Wondering about the factors shaping the future of financial advice? If financial psychology came to mind, that’s no coincidence.

In 2022, eMoney Advisor research focused on better understanding where advisors and investors stood on the adoption of financial psychology (“FinPsych”). The results showed more than 80% of advisors agree that applying financial psychology benefits the client by providing more personalized services, increasing client engagement and satisfaction, and reducing financial anxiety.

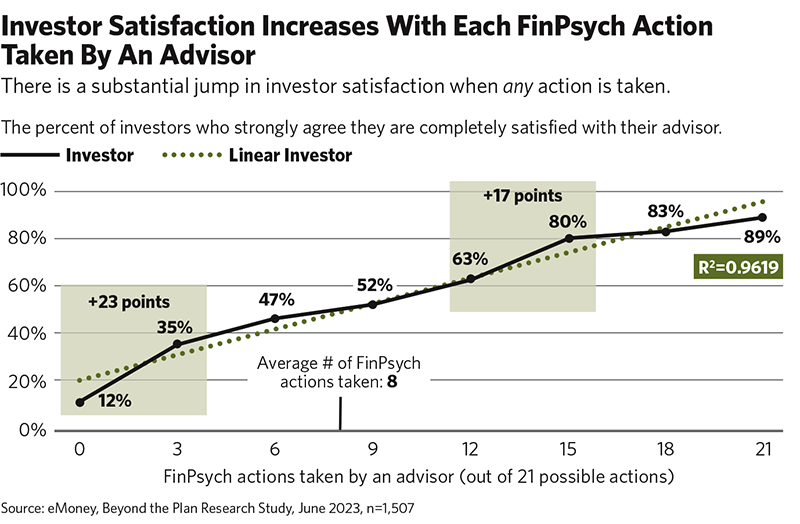

So, this year eMoney took it a step further, setting out to discover what specific actions advisors can take to go beyond the plan. In our latest research, we discovered that not every application of FinPsych will have equal influence. Of the 21 FinPsych actions we tested, here are the five with the greatest positive impact on investors’ overall satisfaction with suggestions on how to adopt them in your practice.

#1: ‘Help Me Identify Meaningful Goals’

A top priority among clients is a planning process that focuses on meaningful personal and financial goals. Let’s unpack what this might mean in practice, starting with generic goals, like “save for retirement” or “build an emergency fund.” These lack intrinsic meaning.

It’s not motivating to feel as though you’re living someone else’s plan for your life. Let that idea guide you in helping clients through a phase of reflection to define unique and meaningful goals, both for the short and long term.

When you have these conversations around goals, the words you use matter. Something as simple as “retirement” can mean something different to everyone, so take some time to create a shared understanding of terms you’re using by asking questions: “What does ‘retirement’ mean to you?” “What picture comes to mind?” “What are you feeling?” “What are you doing, or not doing?”

The eMoney study findings reflect Self-Determination Theory, developed by University of Rochester professors Edward Deci and Richard Ryan. Their research has shown that if someone works toward a self-endorsed goal, motivated by values, interest, or enjoyment, their efforts are more likely to enhance their well-being.

#2: ‘Always Consider What I Value Most In Life’

Simply put, values matter. We found that actions such as getting to know the client’s family history, what causes them financial stress and anxiety, and gaining an understanding of their family and cultural values contribute greatly to a client’s overall satisfaction.

For example, someone who primarily values family, or whose culture values taking care of elders, may manage their money differently than a client who primarily values adventure or novelty.

Getting to know a client’s values is a crucial part of the data gathering phase of financial planning and is even codified in the CFP Board’s Practice Standards. Research from professor Deanna Sharpe and Money Quotient founder Carol Anderson shows that having conversations about client values can build trust—the bedrock of a client-planner relationship.

Our personal values are the guiding principles in much of our lives and decision making, and showing your clients that you are attuned to their values is a powerful way to help them feel deeply understood.

#3: ‘Communicate In Terms I Understand’

Consumers often struggle to comprehend financial terms, and it stands as a substantial barrier to seeking financial advice. A 2017 study by Paul Gerrans and Douglas Hershey shows that clients often have anxiety about meeting with an advisor for this reason.

Effectively communicating your advice and recommendations is table stakes. Use language that is plain and easy to understand, steer clear of nuanced metaphors, and end with the “so what” (e.g., why this is important). To enhance this experience, use visualization, such as interactive charts and collaborative planning tools, to engage clients throughout the process as a way to build greater understanding.

Finally, tread very carefully when you’re recommending a complex financial strategy. While every client is different, simply talking through a long list of facts and figures may lose your clients' attention and leave them feeling confused. Instead identify key themes, client interests, and the “so what” as the basis of your narrative.

#4: ‘Learn About My Money Behaviors And Attitudes’

As The Psychology of Money author Morgan Housel puts it: “Investing is not the study of finance, it’s the study of how people behave with money.”

As a financial advisor, it’s important to understand what the client’s goals are and why, including any influencing factors (e.g., emotions, mindset, etc.). Because part of the human condition is that we aren’t perfect, and our behaviors don’t always align with our goals.

By understanding what is important to our clients, paying attention to what behaviors or money management practices are in place, we can start to notice the gaps when that behavior is going to cause them to fall short of their goals. Understanding these influences can allow you to better evaluate all of the paths a client can take to successfully achieve their desired outcomes.

#5: ‘Understand My Values And Priorities Before Delivering Advice’

By now, hopefully you’re convinced that getting to know your clients and what they value is an important foundation for financial planning. But in case you weren’t, you should know that the clients we surveyed told us exactly that.

It’s even said by regulators: Know your client. Get curious about what drives the client and what is most important to them. Ask insightful questions and use exquisite listening to find the answers. All before you deliver the first piece of financial advice.

Improving The Client Experience

While we know many advisors are doing one or many of these, there is still opportunity for improvement. When we asked clients about the frequency with which their advisors are taking these actions, their responses indicated that it averages to less than 50% of the time.

What makes you different—what sets you apart—is the quality of the experience you provide and that comes through in the way that you communicate and engage with your clients, in the motivation sparked, and your understanding of your client as a person.

That’s going beyond the plan.

To learn more about these FinPsych actions and the transformative power of combining them with technology, check out our latest research.

Emily Koochel, Ph.D., is the head of financial wellness programs at eMoney Advisor.