The landscape of retirement planning in the United States has undergone a profound transformation in recent decades, marked by the decline of traditional defined benefit pension plans. This shift has had far-reaching consequences, influencing not only the financial well-being of individuals but also the broader socioeconomic and political fabric of the nation. In this article, I will delve into the multifaceted effects of the loss of defined benefit pension plans, exploring how it has contributed to lower living standards, a declining middle class, financial anxiety among many households and a fractured political system.

Most importantly, I will describe a bold new alternative for creating retirement security, a vehicle with benefits so compelling it deserves to be embraced by all financial advisors. You just have to get past what I’m going to explain next. This remarkable solution to enhance retirement security is found in the most unlikely of places: life insurance. Don’t hang up the phone! This is not life insurance as you currently understand it. But something new, exceedingly innovative and unambiguously attractive. Read on and give me a chance to explain why my assertion is correct, and why it is very likely that you will be offering this vehicle to your clients in the months ahead.

Some Historical Context: How We Got Here

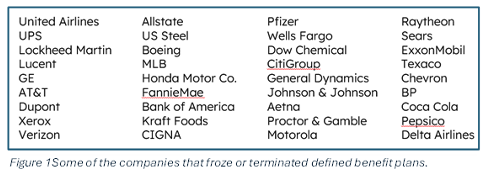

In 1947, IBM introduced its defined benefit pension plan. In 2005, IBM prohibited new employees from joining the plan. In 2007, IBM froze its defined benefit pension plan and ceased accruing benefits for those employees already participating in it.

The period between 1947 and 2007 was remarkable. The post-World War II period witnessed robust economic expansion. The war effort had stimulated industrial production, and the transition to a peacetime economy continued this growth. This economic boom created job opportunities and a rising standard of living.

The GI Bill provided a range of benefits to World War II veterans, including low-cost mortgages, low-interest loans to start a business and educational assistance. This resulted in a significant increase in college enrollment, allowing many to access higher education and skilled jobs.

The GI Bill also played a role in the housing boom. Low-cost mortgages made homeownership more accessible for returning veterans. The development of suburbs and government-backed home loans, such as FHA and VA loans, contributed to the growth of suburban communities, creating a distinctive middle-class lifestyle.

The baby boom, the significant increase in births following World War II, contributed to a larger workforce and increased demand for goods and services. This demographic shift also played a role in the economic expansion.

By 1960, 70% of U.S. households were considered traditional households, meaning a single wage earner, married with children. By 2023, the percentage of traditional households in the United States had declined to 7%.

The Rise And Fall Of Defined Benefit Pensions

Defined benefit pension plans, once a cornerstone of retirement security, provided employees with the most valuable financial benefit a retiree can receive: a guaranteed monthly paycheck for life. However, beginning in the latter half of the 20th century, a noticeable shift occurred as many companies began moving away from these plans in favor of defined contribution plans, such as 401(k)s. This transition marked a pivotal moment in the trajectory of retirement planning in the United States.

Defined benefit plans offered a sense of financial security by guaranteeing a steady income throughout retirement. In contrast, the rise of defined contribution plans shifted the onus of retirement savings and investment decisions to individual employees. This change exposed retirees to market volatility and longevity risk, contributing to financial uncertainty.

The demise of the defined benefit pension has led to a significant gap in retirement savings for many Americans. Individuals, burdened with the responsibility of managing their own investments, often struggle to accumulate sufficient funds for a comfortable retirement, impacting their overall living standards.

With the decline of traditional pensions, many retirees increasingly rely on Social Security as a primary source of income. However, we can all agree that Social Security alone will not provide an adequate standard of living, leading to financial strain for retirees and further contributing to a potential decline in their quality of life.

The shift away from defined benefit pensions has contributed to the widening wealth gap in the United States. Those who had access to traditional pensions enjoyed greater financial stability in retirement, while many others faced challenges in accumulating wealth, exacerbating socioeconomic disparities and contributing to the decline of the middle class.

The erosion of traditional pensions has coincided with a broader trend of job insecurity and stagnant wages. The lack of retirement security adds an additional layer of financial anxiety, impacting workers' bargaining power and contributing to the overall sense of economic precarity.

Impact On Financial Anxiety

• Without the safety net of defined benefit plans, individuals face uncertain retirement horizons. The fear of outliving one's savings, coupled with the unpredictability of financial markets, contributes to heightened financial anxiety among households, affecting their overall well-being.

• The shift to defined contribution plans has also affected retirees' ability to afford healthcare costs. The rising expenses associated with medical care, combined with the absence of comprehensive health coverage post-retirement, contribute to financial stress and anxiety.

