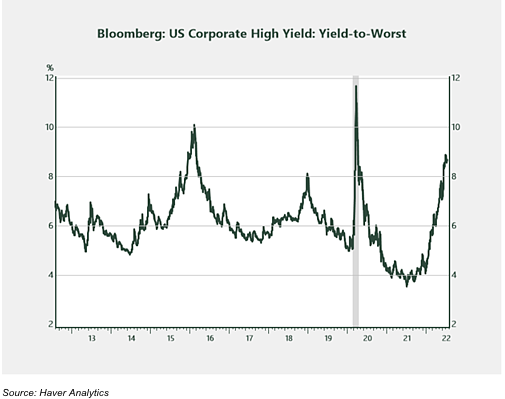

Lower-quality segments. One area that succumbed to a considerable amount of selling pressure in the first half of 2022 is the high-yield space. Currently, the yield-to-worst on the Bloomberg U.S. Corporate High Yield Index is 8.7%, a level that’s only been reached three times in the past decade. The price of bonds in the index is averaging $87 (par of $100), which isn’t too far off from where things ended up in the 2020 downturn. As investors consider their fixed income outlook and allocations, this is one area that deserves some attention.

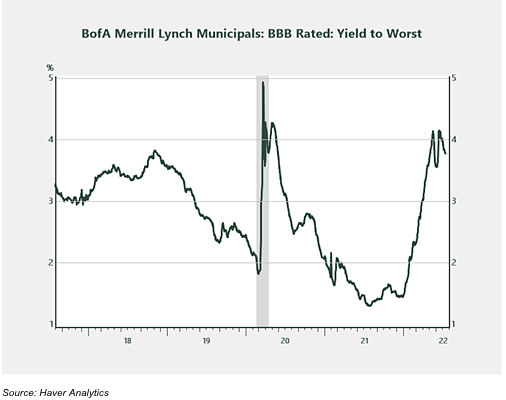

Municipal bonds. Similar to other fixed income sectors, municipal bonds came under a lot of pressure in the first half of the year. The yield-to-worst on the BBB-rated BofA Merrill Lynch Municipal Index currently stands at 3.8%, which equates to a 5.4% taxable-equivalent yield for someone in the 30% tax bracket. In the lower-credit-quality, high-yield municipal space, yields look even more attractive, with the Bloomberg Municipal Custom High Yield Composite Index yielding 4.2% (taxable equivalent of 6%).

The Road Ahead

Peter Essele is head of portfolio management for Commonwealth Financial Network.

Over the next few quarters as the Fed continues with its aggressive approach to curb inflation and markets digest every economic release with fervor, there’s no doubt fixed income will experience bouts of heightened volatility, as will equities. It’s through those periods of perceived chaos, however, that strategic long-term investors should take advantage of areas that have been unduly sold. Periods when irrationality and emotion dominate markets often present the best buying opportunities, and it now feels like one of those periods in fixed income.