Nothing in this life is free—and that’s especially true of massive federal spending programs.

The tax increases in President Joe Biden’s Bipartisan Infrastructure Framework and Build Back Better social spending plan will hurt the most for Americans already living in high-tax areas, according to the nonprofit Tax Foundation, an independent think tank devoted to tax issues.

Taxpayers in the hardest-hit states will end up facing more than $1,000 per year in additional taxes over the next decade compared to what they pay today, according to a Tax Foundation analysis. In some of the states, this annual tax increase will reach $2,000 per year by the end of the decade, the foundation said.

Proposed tax changes in the proposals include adding a new 39.6% income tax bracket for high earners, an increased capital gains rate for high earners, increasing the corporate income tax rate to 28%, expanding and extending the child tax credit, and taxing carried interest as ordinary income. All of these changes, and several others, were considered in the analysis, the foundation said.

Broken down by congressional district, over 96% of districts across the U.S. would eventually see a tax increase. Across the next decade, the largest tax increases would be in high-income districts around cities like New York, Los Angeles and San Francisco, where the average individual tax burden could increase by about $10,000 per year by 2031, the 10th year of the study period.

How They Did It

To determine the additional tax burden caused by the Biden administration’s plans, the Tax Foundation used data from the IRS Statistics of Income for individual tax returns in 2018, which breaks down tax information by congressional district and adjusted gross income. The analysis then distributes the cost of tax increases by income and geography, including an estimate of the eventual burden of the president’s corporate tax increases on individual payers, the foundation said.

Here, in ascending order, are the foundation's 10 worst-hit states and the cumulutive tax increases individuals will pay for the 10 years studied if current tax plans come to fruition:

10. Wyoming - $11,275

Wyoming starts out in 2022 with a $672 annual tax increase for the average tax payer, which increases to $1,553 by 2031.

9. Nevada - $11,698

Nevada starts out in 2022 with a $453 annual tax increase for the average tax payer, which increases to $1,730 by 2031.

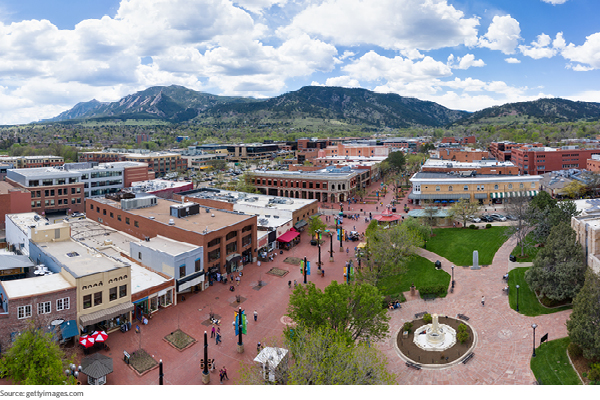

8. Colorado - $12,839

Colorado starts out in 2022 with a $731 annual tax increase for the average tax payer, which increases to $1,715 by 2031.

7. New Jersey - $13,147

New Jersey starts out in 2022 with a $724 annual tax increase for the average tax payer, which increases to $1,749 by 2031.

6. California - $14,095

Califfornia starts out in 2022 with a $755 annual tax increase for the average tax payer, which increases to $1,923 by 2031.

5. Washington - $14,306

Washington state starts out in 2022 with a $813 annual tax increase for the average tax payer, which increases to $1,894 by 2031.

4. Connecticut $17,378

Connecticut starts out in 2022 with a $1,187 annual tax increase for the average tax payer, which increases to $2,181 by 2031.

3. New York - $17,612

New York starts out in 2022 with a $1,052 annual tax increase for the average tax payer, which increases to $2,314 by 2031.

2. Massachusetts - $19,847

Massachusetts starts out in 2022 with a $1,399 annual tax increase for the average tax payer, which increases to $2,467 by 2031.

1. District of Columbia - $22,386

Washington D.C. starts out in 2022 with a $1,497 annual tax increase for the average tax payer, which increases to $2,835 by 2031.

The full report can be viewed here.