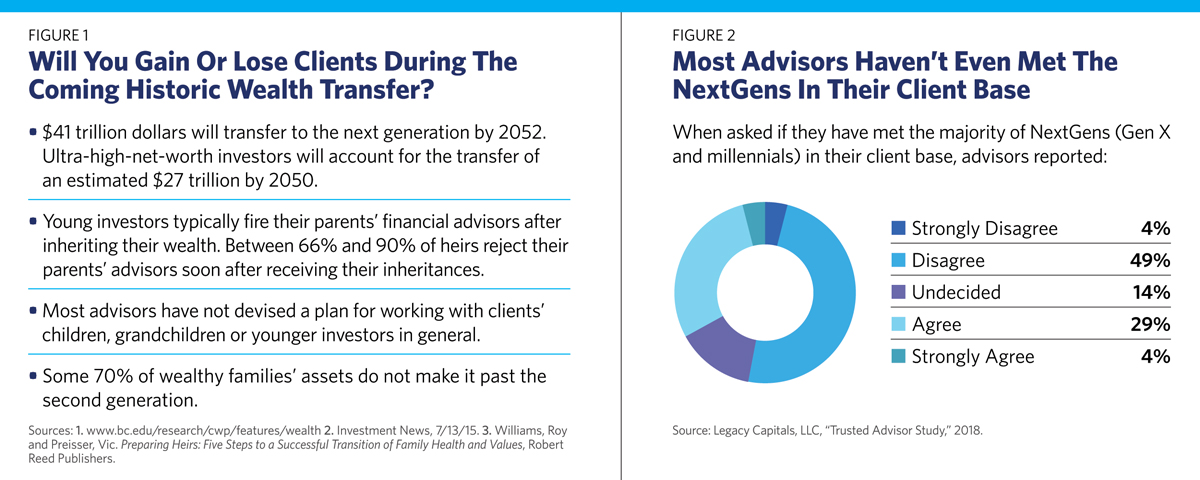

The stakes are extraordinarily high for the investment advisor business. Statistics, including Orlando’s own proprietary research, show advisors will lose clients, assets and fees over the next 30 years unless they begin to fundamentally change their practices now. As many as 90% of next-generation heirs fire their parents’ advisors in the first year after their parents die.

The majority of advisors have admittedly done little to prepare their practices or staff to mitigate the risk, say Orlando and a number of other financial services industry veterans.

“The data is compelling and truly shows the opportunity for advisors, which is the positive side of this story,” says Orlando, author of Legacy: The Hidden Keys to Optimizing Your Family Wealth Decisions. “The opportunity is lying right there. All the data says the next generation is open to it. But on the whole, advisors haven’t even begun to build relationships yet.”

The opportunities for advisors to retain and grow assets are staggering, “but the time to start working with the next generation is now,” says Vincent Valeri, a Legacy Capitals business consultant and coach. Valeri fired his own family’s advisor when he took over his father’s successful corporation—because the firm had failed to ever make him the client.

Preliminary results from Financial Advisor’s “2019 Retirement Survey” show that more than 50% of advisors do not meet with anyone beyond a spouse in a client family. (Look for final survey results at FA’s Inside Retirement conference and in an upcoming issue.) A stunning 67% of advisors admit they haven’t even met the “next gens” in their client base, according to a national survey Legacy Capitals conducted (see Figure 2).

