Faced with an aging advisor and client base, the financial services business has sought ways to attract millennials as clients as their earning power increases and they stand to receive trillions of dollars in potential wealth transfers over the next few decades.

Cerulli Associates expects another transition of assets and influence, of younger financial advisors succeeding baby boomers across the industry. The financial services research firm estimates that 35.5% of the industry, more than 110,000 advisors, will retire within the next 10 years.

This means that nearly 37% of the total advisor-managed assets, almost $6 trillion, will fall under the stewardship of younger advisors. Yet according to the CFP Board, there are more advisors over 70 than there are under the age of 30. Fewer than one in four CFP professionals is under the age of 40. The average age of an advisor is over the age of 50.

“I think the biggest challenge is awareness,” said Rachel Moran of RTD Advisors in Philadelphia. “Most young people are unaware that this career exists.”

When you take a look at Financial Advisor’s 2018 “Young Advisors to Watch,” you realize there is no one-size-fits-all solution to the industry’s demographic challenges.

Some young advisors recognize that they will need to build their own new practices using progressive thinking and efficient work flows, and these entrepreneurs are innovating away from the traditions of the past. Other young people are trying to revolutionize long-established financial firms from within by bringing new blood and new ideas.

While some young advisors are building businesses that can serve larger numbers of lower asset clients with personalized advice, others are creating practices and cultivating skills aimed at satisfying the shifting tastes of the high-net-worth segment. “I would really like to lower the barrier to getting sound advice,” said Don Hance Jr. of LifeSighted in Pacific Palisades, Calif. “I think that’s starting to happen because more advisors are using retainer and subscription models, but it’s still hard for someone making $100,000 or less to stomach a planning fee.”

Many millennial and Generation X advisors are eschewing asset management for technological or third-party solutions, while some are adopting different methods of investing that incorporate social impact or sustainability. Others are encouraging and guiding clients to become successful do-it-yourself investors.

As the potential client base expands, so does the need for a diverse advisor workforce.

“I would love to see the industry look more like a rainbow,” said Bill Simonet. “There are cultural differences between peoples that for the most part, without some kind of shared experience, will be hard for advisors to address.”

Rachel Moran

Rachel Moran

Financial Planner / RTD Financial Advisors / Philadelphia, Pa.

Like many of our 2018 Young Advisors to Watch, Rachel Moran grew up with a love of personal finance, but had no idea that she could build a career out of it.

Moran, 28, was recently elevated to a senior financial planner position at Philadelphia-based RTD Financial and also made a shareholder. She discovered the financial planning profession while a student at Virginia Tech University.

At RTD, she engages in financial life planning for a clientele with $3 million to $5 million in AUM. Most of her clients are married couples with a few children trying to stay on course for their retirement.

“Your relationship with clients becomes deeper when you’re engaging in financial life planning,” says Moran. “When you’re talking about money, you’re getting at the heart of their fears, values and what’s really important to them. You know so much about them, their experience becomes personal to you.”

She has also served clients in RTD’s Wealth Builder program, which works with young, high-earning clients with low net worth.

After graduating magna cum laude from Virginia Tech, Moran’s first job was as an investment advisory associate with Fairman Group Family Office, a tax-focused firm that also offered wealth management to add value.

Early on, Moran used her affiliation with the FPA to join and create study groups focused on planning and practice management topics. She also helped found the FPA Philadelphia chapter’s NexGen community, serving as the local director for three years.

“A lot of my success has been attributable to my peers,” she says. “Working at a small firm, you only have the experience that your colleagues can provide you. Now I’m passionate about networking with my peers and giving back.”

Now she’s chairperson of the FPA’s national NexGen community, after serving as its 2017 president.

Moran recently participated in a 12-week program designed to help financially empower women who had experienced domestic abuse.

She’s also focused on spreading awareness of the advising profession and helping young advisors integrate into their careers. To that end, she co-founded a mentoring program for women completing Virginia Tech’s financial planning program.

