Meanwhile, demand has been building for non-agency RMBS among U.S. Treasury-sponsored Public Private Investment Partnerships, hedge funds and bond funds looking for high yields. "You have a very strong technical supply-and-demand dynamic going on in favor of price appreciation in this asset class," Rosenthal says.

Managers are also finding appealing trading opportunities in whole loans. Combining housing market data analysis with on site expertise, whole loan investors have been buying individual mortgages at significant discounts to current property values. With a low purchase price, managers have room to reduce a loan's principal balance, keep the homeowner in the house and still realize a profit when the loan is eventually refinanced, sold or paid off. "There's a lot of opportunity for managers to [add value] in that process by managing those loans. If you go out and buy a stock, I don't see as many opportunities to add value as compared to the whole loan market because of the level of expertise you have to have," Paddock says.

Foreclosure is rarely a first choice, and a possible bottoming in home values in some markets has reduced the risk of repossession. Also, a growing number of managers now specialize in renovating and trading foreclosed properties.

Not All Doom And Gloom

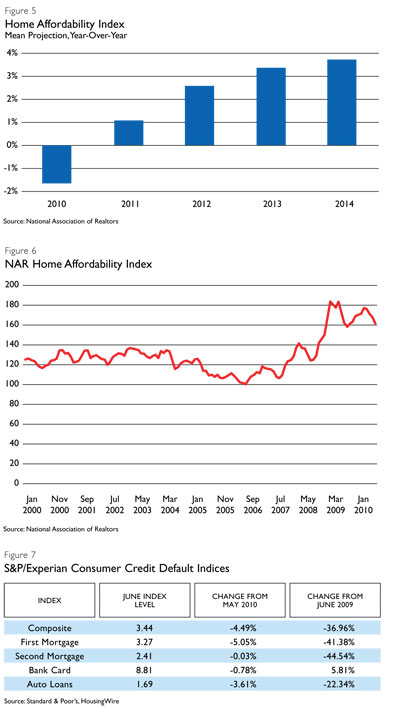

Increasing activity in the refurbishment and retrading of foreclosed mortgage properties is one sign that repair is under way. Other indicators are pointing to a potential revival of the national housing market as soon as next year. The same MacroMarkets LLC survey that indicated a continued home price decline in 2010 also predicts a home price recovery in 2011 (Figure 5). Housing affordability, as measured by the National Association of Realtors (NAR) Home Affordability Index, has reached historically high levels (Figure 6). Additionally, as discouraging as high defaults and foreclosures may be, the borrowers who remain are considerably more creditworthy-a survivorship bias known as "credit burnout." Barclays Capital recently reported that the percentage of subprime borrowers with credit scores over 640 increased last year as those with poorer credit lost their homes. In addition, data from Standard & Poor's and Experian indicate that consumer defaults are now declining across a wide swath of the economy, from auto loans to first and second mortgages (Figure 7). Others take comfort from the fact that a large portion of borrowers have paid on time every month through tough economic times, despite having mortgage balances well in excess of home values. While these trends offer some hope for the housing market, it's important to note that attractive returns on residential mortgage investments do not depend on a housing recovery. Instead, any improvement in the housing market likely represents a bonus.

Gaining Exposure

Affluent individuals have limited choices for investing broadly in residential mortgages. Buying assets directly is difficult given the level of specialized skill and infrastructure required. A handful of mutual funds, ETFs and REITs capture only narrow slices of the vast mortgage universe. A number of experienced mortgage professionals have launched new vehicles, but most are private structures and have limited track records. "It's new-investors haven't seen this before," Knall says. "This is a whole new set of money managers. We've never had distressed residential securities." Wealth advisors may evaluate these managers themselves, or look to others for expert help, or turn to a residential mortgage fund of funds. "The fund of funds works for a lot of investors because it's a diversified way of getting exposure," Paddock says.

Rethinking Asset Allocation

Since residential mortgage strategies have not previously held a distinct slot in private portfolios, wealth managers may find it difficult to fit the asset class into existing asset-allocation models. Traditional asset allocations generally aggregate mortgages with commercial real estate or ignore them altogether, and the relative illiquidity of hedge funds leaves many advisors hesitant to invest. In the July 2008 issue of The Financial Times, PIMCO's Mohamed El-Erian highlighted these shortcomings and predicted emerging value in alternative investment strategies during times of investor anxiety. In commenting on the credit crisis, which was starting to reach full bloom at that time, El-Erian suggested that "incredible bargains" would await investors willing to lock up capital, take a long view, and follow a "process that accommodates opportunities that ... do not fit well into traditional classifications of asset classes."

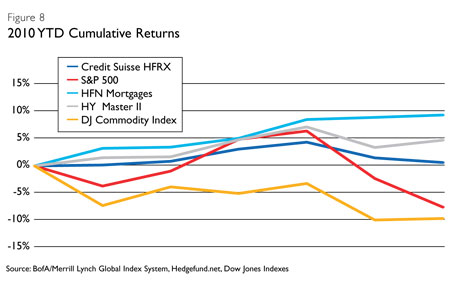

El-Erian's words were prescient. Correlations among several large asset classes reached record-high levels in June as investors fled markets for the safety of U.S. Treasurys, driving the 10-year Treasury yield below 3% for the first time since April 2009. "When there is a flight to quality, there's a flight to [safer] credit. ... perceived credit risk [for agency mortgages] is very low," remarks Narula. Returns in 2010 have converged across most asset classes, but mortgages have been a noteworthy exception (Figure 8). In May and June, months which saw the "Flash Crash," Eurozone instability and dispiriting employment and consumer confidence reports, the HFN Mortgages Index posted positive results while the S&P 500 suffered deep losses.

Opportunity In Uncertain Times

In an environment that Federal Reserve Chairman Ben Bernanke recently called "unusually uncertain," economic expectations have bounced between inflation and deflation, robust recovery and double-dip recession, subjecting traditional asset classes to a cycle of precipitous declines and rapid advances. This volatility has either kept many investors on the sidelines or favored those with a talent for market timing over fundamental analysis. In a post-financial crisis world, there is little consensus about the future.

Even amid uncertainty, most asset classes are priced to reflect economic normalization, and their future performance depends on it. In contrast, residential mortgage assets should perform well in deteriorating conditions-and should preform even better if economic recovery actually takes hold. By assuming the worse of two possible futures, this huge, recently orphaned asset class distinguishes itself as a defensive, worthy and reliable investment for client portfolios.