"Consolidation is used in technical analysis to describe the movement of a stock's price within a well-defined pattern of trading levels. Consolidation is generally regarded as a period of indecision, which ends when the price of the asset moves above or below the prices in the trading pattern."

—Investopedia

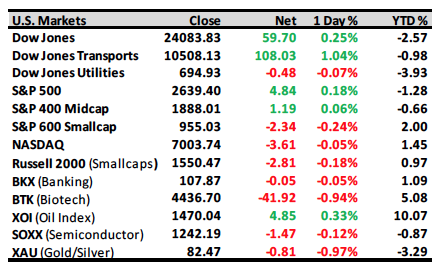

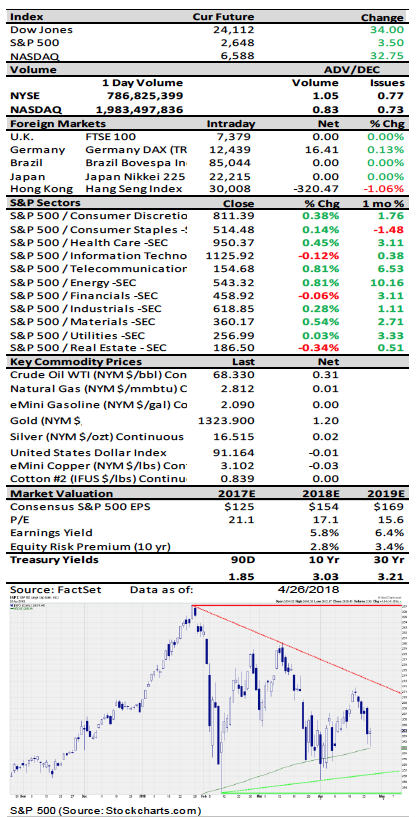

While sentiment still seems to swing from day to day (and sometimes from hour to hour), the stock market is holding in there well all things considered. As we have previously written, the overall cloud of negativity actually feels worse right now than it did at the market lows of February, yet most stocks remain above their bottomed out levels of two months ago. The major averages are also staying resilient despite little help from the biggest stocks in the market, which has likely come as a surprise to anyone who believed the indices would crater without the FAANG stocks leading the way. Both the S&P 500 Equal Weight Index and the Value Line Geometric Index, which better reflect what the average stock in the market is doing, have outperformed the market cap-weighted S&P 500 since the beginning of March as breadth levels have improved. We still have experienced our fair share of bad sessions, of course, but selling pressure does not appear to be picking up even on poor days like Tuesday, which may mean the bears are getting a bit lethargic. The lack of a follow-through on the downside yesterday was just the latest sign of exhaustion and continues the pattern of back-and-forth trading action.

The "candle" formed yesterday in the S&P 500 is encouraging, too, and may mean the bulls have taken back control for now. An intraday reversal and positive close near the high of the day is consistent with the start of a new uptrend, though we will need to see confirmation of this in the days ahead. If we do get a quick turn back lower, it wouldn't exactly be the first time investors have been whipsawed during this consolidation. The larger trading range does remain in effect, and it looks to be getting coiled tighter and tighter, which should eventually force this market to make a definitive move in one direction or the other. We continue to think the odds favor an upside move given the strong earnings and prevailing long-term trend, as the bears seem to have had the perfect chance to force stocks down further given the existing pessimism right now. If the market hasn't broken under the weight of recent global trade fears, backlash against big Tech, missile strikes, inflation and interest rate concerns, "peak" earnings discussions, and numerous political headlines, we're not sure why it would all of a sudden implode without a real black swan event.

For now, we still want to the 200-day moving average to hold in the S&P 500 (currently around 2609), and of course the same applies to the lower end of the consolidation that has formed since the January high. There should be heavy support in this region to help force stocks back up, though they still have some ground to cover before we get another upside breakout attempt. The futures are slightly positive this morning as Facebook beats expectations in their first report since Mr. Zuckerberg went to Washington. The stock is trading up in the pre-market, which could help sentiment in technology stocks if the gains hold. And if the big Tech companies get going again, it's really going to be difficult for the bears to force a significant move lower. Have they missed their chance?

Andrew Adams, CFA, CMT, is senior research associate, market strategy at Raymond James.