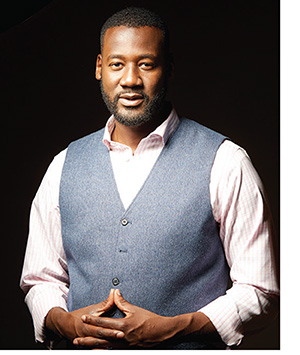

Bill Simonet

Bill Simonet

Principal Advisor / Simonet Financial Group / Kyle, Texas

Bill Simonet, founding principal of Kyle, Texas-based Simonet Financial Group, didn’t know what he wanted to do immediately after high school, so he joined the U.S. Marine Corps.

Simonet, 34, born in Florida as Billy Graham Simonet, is the child of Haitian immigrants.

“They worked hard for the American dream. Most of the people in my family and in my culture go on to become preachers, teachers, attorneys, doctors or engineers, but I didn’t fit into those categories,” says Simonet.

In addition to learning how to improvise, adapt and overcome, Simonet’s military experience taught him the value of financial literacy. After returning from his first tour during Operation Iraqi Freedom, Simonet had quickly spent his back pay, much of it on a brand-new SUV that he subsequently destroyed in an accident.

Simonet vowed to do better after his second deployment—he went back to school to learn more about finance and business, graduating from Everglades University with a bachelor’s degree in management.

Simonet offers clients a menu of options, allowing them a choice of different services at fixed fees. He doesn’t shy away from comparing his service segmentation to the elegance and efficiency of the McDonald’s menu.

“It’s package-based planning with services based on clients’ life experiences,” he says. “Our options are geared towards answering the most common questions people have based on their life stage.”

Simonet also is unafraid to serve young and low-asset clients. He considers the emerging and mass affluent segment, those with between $250,000 and $1 million in net worth, to be an underserved sweet spot for U.S. financial planners.

“That’s the heart of America, the largest overall potential client bases,” he says. “Financial planning is especially good for middle class families who need to find a path towards their future.”

Simonet sits on the board of the Austin Financial Planning Association chapter. He also serves as a bugler for military ceremonies. He offers pro bono planning and advice within his community and speaks at college campuses to expose students to his profession and to encourage more diversity among planners.

Simonet has also created a video blog series, Advisor After Hours, geared toward up-and-coming advisors.

Shannon McLay

Shannon McLay

Founder and President / Financial Gym / New York City

Shannon McLay, 39, wants the world to get financially fit—that’s why she founded the Financial Gym, based in New York’s Flatiron District.

While working at Merrill Lynch, McLay was engaged by her young, low-net-worth peers who needed financial advice. At the time, traditional financial firms were ill-suited to serve such clients.

The Financial Gym charges a flat monthly fee: $85 for individuals, $145 for couples and $35 for students. Services include a monthly meeting, an on-call advisor and a financial plan. Advisors are branded “trainers” who provide a variety of different services to clients, whom McLay has deemed “members.”

“Members are mostly people getting their finances together, they’re working and looking at their whole picture,” she says. “We help them with managing their student loans and learning how to invest.”

McLay doesn’t believe robo-advisors are ideal because people need a relationship and a comforting environment to address their financial problems. Middle-income, low-wealth Americans often feel fear and shame when asked to confront their finances, says McLay.

When members walk into the gym, they’re offered a seat at a “Money Bar” and greeted by a trainer. Then they’re asked to “get naked” and expose their financial selves. Each month, members receive a letter grade for their financial fitness.

“We have something called ‘The Magic Fund.’ As clients start working on their money and have an unexpected surprise to the positive, we’ll say, ‘It’s magic,’” she says. “Clients can give to the Gym, and it becomes a community fund to give to other clients who might need a little more magic in their lives.”

So far, Magic Fund awards have helped clients pay student loan bills, car payments, even Financial Gym membership dues.

McLay also hosts a podcast, “Martinis and Your Money,” to discuss financial topics in an engaging manner. She blogs at “Financially Blonde,” taking inspiration from Elle Woods, the protagonist of the Legally Blonde movies.

McLay sees the Financial Gym as part of a movement that will redefine the financial services industry. Recently, she announced $1.8 million in seed funding from private investors and plans to open a second gym on Long Island, then look to other locations.

Don Hance, Jr.

Don Hance, Jr.

Founder / LifeSighted / Pacific Palisades, Calif.