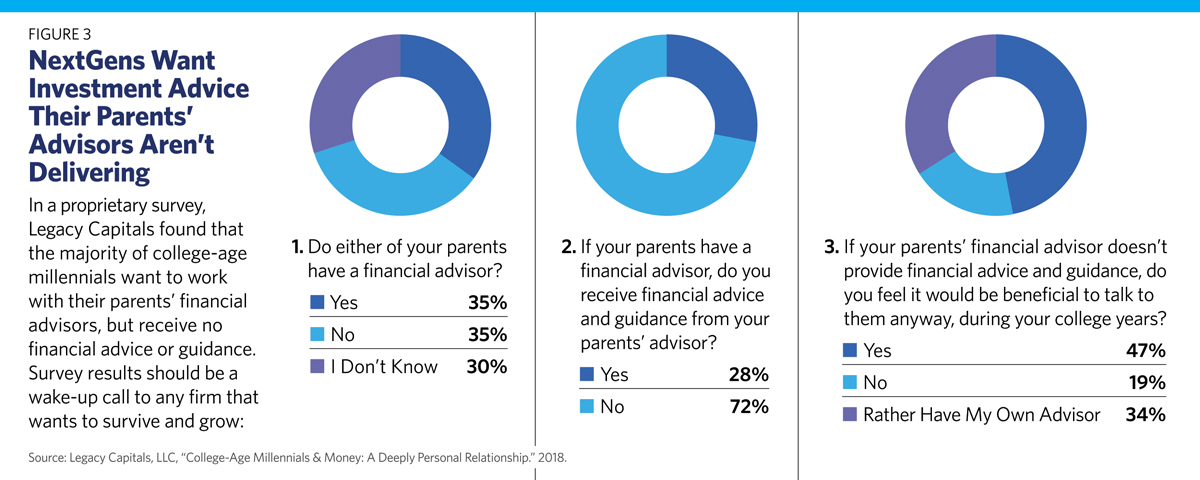

Millennials, meanwhile, know their parents’ advisors are slacking and have done pretty much nothing to cultivate a meaningful relationship with them. A shocking 72% of millennials report that their parents’ advisors have never attempted to provide financial advice or counseling to them, although many say they’d find it helpful, the firm reports (see Figure 3).

“These coming decades can either be the most profitable in history for advisors or a struggle. It’s all up to advisors,” says Orlando, who was the director of Merrill Lynch’s Global Practice Management Consulting Group and a family coach for the firm’s national family office before launching Legacy Capitals. The company offers workshops, online training and coaching for help in things like leading client meetings. Orlando’s team is also hired by affluent families who want to make sure their kids are prepared for the wealth and responsibility they inherit.

On the business side, Orlando’s clients run the gamut from some of the highly successful investment advisor firms to the largest broker-dealers, trust companies and mutual funds, including J.P. Morgan, Merrill Lynch, Morgan Stanley, PagnatoKarp, PNC Hawthorn, Raymond James, UBS and Venturi Wealth Management, all eager to ensure advisors don’t let this wealth-transfer opportunity slip through their fingers.

Many Legacy clients are brokerage firms, trust companies and banks, most of whom have more client relationships than RIAs. Many hybrid brokerage relationships tend to be transactional with less involvement in clients’ overall financial lives; Legacy works to change that. With its more holistic approach to financial planning, the RIA profession probably is better positioned to retain a larger proportion of clients’ children. But even here the record is spotty. Most RIAs try to consult with both spouses and discuss the offspring when creating financial plans. Some meet occasionally with clients’ children, but many do not, as both the FA and Legacy surveys reveal.

A former advisor himself, Orlando has spent the past two decades coaching advisors to engage affluent clients and heirs in values-based, multi-generational planning that involves the whole family, not just the one client. “While advisory firms prepare assets for clients, our job is to prepare families for their assets,” says Orlando, who has conducted 25 workshops around the country for more than 600 advisors and brokers in the past two years. Sponsored by OppenheimerFunds, the one-day workshops are designed to help advisors with affluent clients re-engineer their firms to engage multiple generations and retain and grow assets. “We help them build acquisition and growth strategies,” Orlando says.

“The powerful outcome is incredible for the family and quite remarkable for the advisor, giving them the tools to bend the curve on what happens when a client passes away,” says Ned Dane, senior vice president and head of the Private Client Group at OppenheimerFunds. “As an industry, we don’t have a very good batting average in keeping that money.

“If you have this information on each family member, it helps you understand how they think and where they want to head in terms of money, values and philanthropy,” Dane adds. “It’s a powerful discovery process for advisors.”

Sometimes advisor interactions with clients’ children can be adversarial. Sadly, the biggest obstacle to a comfortable retirement for many upper-middle-class boomers is grown-up children who require financial support well into adulthood. As fiduciaries, many RIAs have found that their most thankless tasks can be persuading clients to cut the financial cord for dependent 30- or 40-somethings and send them packing on the road to financial independence, often against the children’s will.

One prominent advisor has even developed a process he calls “the exit interview” in which he and his partners sit down with clients and explain to their children why funds are being cut off. While it’s questionable whether many advisors would want these individuals as clients, the feeling can no doubt be mutual.

That said, a growing number of millennials who experienced the Great Recession are valuing financial independence even more than their parents did in their 30s. But they look at money differently, and advisors trying to create a multi-generational business need to take these attitude differences into account. Gail Graham, the former CMO of United Capital and founder of Graham Strategy, says: “Advisors who have the will to reshape their practice into a firm that serves multiple generations can move from strategy to action in about a year. But wishful thinking is not a strategy; you need a plan.”

