Key Points

• We believe 2017 will be a “Year of Transition” as growth accelerates, interest rates rise and equity market leadership changes.

• We think equity prices can still rise as long as corporate earnings accelerate.

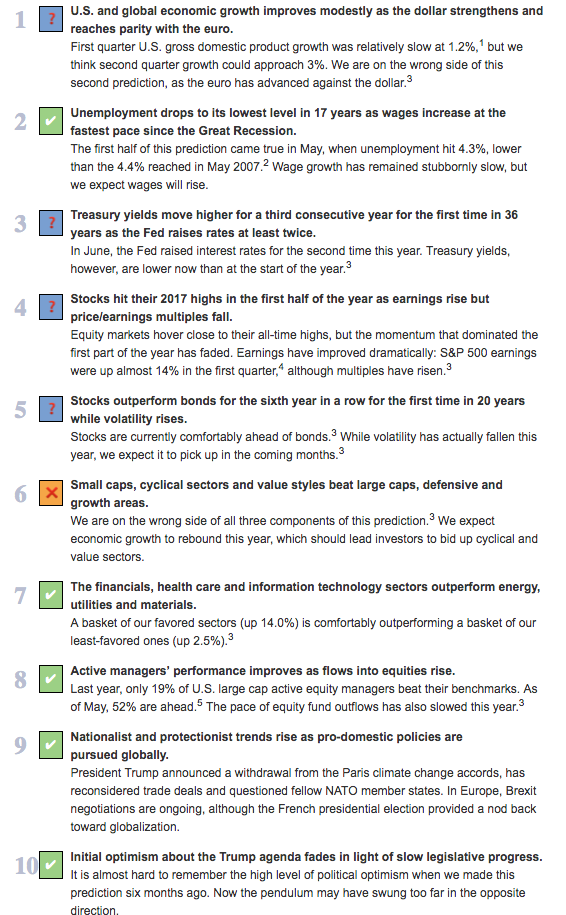

• At this point, more of our 2017 predictions are trending correct rather than incorrect.

At the beginning of the year, we labeled 2017 as a “Year of Transition.” We expected improving economic growth, accelerating corporate earnings and rising interest rates. We also predicted rising volatility amid equity market leadership changes that would create a more difficult investment environment. At the mid-point of the year, the fate of some of our predictions remains uncertain, but more are trending correct than heading in the wrong direction.

Equity Outlook: Earnings Are the Critical Variable

Although many investors are questioning equity valuations, we believe valuations can be sustained or climb further, as long as corporate profits and earnings rise. And notwithstanding some recent economic weakness, we believe the global economy should continue to accelerate modestly, providing a tailwind for corporate earnings, profits and equity prices. As such, we think equity prices will move unevenly higher over the next 6 to 12 months (and likely beyond), but also expect more modest returns than investors have seen in recent years.

Bob Doll is chief equity strategist at Nuveen Asset Management.

1 Source: Bureau of Economic Analysis

2 Source: Bureau of Labor Statistics and Bloomberg

3 Source: Morningstar Direct, FactSet and Bloomberg

4 Source: JP Morgan 5 Source: Bank of America Merrill Lynch