For many financial advisors, serving clients primarily involves addressing life cycle needs like retirement and legacy—but Don Hance Jr., founder of LifeSighted, believes it’s not always the final life cycle goals but the lives themselves that need attention. His primary clients are high-earning people in their 20s, 30s and 40s who aren’t necessarily thinking about retirement saving just yet.

“Many people put off doing the things they want to because they think they can’t afford them, so they wait until they retire to do them,” says Hance. “I like to help people realize that they can do those things now, or maybe in a few years as opposed to waiting decades to do them.”

Hance has a background in coding and programing, and he spent several years running a technology and sports-related start-up. At a certain point, he found his tech career unsatisfying and pivoted to financial planning, where his father has worked for decades.

Like many of the young advisors on the 2018 list, he found he had an innate passion for finance, which led him to return to school to earn his CFP designation. After school, his first position was at a firm serving high-net-worth clients. Soon, he realized that the trappings of wealth weren’t really fulfilling in and of themselves—thus, LifeSighted is a practice focused on helping clients live the lifestyles they prefer.

The firm offers comprehensive financial planning and investment advising, but Hance focuses a great deal on behavioral management. Most clients come on board with debt, including large student loan and credit card balances. Often, his first task is to encourage some kind of behavioral change in the client.

He touches base with his clients throughout the year in a series of accountability checks, sometimes meeting with them more frequently. He aims to grow LifeSighted gradually, attracting six to 12 clients per year. Moving forward, he plans to use his tech skills to innovate within his practice. He’s already programmed and designed LifeSighted’s sleek website, with plans to build his own questionnaires and portals to aid in the planning process.

Dominique McQueen

Dominique McQueen

Financial Advisor / Finwell Benefits / Encino, Calif.

Dominique McQueen started small. Born on a tiny island, today she works in one of the world’s largest cities, serving employee benefit plan participants with planning and financial wellness services.

McQueen, 34, currently serves as director of financial planning at Encino, Calif.-based Finwell Benefits. She hails from Harbour Island in the Bahamas, which is three square miles in area and known for pink sand beaches with little industry beyond tourism.

“There wasn’t anyone or anything there that could guide me into this; I had to look to myself to take a role in forging my career,” she says.

Like many young women, she learned to appreciate financial stewardship and budgeting after being paid as a babysitter. Her parents weren’t college educated and she didn’t really have financial role models—as a result, she became a bookworm eager to learn more.

At age 15, McQueen won a scholarship to a private school in Nassau, her first ticket off of Harbour Island. From there, she was awarded a scholarship to attend school in Wisconsin. “I had never seen snow in my life, and suddenly I was facing winter in Wisconsin during my first semester abroad,” she says.

McQueen completed her undergraduate career, leaving school summa cum laude, then decided to pursue an MBA at Rollins College, a small liberal arts school in Florida. There, her love of finance led her to the CFA certification. Coming out of school, she thought she would be working in investment advisory roles.

“I found that in the investment sphere, I was focused in one area—there were so many things that people needed but I couldn’t provide,” says McQueen. “I realized that my solution was going through the CFP program.”

Finwell Benefits is, in part, founded on the idea that everyone should have access to financial planning regardless of income or net worth, and that the best route to provide access to planning is through workplace benefits. McQueen serves on the NexGen board of directors for the Financial Planning Association’s Los Angeles chapter. Through Finwell and the FPA, she participates in pro bono planning events like financial planning workshops in the community.

Mike Salmon

Mike Salmon

Principal and Financial Advisor / Moisand Fitzgerald Tamayo / Orlando, Fla.

Mike Salmon, 34, is helping to lead the next generation movement in his firm. In 2014, Salmon was made a partner in Moisand Fitzgerald Tamayo, an Orlando-area financial planning practice.

“I’ve spent most of my time fine-tuning the client experience here and developing ways to educate and mentor newer paraplanners and other entry-level people coming into the profession,” says Salmon. “We’re becoming involved with several academic financial planning programs and we’re trying to hire a person per year going forward.”

Salmon made his first investment purchases while he was still in elementary school with the help of his grandmother. As he grew older, income from a paper route was put into a CD, or into stocks and mutual funds with her help. It was from her that Salmon learned the value of financial advice.