• The financial anxiety stemming from the loss of traditional pensions can influence political dynamics. Retirees, facing economic uncertainty, may be more inclined to support policies that promise to address their financial concerns, potentially contributing to a fractured political landscape.

• The decline of defined benefit plans has spurred debates and policy discussions on retirement security. Policymakers grapple with finding solutions to ensure the financial well-being of retirees, reflecting the broader impact of this shift on the political discourse.

One Thing Republicans And Democrats Can Agree On

In our fractured political climate, it seems like Democrats and Republicans can’t agree on anything. But Marco Rubio, Elizabeth Warren, Ted Cruz, Bernie Sanders, Ben Carson and Patty Murray are in lockstep on one issue: Our nation faces a retirement crisis that only innovation can solve. Even artificial intelligence represented by ChatGPT agrees: The decline of defined benefit plans has left a void in our social safety net that 401(k)s and other defined contribution plans simply cannot fill.

Problems In Today’s Life Insurance Market

One needs only to visit LinkedIn to understand that many financial advisors are turned off by the marketing messages of some life insurance agents. These overly hyped, aggrandizing pitches for indexed universal life tend to give me a stomachache.

I began my career as a life insurance agent, and I understand the extraordinary benefits that life insurance offers. I’ve seen up close how it brings financial security to families at the worst possible moments.

In 1987, I invented the first life insurance strategy utilizing systematic withdrawals via tax-free policy loans to strengthen retirement security. It was called the Alternative Plan, and it was introduced by EF Hutton Life Insurance Company, the subsidiary of the big brokerage firm by the same name. I’m proud of my invention, but I take offense at the way it has been sullied and bastardized by some.

I implore you to understand this: the problem is not with the indexed universal life insurance policy. Rather, the problem is with its misuse by some agents compounded by misleading marketing that has become a feature of Tik Tok and other social media advertising. This nonsense is slowly being cleaned up.

The IRS Steps In

The largest life insurance policies being issued today are typically emerging from Silicon Valley. The young tech millionaires and billionaires have discovered the unmatched tax advantages life insurance offers. This isn’t the first time that the rich have gravitated toward life insurance. By the early 1980s, the IRS had seen so many examples of large lump sums being placed into life insurance policies that looked more like deposit accounts than life insurance. The reason was that only the tiniest amount of life insurance coverage was featured in these policies. They basically were tax-sheltered deposit accounts paying high-interest rates and offering the ability to access the cash in the policies income tax-free.

Congress passed three tax acts in the 1980s known by the acronyms TEFRA, DEFRA and TAMRA. These laws prescribed tests that mandated at least a minimum amount of life insurance for any given investment made into a policy. The new IRS regulations stipulated that if the policy did not conform to the new guidelines, it would lose the favorable tax treatment enjoyed by life insurance. In 1988, the IRS published regulations creating the modified Endowment Contract commonly known as a MEC. A MEC is a life insurance policy that loses its tax benefits because too much money is paid into it too fast. The IRS’s move immediately shut down large lump sums being paid into life insurance policies. To retain the full tax benefits of life insurance, the new rules stipulated that premiums must be paid in over a time frame of at least five years.

Defined Benefit Life is typically funded over 20 or more years. This is in line with the target buyer of Defined Benefit Life who is typically in the age range of 30 to 50. Importantly, when the life insurance amount is brought down to the minimum level to be in compliance, the policy’s internal costs are reduced to such a low level that incredible wealth-building opportunities are maintained.

Consider these tax advantages:

• Tax-deferred growth. As money is invested in the policy (referred to as the “premium,” life insurance has its own vocabulary), it accumulates without current taxation.

• At the death of the insured, the life insurance coverage amount is paid to a named beneficiary income tax-free.

• Policy owners may access their accumulated cash by taking withdrawals in the form of policy loans. These policy loans are available at very favorable rates, as low as zero net cost. Policy loans are income tax-free. Policy loans may be taken systematically, i.e., at retirement, and the accumulated loan amount taken can be multiples of the cost basis. It is still income tax-free. Wish for a lifetime of tax-free income? This is one way to achieve it.

• When the insured person dies, even after taking a significant amount of capital tax-free in the form of policy loans that may dramatically exceed cost basis, the loans are retired by the policy’s death benefit, with the remaining amount payable to the named beneficiary, again, income tax-free.

With All Of These Advantages Why Did So Many Universal Life Insurance Policies Become Impaired?

