Financial advisors confront the complexity of generating retirement income for their clients every week. Coordinating Social Security claiming strategies, variable spending patterns, minimizing Medicare premiums, tax-loss harvesting and tax-efficient withdrawal sequences across accounts and holdings is one of the most challenging problems in finance.

This is the first of two articles to raise awareness of the opportunity advisors have to upgrade their current financial planning process and the tools to provide specialized advice that can make their clients’ money last longer. This article outlines and compares different “decumulation” approaches advisors use today.

Let’s start by reviewing the history and comparing the methodology of different withdrawal strategy processes. Then we’ll spell out a new framework that creates the maximum value for clients. A recent survey by the American College shows that 71% of clients would look for a “retirement income specialist” as the top attribute when selecting an advisor. Consequently, top practitioners will need to learn how to incorporate sophisticated tax-efficient withdrawal strategies into their practice to differentiate themselves, and grow and satisy their clients’ demands.

Retirement Income Projection Methodology

Advisors focusing on “coordination” of their clients’ entire household balance sheet, providing “holistic advice,” are winning assets and clients. Fortunately, breakthroughs in research and software development over the last 10-plus years have helped identify opportunities for advisors to “fill in the gaps.” Consequently, they can provide more sophisticated advice for generating income for families entering into or in their retirement.

Let’s examine the evolution of retirement income advice over four phases, where the last is our new proposed framework on how advisors can showcase their value and maximize clients’ wealth over other approaches used in the industry.

Products And Rules Of Thumb

A proliferation of products designed by asset managers and insurance companies to address income have flooded the market. Single product solutions and default solutions in 401(k)s are not going to solve a household’s issues, when “coordination” of resources and liabilities is needed to provide the best outcome. Don’t get us wrong. Smart low-cost products that are transparent will be part of the solution. But a single product and advice directed to a single account is not the answer, when smart planning and ongoing management are required. As the case in this article shows and detailed cases in the second article will show, advice at a household level significantly outperforms single-product solutions and guidance designed solely for a single account.

Similarly, much has been written about the 4% rule and other “safe withdrawal rates.” This is important work. However, this area of research provides only a “rule of thumb” or a guideline. For advisors that manage clients’ money and generate financial plans, these guidelines are not specific enough to tell you when to claim Social Security, how to minimize taxes, or exactly what to buy or sell to generate the income your clients desire.

‘Conventional Wisdom’ And Proportional Withdrawal Sequences

The best financial planning software programs that most advisors use recommend the same general withdrawal sequence to generate income in retirement. Several years ago, we described this withdrawal strategy as the “conventional wisdom.” We estimate that over 80% of advisors still recommend that their clients generate income by withdrawing funds from taxable accounts until exhausted, then from tax-deferred accounts until exhausted, and finally from tax-exempt accounts until exhausted. Advocates of this Conventional Wisdom approach argue that delaying paying taxes as long as possible and letting qualified assets grow tax-free for the longest possible time period are the best approach to generate income for clients.

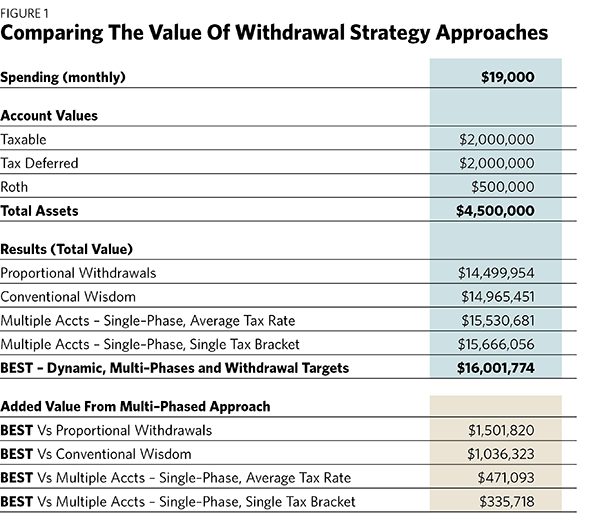

Note that most large institutions still recommend this withdrawal sequence. If you are a financial advisor, you clearly can provide more value to your clients—over $1 million more in the case outlined later in this article—despite assuming the same holdings, pre-tax risk, and spending levels for the client. Advisors need to “add on” technology to help them identify better strategies that will add more value to their clients’ accounts.

Recently, you may have seen Charles Schwab and Fidelity advertising their new withdrawal strategies directly to consumers. Don’t be fooled. Financial advisors reading this article have a huge opportunity to demonstrate their added value by contrasting these new strategies against those using a “proportional” withdrawal sequence.

Essentially, proportional withdrawals are determined by calculating the ratio of the client’s taxable, tax-deferred, and tax-exempt accounts relative to the total value of all savings and using those percentages to fund the spending amount. For example, in a current year, if taxable accounts are 30%, tax-deferred accounts are 50%, and the tax-exempt accounts are 20% of the total household value, then the withdrawals using these percentages will be taken from each account type to fund the spending.

Typically, this strategy beats the “conventional wisdom” strategy. However, in the case discussed in this article, the Conventional Wisdom strategy beats the Proportional strategy. The key insight, however, is that a financial advisor can recommend a withdrawal strategy that beats both Conventional Wisdom and “Proportional” strategies almost every time with the next two approaches. Neither the Conventional Wisdom nor Proportional strategies incorporate tax-efficient withdrawal sequences that exploit the rising and falling pattern of marginal tax rates that are caused by the taxation of Social Security and income-based Medicare premiums.