While in school at Purdue University, Salmon watched many of his classmates enjoy successful internship experiences at brokerages and traditional wealth management firms, but he realized that the sales-oriented business was not for him.

“At first, I was turned off by their experiences. I didn’t want to be a financial advisor,” Salmon said. “Then, in my first year after school as an accounting clerk, I realized I wanted to do more than just numbers.”

After moving to Florida, Salmon took a job in the hospitality industry, but continued to study personal finance and investments. He started going door-to-door looking for a job at a planning firm. One of his interviewers recommended that he go to the local Central Florida FPA chapter to start networking. It was there that he met Charlie Fitzgerald, a founding partner of Moisand Fitzgerald Tamayo.

As an enrolled agent, somebody who is allowed to represent taxpayers before the IRS, Salmon also offers his clients tax-planning services. (Half of Moisand Fitzgerald Tamayo’s clients look to the firm for tax preparation.) He also assists clients with education planning.

As a member of the FPA of Central Florida, he has participated in its pro bono “Financial Planning Hotline” and contributes to an advice feature in a local newspaper.

Lori Choi

Lori Choi

Partner / Veris Wealth Partners / New York City

Lori Choi is a partner and senior wealth manager for Veris Wealth Partners, a San Francisco-based, ESG-oriented wealth advisory firm.

Choi, 37, works with a group of Veris’s 30 to 40 largest clients in the New York office, serving them with impact investing solutions, as well as serving personal clients with financial advice.

Choi is co-founder of Women Investing for a Sustainable Economy (WISE), a professional networking group for women in the impact investing industry. “It’s a growing, wonderful community of women who are trying to take ESG and impact investing mainstream,” she says.

Today, WISE consists of more than 900 women organized in eight chapter locations—a testament to the increasing visibility of women in the industry and the rapid growth of impact investing. She works with multigenerational clients like ultra-high-net-worth families and private foundations—at times, her point of contact with her clients is another millennial. Many of Choi’s clients are women.

“We have an approach that is very conducive to working collaboratively with people looking for education to guide them through their life stages, but we’re also working alongside their life values,” says Choi. She also helps serve her clients with advice on charitable giving and legacy planning.

One of Choi’s focuses is Veris’s gender lens investing portfolios, which seek out companies run by or supportive of women. Choi’s portfolios not only tilt toward social and environmental impact, but also reflect each client’s risk profile.

A native of Honolulu, Choi is a graduate of the Wharton School and a CFA charter holder. Before joining Veris, she was vice president of account management at Markit and assistant vice president and portfolio manager at Bank of Hawaii Private Client Services.

Gradually, she found she gravitated toward private client asset management and the relational side of the business, which led to her joining Veris in 2010. “My career at Veris has experienced the mainstreaming of the broader impact investing industry,” says Choi. “I’ve gotten to see more interest and client demand for ESG. In 2010, there wasn’t yet a lot of understanding of impact investing.”

Inga Chira

Inga Chira

Founder and President / Attainable Wealth / Los Angeles, Calif.

Inga Chira is president and founder of Attainable Wealth, where she offers financial planning and investment services to a clientele composed mostly of academics.

After immigrating from Moldova during high school, Chira, now 36, earned a doctorate in finance, and she also works as an assistant professor of finance and financial planning at California State University, Northridge. In addition to her academic roles, she is a veteran of CitiStreet and ING, where she worked in benefits administration.

“Originally, I wasn’t going to practice, but to be a good professor, you have to have experience,” says Chira. “I wanted to be able to teach what I practice.”

In Attainable Wealth’s first year of operations, she’s on-boarded 23 clients while maintaining her full-time position as a researcher and instructor. Chira offers investment management services charging asset-based fees, but she also gives clients the option to engage in ongoing flat-fee planning services without investment management.

In addition, she offers a flat-fee focused financial planning session, usually broken into two virtual sessions, to allow clients to discuss one to three pressing financial questions or issues they face.

Finally, Chira offers one- to two-hour virtual “happiness focused” sessions where the financial planning incorporates behavioral strategies derived from research on money and happiness. In these sessions, clients are encouraged to discuss their values, relationships and non-financial goals to find the links between their money and their emotions.