The life insurance sales process is broken. That shouldn’t be a controversial statement, but some will certainly take it that way. Life insurance sales are typically made today based upon which insurance company projects the highest cash values decades into the future. This sets up the policy for trouble should actual interest crediting prove to be less than what was illustrated in the original projection. The reason is that the premium paid into the policy is a function of that projection. The higher the cash value projection, the lower the premium required.

Universal life insurance was a revelation when it was introduced in 1979. For the first time, life insurance became transparent, unbundled, with the internal costs visible for the first time. The first universal life insurance policy, complete life from EF Hutton Life featured a radically different compensation structure.

Irrespective of the size of the policy, the commission paid to the agent was a flat fee. There was an additional commission, but it was restricted to only the term insurance element inside the policy. Subsequent generations of universal life provided a compensation structure that was based upon the premium paid into the policy in its first year. With these policies, the agent gained control over the amount of commission he or she earned by either lowering or increasing the amount of life insurance coverage provided for a given premium outlay. The tendency was to provide as much insurance as possible. This may have been good for a family, but it also increased the internal costs of providing life insurance coverage, thereby leaving little margin of error should interest crediting in the future be lower than originally projected.

In the years following its introduction, universal life policies projected double-digit returns. During those years, CDs, the prime rate and home mortgages were all in double-digit ranges.

From 2000 through 2021, the United States saw a structural decline in interest rates that had no precedent. Six-month CD rates in 2000 averaged 6.91%, but by 2021 had fallen by 99% to a mere nine basis points.

The dramatic decline in interest rates caused havoc for the universal life policies that were projected to deliver double-digit interest rate crediting. God knows how many policies became impaired, destined for lapsation and only fixable with a large infusion of additional premium dollars.

This situation created a terrible conundrum for life insurance agents. The prospect of facing clients and informing them of the need to pay a significant and unanticipated amount of money to salvage their policies was unappealing to put it mildly.

If one examines the phenomenon of policies becoming impaired, it’s very clear that what was missing was a system of monitoring and adjustment that would have maintained the integrity of the life insurance policies, even in the face of dramatically declining interest rates. When interest crediting to these policies began to be less than originally projected, a small upward adjustment in the premium would have made all the difference. The problem becomes acute and unsalvageable when the policy is neglected for five years or 10 years or even more.

By failing to make small adjustments to the premium along the way, the cash value of the policy becomes so stressed and eventually overwhelmed by the cost of providing the life insurance that it is not practical to keep the policy in force. A lapse is its destiny. That this occurs at a time when insureds are older and perhaps in dire need of the coverage only makes the death of the policy a truly tragic outcome.

A Bold New Option For Retirement Security

I said in the beginning that I would describe a bold new alternative for retirement security, one with benefits so compelling that every financial advisor should offer it. Here it is. It’s called Defined Benefit Life. Allow me to explain why it’s an unbeatable strategy for wealth building, lifetime financial security and lifetime tax-free retirement income.

Imagine a strategy that:

• Recreates the economic model of a defined benefit pension,

• Applies down to the level of an individual investor,

•Defines the income to be received at retirement,

• Systematically builds wealth year over year without current taxation,

• Is supported by a policy management system that annually advised the policy owner of any premium adjustments required to keep the policy on track to deliver the targeted retirement income, and,

• Provides income at retirement that is income tax free.

How It Works

What I’ve described above sounds a lot like a defined benefit pension. In fact, its economic methodology is that of a defined benefit pension. But this is life insurance, albeit life insurance that is done very differently.

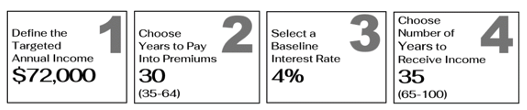

One area that is similar is that the process begins with an application. Because there is life insurance here, the application must be reviewed and approved by the life insurance company. At the time of application, the policy applicant makes four decisions. These decisions will govern the structure and management of the policy going forward.

1. Define the targeted annual income.

2. Choose the number of years Premont will be invested in the policy.

3. Select a baseline interest rate assumption that the policy owner believes the policy will earn over its lifetime.

4. Choose the number of years income will be received.

A Hypothetical Example

Jennifer is a human resources executive at a biotech company. She has maxed out on her 401(k) contributions. However, at age 35, she is concerned about her retirement security. She does not put faith in Social Security, and she believes that she must take personal responsibility for her retirement security.

Jennifer has the cash flow and the will to take action to strengthen her retirement. She is attracted to the tax benefits and structure of Defined Benefit Life, viewing it as a disciplined, systematic strategy for building wealth and future retirement income. Jennifer’s four decisions look like this: she defines her retirement income as $6000 per month, or $72,000 annually. She will invest premiums into the policy for 30 years, from ages 35 through 64. For her baseline assumed interest rate she selects 4.5%. And she wishes to receive income for 35 years, from age 65 through 100.