Graham just helped an RIA firm rebrand, change its service offerings and hire younger staff in order to retain and grow its next-generation client base. “About 50% of firms have a conscious and deliberate strategy, and the other 50% don’t,” Graham says. “They’re resting on their laurels on their path to retirement.”

She believes the failure of advisors to plan for what happens when clients’ wealth passes to their heirs is not only a business risk, but a dereliction of fiduciary duty. She says she would discount the assets of any firm that had an average client age of 60 or older and had no strategy in place to work with the next generations. “The risk of attrition is just frightening,” she says.

To retain the next generation as clients, firms have to be very committed to creating a relationship with clients’ heirs and spouses and doing real multi-generational planning, not just spitballing retirement or long-term-care numbers, says Stephen Gresham, president of the Gresham Co. and the former head of the Private Client Group at Fidelity Investments. “It’s a conscious decision to organize your practice to capture the next generation. It doesn’t just happen.”

Bringing in younger advisors to the firm not only enhances its long-term viability by putting a succession plan in place; it also provides a talent pool that can relate to the next generation of clients. Paula Hogan, the president of Hogan Financial, says she has designed a multi-generational firm that includes different generations of clients and staff. She also has a partner in his 30s.

“Multi-generational planning is integrated from the beginning of our engagement when we ask clients, ‘Is the next generation prepared?’” says Hogan, who does comprehensive financial and estate planning and also creates a team of family members and professionals for each client relationship. “If kids are home during holidays,” she says, “we invite them in and introduce them to our team and say, ‘Next time, you can meet the estate attorney.’ Then we nudge them into annual meetings. We see this as part of comprehensive planning and our fiduciary duty.” Hogan’s client accounts average $2 million, but can go as high as $10 million.

For firms that haven’t built a planning approach around entire families, it is imperative to identify those affluent clients approaching wealth transfers and engage them in whole-family meetings. “We help advisors look at their books differently and show them the opportunity of engaging the next generation,” Valeri says. “To start, this may mean concentrating on 10 or 15 clients.”

Orlando designed a deck of 52 cards (called “Capitals Cards”) for advisors to use with individual family members. The cards help family members identify their top values and priorities. One of the cards, for instance, allows clients to prioritize an overall goal-based financial plan, while another might say that children and grandchildren should be included in a client’s acts of philanthropy. The strategic discovery questions are designed to help family members pinpoint values, planning goals, and gifting and philanthropy strategies that advisors can use.

Orlando and his team also share real-world ideas they’ve gleaned from advisors across the country—such as chartering boats, renting movie theatres, catering barbecues and providing targeted seminars for clients and their spouses and heirs. Some firms also bring Orlando or one of his team members in to facilitate multi-generational family meetings for their wealthiest client families. “We train them on how to successfully design and facilitate these meetings and in some cases, they ask us to co-deliver it with them,” Orlando says.

“What Richard helps us do is penetrate and strengthen our relationships with the whole family, which not only informs our planning, but helps the parents and their kids develop even greater trust in us,” says Lars Okeson, family wealth advisor and CFO at PagnatoKarp, an advisory firm with almost $2 billion under management.

PagnatoKarp melds “family coaching into the portfolio management, estate planning and banking so we deliver it in an integrated fashion. We think it’s integral to incorporate family governance and talk about ways to transfer wealth and what it will mean to each generation,” adds Okeson, who says Orlando customizes advice based on each family’s values and needs.

“He’s very good at creating awareness for families about all the different ways they can achieve meaningful wealth transfer and educate their kids. Families are grateful. What we hear is, ‘We had no idea these services were available,’” Okeson says.

Early and ongoing family conversations are critical when it comes to preserving client relationships after wealth transfers. Valeri recently worked to help an advisor team at a bank retain a $50 million family client that was on the verge of changing advisors. “The firm had missed some opportunities,” he says. “Through conversations, I helped the younger generation see the value of the relationship without reinventing the wheel. They realized they were missing the deeper family conversations that were needed.”

And it can be daunting for advisors as well, who may lack the soft skills and emotional intelligence to engage and empower the next generation, says Kristen Heaney, a Legacy Capitals coach and consultant who wound up firing her father’s entire advisory team when she inherited his wealth unexpectedly at age 21. “They hadn’t developed a peer-to-peer relationship with me. The next generation has a keen sense of how other people are viewing them. If I’m going to be successful, I need advisors who are going to see me as capable and empowered even if I’m still learning,” adds Heaney, who teaches advisors “how to build and flex these muscles.”