Chira is convinced that most people’s financial issues are as much about psychology as they are about tangible money problems, thus the happiness sessions help clients evaluate their lives and their relationships with money so they can figure out how they can become happier. She also does research on corporate finance and financial planning. She’s currently studying what motivates people to save for retirement and people’s perceptions of the financial planning industry.

“I also am researching gender, asking ‘Why don’t we have many women?’ and ‘Why might women be better at this profession than men?’” she says. “I think it’s mostly about corporate culture—women barely get started before they decide to give up the profession.”

Hannah Moore

Hannah Moore

Owner & Principal, Financial Advisor / Guiding Wealth Management / Dallas, Texas

Hannah Moore is the owner and founder of Dallas-based Guiding Wealth Management.

Like many young planners, she entered college largely unaware that she could make a career out of giving sound financial advice. It wasn’t until she was at Baylor University that she was introduced to the profession.

After school, Moore was taken in by a solo practitioner looking for a young planner who could eventually be part of a succession plan. In 2013, she ended up buying out her partner and bought another practice several months later, giving her a roster of more than 250 clients.

“I was so clueless, I had jumped into the deep end,” she says. “I started the week the market hit its low in 2009. It was a great time to start, but looking back, I realize that I didn’t know what I was doing.”

Moore wanted to pivot away from investment management and toward financial planning; however, she discovered that one advisor couldn’t serve that many clients with comprehensive financial planning. That led her to found Guiding Wealth as a fee-only boutique RIA.

Now she focuses on the human elements of financial planning and has eschewed scalable technologies like robo-advisors. Moore cautions young advisors about becoming part of someone else’s succession plan—older advisors usually have a stagnant client base with ages averaging in the 60s or 70s, meaning that their younger partners are often left with practices that bleed assets from distributions over time.

Moore is a founder of the Dallas-Fort Worth FPA’s NexGen program. She’s created an “Everyday Money Workbook” to help potential clients who aren’t financially ready engage with a financial planner.

Moore also hosts “You’re a Financial Planner … Now What?” a podcast aimed at helping up-and-coming planners found their practice, build a book of business and innovate within their firms.

So far, she has recorded and published scores of weekly 45-minute episodes of the podcast, featuring advisors like David Yeske, Bill Winterberg, Eric Roberge and Blair duQuesnay—as well as fellow 2018 “Young Advisor to Watch” Bill Simonet.

Daria Victorov

Daria Victorov

Financial Advisor / Abacus Wealth / Sebastopol, Calif.

Daria Victorov, 26, a financial advisor at Abacus Wealth, was indirectly pushed into financial planning by her parents.

As a teenager coming home from orientation at Virginia Tech, she was told by her father that her parents had not saved for her education. She had no idea what college would cost and started to scramble to figure out how she was going to afford her schooling.

The mad search for financial aid and funds to cover living expenses led Victorov right into the arms of a financial planning program in school—she became hooked on the thought that she could help people like her parents make sound financial decisions.

“My experience really deepened my passion for this profession and topic,” she says. “My family made a lot of mistakes, but people can learn to manage their money. I want to help people achieve their goals.”

At the FPA, she has served as director of the organization’s NexGen initiatives. She also is a recipient of a 2018 FPA NexGen Gathering scholarship.

Abacus offers clients “financial checkups,” one- to two-hour annual sessions that assess an individual’s or a family’s financial progress and what steps still need to be taken to achieve their goals. For some individuals, checkups are provided on a pro bono basis.

To serve members of her generation, Victorov is interested in creating flexible financial solutions for younger clients that will be able to change as their lives change.

“I serve all types of clients. Some have negative net worth because of student loans, others have their own personal foundations,” says Victorov. “I like being able to bounce between them.”

Abacus is a firm focused on sustainability and impact. For many millennial clients, this approach holds a powerful appeal.

As a world traveler, Victorov has witnessed firsthand the impacts of pollution, including climate change. This has led her to a focus on creating sustainable portfolios and an interest in helping clients divest from companies that do not align with their values.

“During my trips to Asia, I saw the effects, people wearing face masks and coughing up black stuff from the air pollution,” she says. “When I returned to California, it became something I really wanted to focus on.”