Based upon a 4.5% assumption and current factor is kind of Susan, Jennifer’s life insurance agent, indicates that $1000 per month must be invested into the policy.

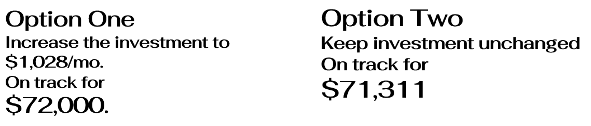

The First Year

At the first policy anniversary, Jennifer receives her Defined Benefit Life annual report. The report advises her that her policy earned 3%, less than the baseline interest rate assumption of 4.5%. The annual reports outlines two options for Jennifer to consider. She can raise her monthly premium for the next year to $1,028, which will get her back on track for $72,000 of retirement income. Her second option is to leave her premium level at $1,000 per month, but now be on track for a slightly lower retirement income, $71,311. Because she can comfortably afford to do so, Jennifer raises her outlay to $1,028 per month.

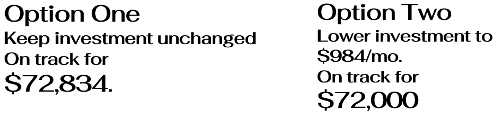

The Second Year

At the second policy anniversary, Jennifer’s annual report indicates that her interest crediting for the year was higher than the baseline, 6.8%. Again, Jennifer is advised of two suggested options. Option one, she can keep her premium at the present level of $1,028 per month and now be on track for a higher income, $72,834. Or option two, she can reduce her premium to $984 per month and be on track for her originally desired $72,000.

The monitoring and guidance process described above is a revolutionary development for the life insurance industry. Combined with reducing the life insurance element, thereby reducing the costs against the cash values, we create a wealth accumulation and retirement security vehicle offering a constellation of benefits that cannot be matched by other choices.

Conservative, Not Aggressive

The process in front of the client with Defined Benefit Life is the reverse of how life insurance is typically executed. We have no desire to project a high interest crediting rate. Rather, we assume a conservative baseline assumption because that minimizes the possibility of significant adjustments to the premium in the future. It also increases the odds that the policy will over perform, rather than underperform. Over performance means more income. That’s good.

Monitoring and adjustments are an annual feature of Defined Benefit Life. With this system, no policy should ever lapse. But it is up to the policy owner to make the required premium adjustments needed to remain on track for the desired retirement income.

Growth Potential

We use index universal life to fund Defined Benefit Life because of the potential to deliver interest crediting that exceeds typical safe money vehicles. Depending on the policy chosen, there’s a wide selection of indices that can be the basis for interest growth. Available indices include the following:

• S&P 500 Index

• NASDAQ-100 Index

• Dow Jones Industrial Average (DJIA)

• Russell 2000 Index

• MSCI EAFE Index (International Developed Markets)

• MSCI Emerging Markets Index

• Bloomberg Barclays U.S. Aggregate Bond Index

• Euro Stoxx 50 Index

• Bespoke indices

If in the future we enter a period where stocks are not performing, even potentially sustaining losses over an extended period, the cash value can be reallocated to the fixed rate account, which would be expected to reflect a higher rate should we enter an increasing interest rate environment.

Education And Marketing

The public will have no familiarity at all with life insurance that works the way Defined Benefit Life works. A broad range of digital education tools has been created to support clients’ understanding of the strategy.

These tools include customized advisor websites, a client seminar, video presentations, and even AI generated digital humans who help the advisor add interest in novelty to the education experience. You can experience what clients experience by visiting www.definedbenefitlife.com.

Concluding Thoughts

Defined Benefit Life solves some of the most vexing problems that plague the life insurance industry. But more than that, it provides individuals with a vehicle for building retirement security that address shortcomings of many other strategies. On a personal level, Defined Benefit Life is the culmination of work that began 35 years ago.

In the beginning, I asserted that Defined Benefit Life is a strategy that every financial advisor should implement. Do you agree with me? Do you have questions about it? If you do, I am ready to answer them for you. I am a missionary for this concept, and I want to help as many financial advisors as possible share it with their clients and enjoy the benefits it provides. Do not hesitate to reach out to me by phone if you’d like to discuss Defined Benefit Life. My mobile number is 978-375-3400. Or you may email me at [email protected].

Wealth2k founder, David Macchia, is an entrepreneur, author and public speaker whose work involves improving the processes used in retirement-income planning. He is currently creating solutions to mitigate the threat to human financial advisors that is posed by emerging AI competitors.